Kathmandu. It has already been three months since the Nepal Insurance Authority (NIA) brought its annual policy and program for the fiscal year 2082/83 to the public. The NRA has made very slow progress in the implementation of the policies and programs issued by the Nepal Rastra Bank for the first time.

In most of the commitments included in the program, the NRA has not yet initiated any initiative to implement it within a year’s time. There is not a single instruction with measurable impact.

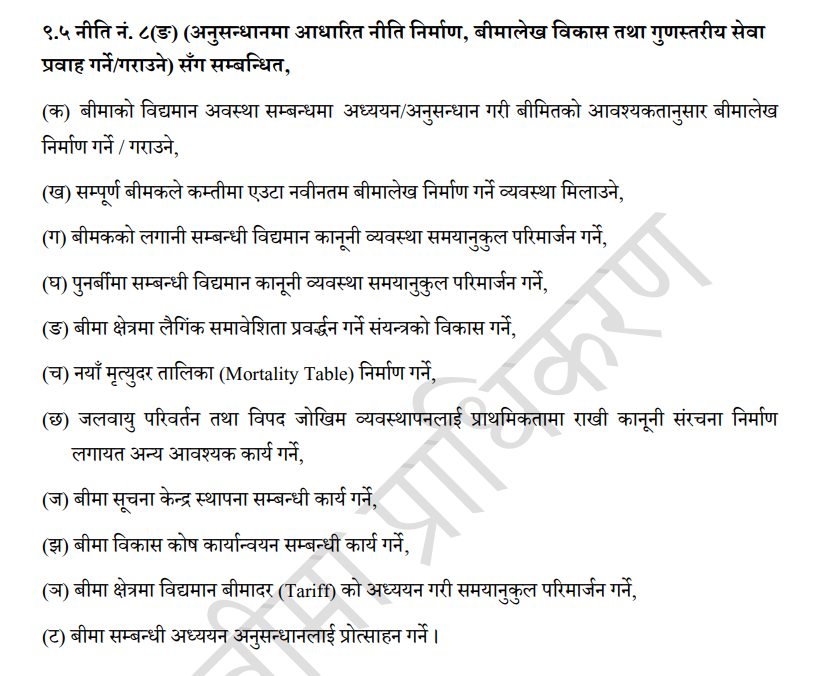

The authority has presented an ambitious plan to modernize the insurance sector of Nepal through research-based insurance production, innovation in insurance production, gender inclusion, climate-risk preparedness, and the establishment of an insurance information center.

These announcements are not highly unlikely or unforeseen matters, but a list of minimum and routine actions that a regulator should do. However, the NRA has not shown any urgency in implementation.

In its annual policy and program, it has been mentioned that the authority will carry out research and development activities within a year:

To carry out research on the current state of insurance in Nepal and to prepare insurance policies as per the needs of the insured, to issue at least one new policy to each insurer and to upgrade the laws related to insurance investment and reinsurance. None of this work has started.

Develop a new mortality chart, promote insurance access and gender inclusion in leadership, establish an Insurance Information Centre and operate an Insurance Development Fund

.

It has announced a review of the old fees to ensure fairness and market efficiency. The NRA has been discussing the mortality chart continuously for the last seven years.

The NRA has not been able to take any policy initiatives in Karnali and Madhes provinces which are lagging behind in terms of insurance access. Programs promoting gender inclusion under insurance leadership seem to have been included only for cheap popularity. The NRA has not initiated any fruitful work regarding the establishment of Insurance Information Center and the Insurance Development Fund.

The general insured people have to bear the price of the sluggishness shown by the NRA in the establishment of the Insurance Information Centre, Insurance Development Fund and the preparation of a new mortality rate.

The NRA has not been able to move forward in the implementation of policies and programs through collective initiatives by regularly publishing work deadlines and progress measures, forming expert task forces with clear achievements, bringing insurers, educationists and consumer bodies on the same table.

Nepal’s insurance sector needs a regulator to lead, implement and work for it, rather than just more schemes – not just paper declarations. Until that happens, the Nepal Insurance Authority should answer a simple question:

If it can’t be implemented, why should the sector trust regulators?