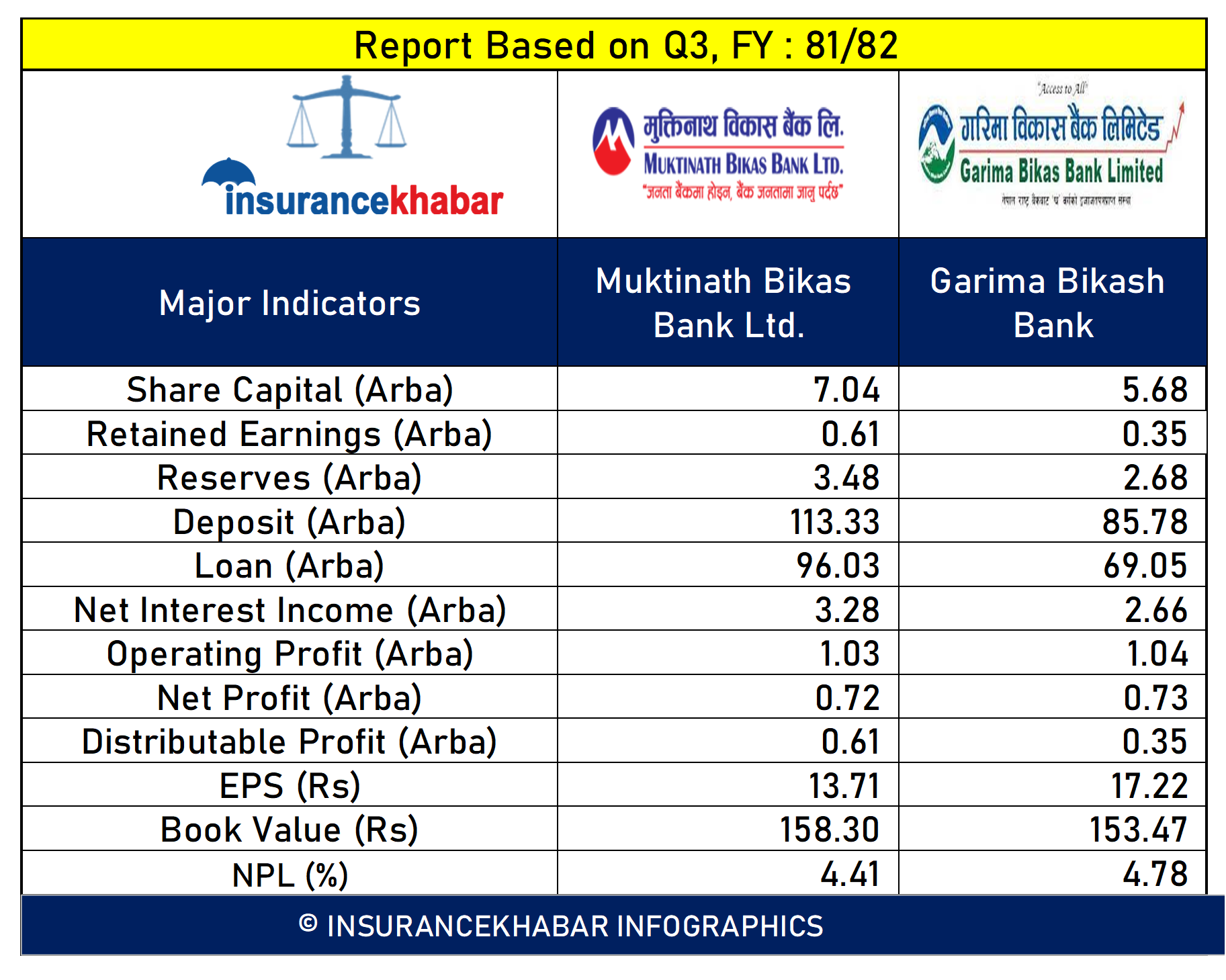

Kathmandu. Muktinath and Garima Bikas Bank are the development banks that have been competing with each other in financial indicators. Both the banks are in the current fiscal year 2081. When the financial statements of the third quarter of 82 were made public, the insurance news between the two banks made a comparison based on major financial indicators. Study:

#inline_tags_PLACEHOLDER_10##चुक्तापुँजीः##inline_tags_PLACEHOLDER_11#inline_tags_PLACEHOLDER_12##Muktinath has a paid-up capital of Rs 7.04 billion while Garima’s paid-up capital is Rs 5.68 billion.

#inline_tags_PLACEHOLDER_10##जगेडा Fund:##inline_tags_PLACEHOLDER_11#inline_tags_PLACEHOLDER_12##Muktinath has Rs 3.48 billion in reserve fund while Garima has Rs 2.68 billion in reserve fund.

#inline_tags_PLACEHOLDER_10##रिटेन्ड Earnings: #inline_tags_PLACEHOLDER_12##Muktinath’s retained earnings are Rs 61.95 crore and Garima’s retained earnings are Rs 35.04 crore.

#inline_tags_PLACEHOLDER_10##निक्षेप and loans:#inline_tags_PLACEHOLDER_12##Muktinath has collected Deposits of Rs 113 billion and disbursed Loans of Rs 96.03 billion, while Garima has collected Deposits of Rs 85.78 billion and disbursed Rs 69.05 billion.

#inline_tags_PLACEHOLDER_10##खुद Interest Income:#inline_tags_PLACEHOLDER_12## Muktinath earned a net interest income of Rs 3.28 billion, out of which Garima earned Rs 2.66 billion.

##inline_tags_PLACEHOLDER_10#सञ्चालन Profit:##inline_tags_PLACEHOLDER_12#मुक्तिनाथले has made an operating profit of Rs 1.03 billion, out of which Garima has made an operating profit of Rs 1.04 billion.

#inline_tags_PLACEHOLDER_10##खुद Profit:##inline_tags_PLACEHOLDER_11#inline_tags_PLACEHOLDER_12#Muktinath has made a net profit of Rs 72.48 crore, out of which Garima has made a net profit of Rs 73.34 crore.

#inline_tags_PLACEHOLDER_10##वितरणयोग्य Profit:#inline_tags_PLACEHOLDER_12## Muktinath has a distributable profit of Rs 619.5 million, out of which Garima has a distributable profit of Rs 350.4 million.

#inline_tags_PLACEHOLDER_10##किताबी Price: Muktinath’s book price is Rs 158.30 while Garima’s book price is Rs 153.47.

#inline_tags_PLACEHOLDER_10##वार्षिक earnings per share: inline_tags_PLACEHOLDER_12## Muktinath’s annual earnings per share is Rs 13.71 while Garima’s annual earnings per share is Rs 17.22.

#inline_tags_PLACEHOLDER_10##खराब loan: ##inline_tags_PLACEHOLDER_11#inline_tags_PLACEHOLDER_12##Muktinath’s bad loans are 4.41 per cent while Garima’s bad loans are 4.78 per cent.

(Note: The analysis based on available data is not complete. Take a decision after further research. The above news is not for stock trading purposes. )