Kathmandu. The number of new entrants in the profession of insurance agents, which is playing an important role in ensuring the common man’s access to insurance, has increased significantly in the last 3 years.

Although the Nepal Insurance Authority (NIA) has been tightening policy regarding the distribution of agent licenses, renewal of license fees, and adherence to code of conduct, the number of agents has increased from 277,000 to 400,000 in the last three years.

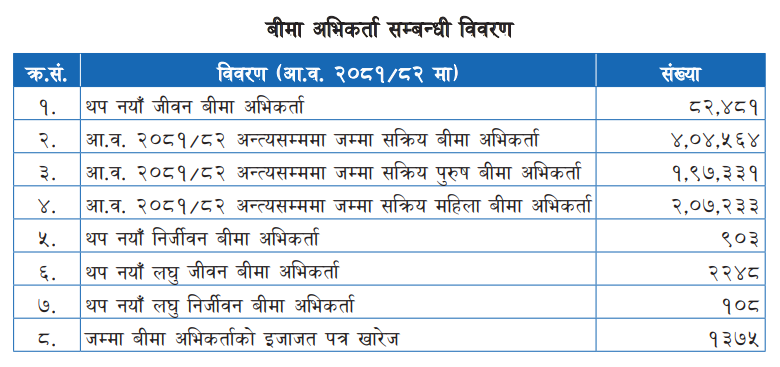

The number of insurance agents increased exponentially in the fiscal year 2081. There are about 4,404,564 insurance agents working in the country. Fiscal Year 2081. A total of 82,481 new licenses have been issued under the life insurance category in the fiscal year. This data shows that life insurance companies have been active in agent production in the last financial year.

Fiscal Year 2081. As of mid-July 2018, there were 197,331 male agents and 207,233 female agents. Similarly, the fiscal year 2081. A total of 903 licenses have been issued under non-life insurance, 2,248 under micro life and 108 under micro life insurance in Province 82. During the period, the licenses of 1,375 insurance agents were revoked.

Insurance agents play an important role in the insurance business. They not only act as a bridge between the customer and the insurance company but also contribute significantly to the expansion of insurance services. The agents provide services that reach the doorsteps of the customers from the remote to the remote villages to explain the need and importance of insurance, motivate them for insurance, develop the habit of saving compulsorily, ensure risk management, teach money management skills, and facilitate for insurance claims.

The insurance agent receives a certain percentage of the insurance premium for the service provided by the insurance agent and for the remuneration of the hard work. This amount of commission is the basis of their livelihood.

In our society, the word ‘commission’ is synonymous with bribery in the purchase and sale of goods and contracts in the public sector, so the common people do not like this word. And, it is a matter of concern that the agent earns a commission for his work for the insured and the insurance company. The importance of an insurance agent is realized by the insured or his or her dependent family members only when the agent advocates on behalf of the insured to get the insurance claim paid. When the insured party is in distress, the insured is compelled to bow down to the insured party due to respect for the agent by getting the claim payment from the insurance company.

Any Nepali citizen who has completed formal education up to grade 12 is eligible to apply, train, become an agent and work at any age. The fee for agent license training, examination fee, regulation fee and license fee has been fixed at Rs 3,000.