Kathmandu. Karnali Province’s agricultural crop insurance has shrunk significantly after the Commission for the Investigation of Abuse of Authority (CIAA) launched an investigation into allegations of misuse of agricultural insurance subsidy.

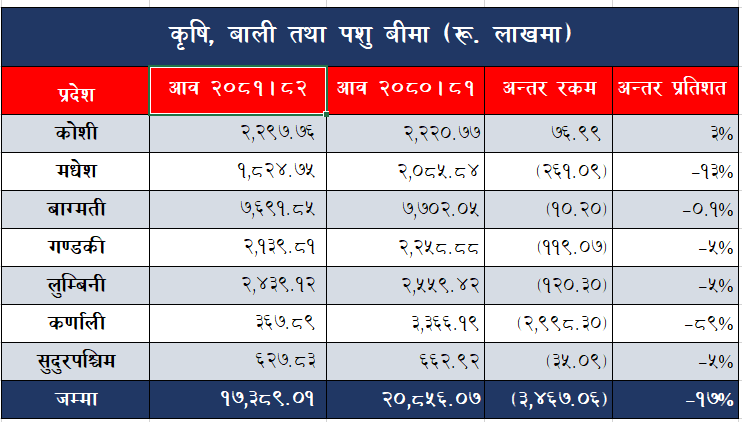

According to the data published by the Nepal Insurance Authority, the previous fiscal year 2080. Compared to 81, the last fiscal year 2081. Income from agriculture, crop and livestock insurance has shrunk by 89 per cent in 1982. The income from agriculture insurance, which has shrunk from 0.1 percent to 13 percent in other states after the tightening of the insurance subsidy process, has reached a worrisome situation in Karnali.

According to nea, the previous fiscal year 2080. The non-life insurer had collected a total of Rs 336.619 million in insurance premium, including grants, by issuing agricultural crop and livestock insurance policies in 1981. Last fiscal year 2081. A total of Rs 36.7 million has been collected as insurance premium. In terms of amount, rs 299.8 million has been collected in the last fiscal year compared to the previous fiscal year.

Shikhar Insurance Company has stopped the sale of crop insurance policy after the CIAA launched an investigation into a complaint regarding misuse of insurance premium subsidy. Shikhar Insurance has stopped the sale of apple insurance policy in the last fiscal year, alleging that the CIAA investigation has obstructed the service delivery and created confusion regarding the payment of claims of old insurance policies and the admission of grant amount.

A complaint has been lodged with the CIAA alleging that the non-life insurer had embezzled the subsidy amount by insuring the paper of the apple plant that was not taking place in the farmers’ fields.

The ministry of agriculture has implemented tight provisions through the insurance subsidy guidelines to prevent misuse of subsidy amount of agricultural crop insurance and ensure that the target group is benefited. Apart from Koshi Province, the collection of agricultural insurance fees has shrunk in other states.

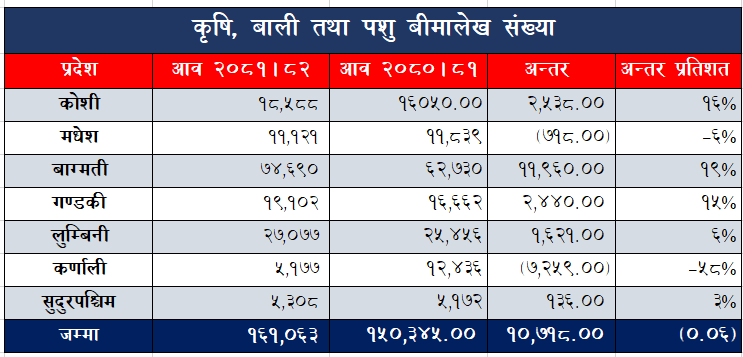

Similarly, agriculture insurance has been significantly narrowed in Karnali on the basis of the number of insurance policies. According to the NRA, a total of 5,177 policies have been issued in the last fiscal year. In the previous fiscal year, 12,436 policies were issued.

Insurer’s burden in agricultural insurance, more insurance for misuse of subsidy

Based on the number of insurance policies, the impact of the tightening of insurance subsidy has been seen only in Madhes and Karnali provinces. The number of crop insurance policies has decreased by 6 percent in Madhes province and 58 percent in Karnali province. On the other hand, the number of crop insurance policies has increased by 19 percent in Bagmati, 15 percent in Gandaki, six percent in Lumbini and 3 percent in SudurPaschim.

It is not a good sign that the promotion of crop insurance is more necessary for the promotion of apples, herbs, marsi rice, legumes, etc., which are considered as the basis of karnali’s prosperity.

In a clarification given to Karnali lawmaker Gyan Bahadur Shahi on June 27, the CIAA claimed that the farmers had insured them by mentioning the number of plants 25 percent more than the actual number. Apart from this, the financial year 2080. Rs 300 million is yet to be received as grant from the government.

The insurance company is yet to receive a huge amount of grant from the government, and it has not received clear instructions from the regulator regarding the cancellation of the insurance policy with fake number, etc.

Shikhar Insurance, in its clarification to Lawmaker Shahi, has stated that the apple insurance policy mentions more number of plants than the actual number and the farmers have insured them. According to the insurance company, the farmers have shown 25 percent more number of plants.

Shikhar Insurance’s underwriting side is weak as the CIAA has not been able to ascertain whether the number of plants proposed in the policy is genuine even before the investigation.

The British Aid Agency (UK AID) has also provided technical and grant assistance for the implementation of seasonal index-based crop insurance in different districts of Karnali and Mustang of Gandaki. Shikhar Insurance has been implementing the crop insurance program in these districts.

Farmers in Karnali should be deprived of the insurance facility until the CIAA settles the dispute over apple crop insurance.