Kathmandu. Nepal Rastra Bank (NRB) has revealed that the Deposit and Credit Protection Fund, which guarantees deposit protection of banks and financial institutions licensed to carry out financial transactions, is financially weak.

According to the Office of the Auditor General, if only one of the 55 banks and financial institutions entrusted with the responsibility of securing deposits to the 49-year-old institution is overturned or dissolved, the fund will not be able to return the deposits of the savers.

According to the 62nd Annual Report of the Auditor General, the fiscal year 2080. A total of Rs 1,430.45 billion has been guaranteed as deposit security of banks and financial institutions. Based on this amount, the deposits are estimated to be rs 26.83 billion on an average.

The deposit protection risk fund has a total of Rs 9.82 billion, which is insufficient to bear the liability of returning the deposit of Rs 26.83 billion of a bank.

Referring to the weak financial system of the Fund, the Auditor General has said that if any one of the ‘A’ class banks collapses, rs 16.17 billion will be insufficient to pay compensation.

The Government of Nepal and The Nepal Rastra Bank (NRB) have guaranteed to return a maximum of Rs 500,000 from the deposits deposited by the general public in one of the banks of the individual. For this, the fund has been charging a large amount annually as security fee from each bank for the security of deposits.

Although the fund has accepted a liability of more than rs 100 billion, it does not have the capacity to repay the liability. The fund has not even reinsured to address the risk of returning public deposits in case the bank sinks. As a result, if two or three banks turn upside down at once due to the disturbances in the financial system, then the fund will cheat the general public by not being able to return the money.

It is seen that the Fund should make an actuarial assessment under deposit protection and increase the fund’s rock so that it is sufficient for payment of deposit protection claims in the future.

The same is true for loans:

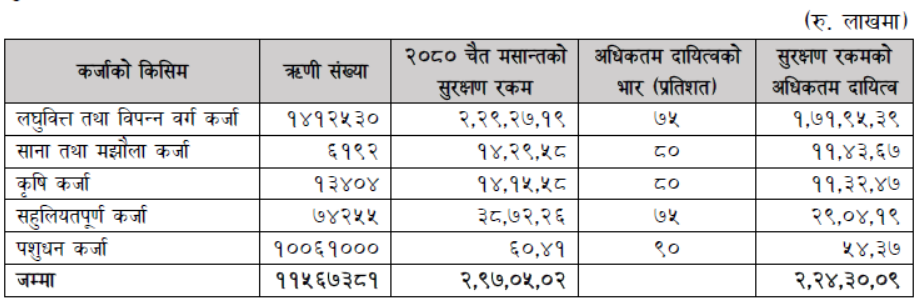

Similarly, the maximum liability for loan security is Rs 224.30 billion and the loan protection fund is Rs 7.52 billion. The maximum liability for loan protection up to Mid-Chaitra 2080 is as follows:

“Arrangements should be made to ensure the responsibility of payment of loan security claims by conducting an actuarial assessment of the liability on the basis of secured maximum liability of the last fiscal year and the annual expenditure of the last year under the loan security,” the Auditor General said in its opinion to the Fund. ”

Insurance does not have such:

If the insurance company accepts more risk than it can afford, it is mandatory to re-insure with another insurer or reinsurer. Even in the event of a predetermined risk situation, the reinsurer supports and enables the insurance company to bear all the compensation. Nepal Insurance Authority (NEA) takes action under the provisions of the Insurance Act 2079 against the insurer who knowingly takes more risk without reinsurance.

However, the Deposit and Credit Protection Fund has not reinsurance despite carrying many times the risk of self-determination, and is only charging security fees by cultivating lies that protect the sweat earnings of the general public.