Kathmandu. With the presence of micro insurance companies in the domestic market, there has been a significant increase in the sales of micro insurance. In the third quarter of the current fiscal year, non-life insurers (including small non-life insurers) have earned a total of Rs 599.7 million in insurance premium.

This is the last fiscal year 2080. This is 3.11 times higher than the same period in 1981. According to the monthly transaction data published by the Nepal Insurance Authority, the non-life insurer had collected Rs 170.2 million in insurance premium till mid-April of the last fiscal year.

During the review period, a total of 287,896 insurance policies have been sold by non-life insurers this year. A total of 85,810 policies were sold in the same period of the last fiscal year.

Although the overall figures are encouraging, property insurance and motor insurance account for most of the contribution in the small insurance business. That too in urban or urban areas.

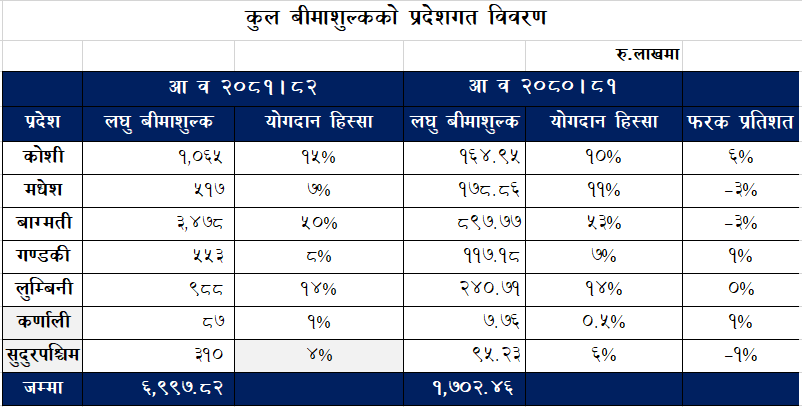

The small insurance business seems to be concentrated in the province, which is considered to be the easiest in the remotest in terms of both the number of small insurance sales and insurance revenue. Of the seven provinces, Bagmati province alone accounts for more than 50 per cent. According to the NRA, Bagmati, Lumbini and Koshi provinces account for nearly 80 per cent of both the number of insurance policies and the collection of insurance premiums. The share of micro insurance issued in other states and micro insurance collected is high in all three provinces.

On the basis of per capita income, the business of micro insurance in Karnali, Remote and Madhes provinces is shocking. All the three states accounted for only 12 per cent of the total insurance premium income till the third quarter of this year. The share of micro insurance is only 5 percent in Karnali and Sudurpaschim regions, which are said to be dominated by economically poor and backward communities.

Minimum Insurance Sales Number of Non-Life Insurers. Source: Nepal Insurance Authority ##shortcodes_PLACEHOLDER_1

Minimum Insurance Sales Number of Non-Life Insurers. Source: Nepal Insurance Authority ##shortcodes_PLACEHOLDER_1

Micro insurers have been aggressively involved in business expansion after the distribution of licenses for micro-insurance for the promotion of micro insurance. This has led to unhealthy competition among insurers. Although the objective is to promote micro insurance while issuing licenses to micro insurers, the small insurers are looking for expensive but easy business, contrary to the findings of the study report prepared by the Nepal Insurance Authority to confirm the need and justification of micro insurance.

Collection of short insurance premium of non-life insurers. Source: Nepal Insurance Authority ##shortcodes_PLACEHOLDER_1

Collection of short insurance premium of non-life insurers. Source: Nepal Insurance Authority ##shortcodes_PLACEHOLDER_1

Small non-life insurance companies are now more focused on vehicle insurance and property insurance. The presence of non-life insurers is more visible outside the main gate of the Transport Management Office in urban areas than in rural areas. The voices of those who complain that additional commissions are being distributed to importers and brokers in violation of the rules to get the business of motor insurance are getting louder. As a result, the cost of selling insurance policies of micro insurers has increased unnecessarily, increasing pressure on expenses.