Kathmandu. Till the first week of May of the current fiscal year, the rights shares of six insurance companies have been allowed to issue. There are still four companies awaiting issue of rights shares.

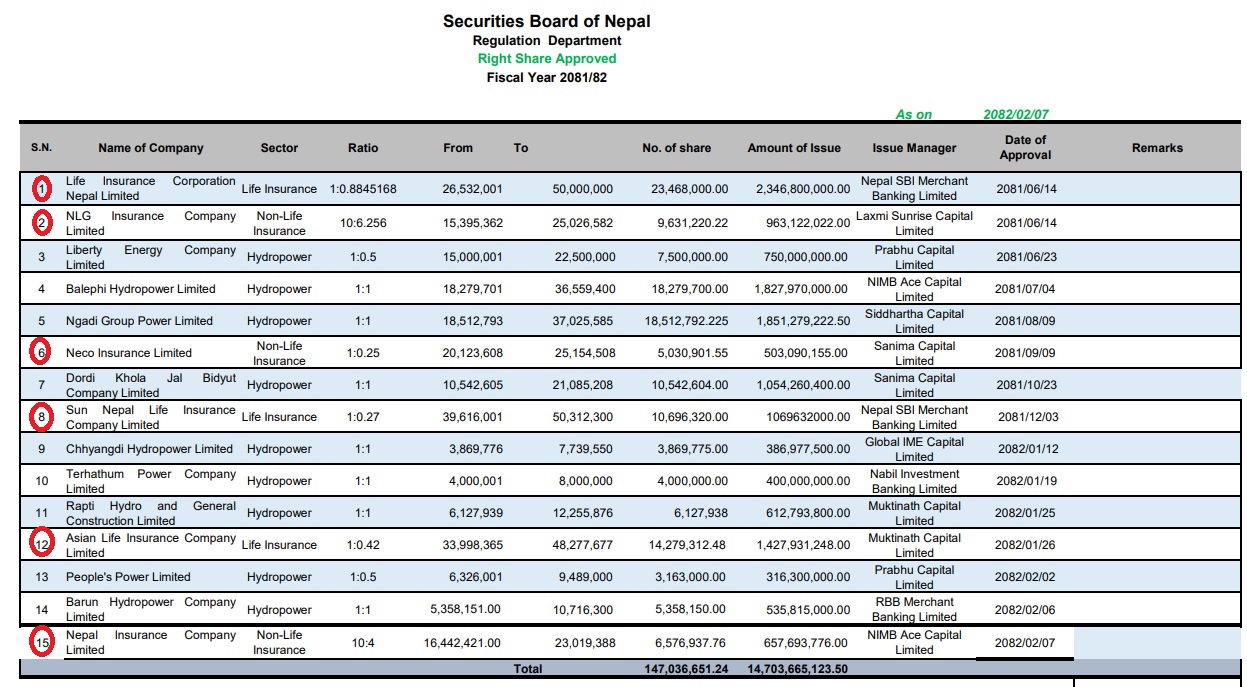

Life Insurance Corporation (LIC), Sun Nepal Life Insurance and Asian Life Insurance have so far got permission from the Securities Board of Nepal to issue right shares in the life insurance category. Of these, LIC has sold right shares worth Rs 2.34 billion to its shareholders, accounting for 88.45 per cent of its paid-up capital.

Sun Nepal Life is selling rights shares worth Rs 1.06 billion, representing 27 per cent of its current paid-up capital. Asian Life, on the other hand, has fixed the date of book closure for issuing right shares worth Rs 1.42 billion, which will be 42 percent of the paid-up capital.

Similarly, the Securities Board of Nepal has already given permission to issue right shares of NLG Insurance, Neco Insurance and Nepal Insurance under non-life insurance. Out of these, NLG Insurance has issued right shares worth Rs 963.12 million with 62.65 percent of the paid-up capital and Neco Insurance has issued right shares worth Rs 503 million 90 thousand 155 with 25 percent of the paid-up capital.

However, Nepal Insurance has received permission to bring right shares worth Rs 657.69 million, representing 40 per cent of its paid-up capital. However, the company has not yet fixed the date for issuing the right shares.

The Securities Board of India ( SEBI) has allowed 15 companies to issue right shares along with insurance companies so far in the current fiscal year. All these companies have been allowed to bring right shares worth Rs 14.70 billion.

SEBI) has allowed 15 companies to issue right shares along with insurance companies so far in the current fiscal year. All these companies have been allowed to bring right shares worth Rs 14.70 billion.

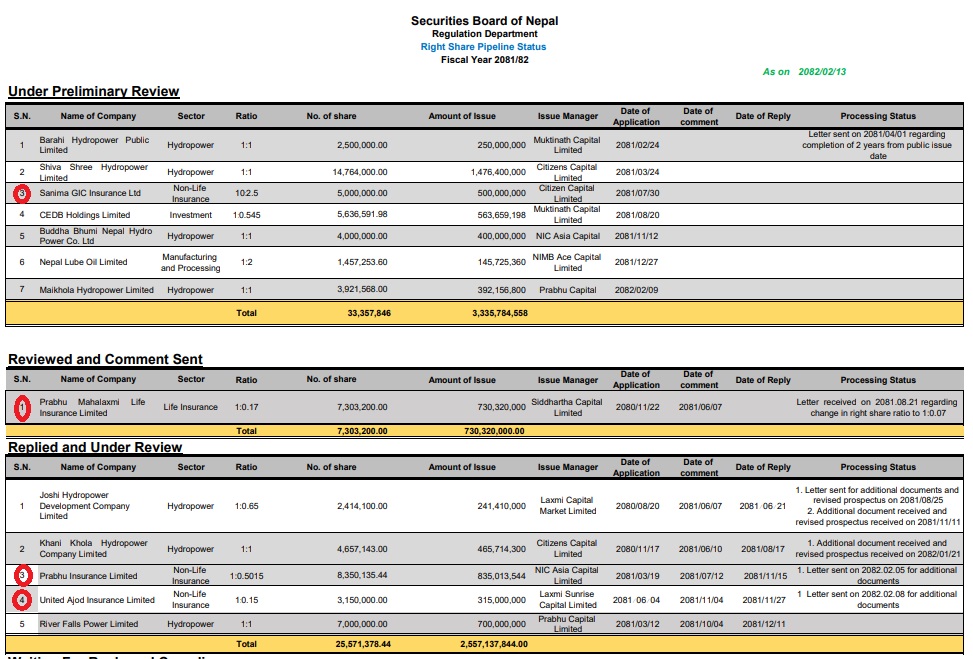

Similarly, three non-life insurance companies and one life insurance company have right shares in the pipeline of the Securities Board. Among them, Sanima GIC, Prabhu and United Ajod are in the non-life insurance category and Prabhu Mahalakshmi in the life insurance category.

Sanima GIC has sought permission to issue right shares worth Rs 500 million, Prabhu Insurance rs 835 million 13 thousand 544 with 50.15 percent and United Ajod with 15 percent to Rs 315 million.

Similarly, Prabhu Mahalakshmi Life has sought permission from the Securities Board of Nepal to bring right shares worth Rs 733.2 million, which is 17 percent of the current paid-up capital.

Right shares of 13 companies are still awaiting permission along with insurance companies in the securities board pipeline. These companies are preparing to issue rights worth Rs 6.62 billion.

Right shares of 13 companies are still awaiting permission along with insurance companies in the securities board pipeline. These companies are preparing to issue rights worth Rs 6.62 billion.

The right shares of insurers who have received permission from the Securities Board and are awaiting permission are at a face value of Rs 100.

According to the provisions made by the Nepal Insurance Authority, the minimum paid-up capital of the life insurer should be Rs 5 billion and that of the non-life insurer should be Rs 2.5 billion. To reach the minimum paid-up capital, some insurers have chosen the path of issuing right shares, while some are issuing bonus shares.