Kathmandu. It is said that it is impossible to say when fate will knock on someone’s door. Investing in the stock market can be risky, but in the long run, it can prove to be a profitable deal for stock investors.

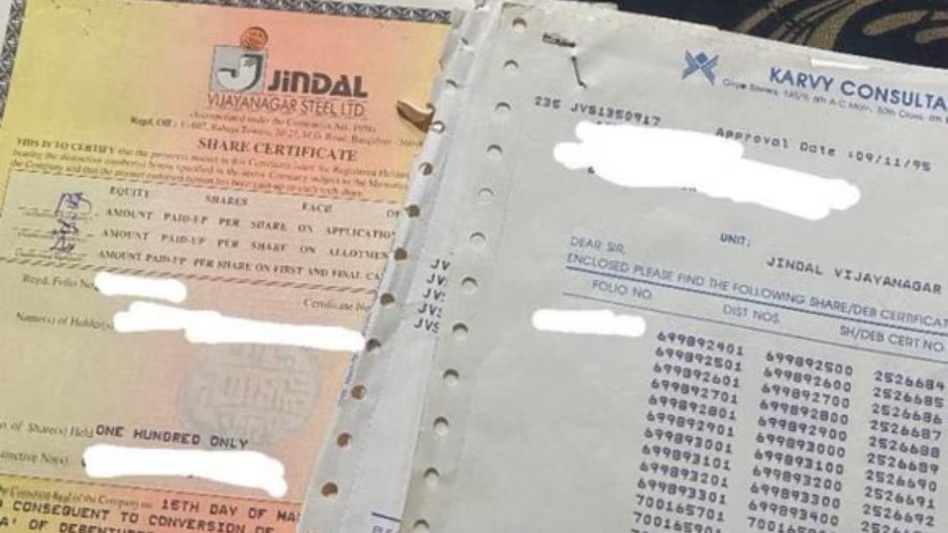

A similar incident has come to light recently. A man suddenly found a certificate of shares he had bought in 1995 at home. These documents relate to shares of GSW Steel Company purchased by the man’s father. In which Rs 1 lakh was invested. Which is now around Rs 80 crore. The man has become a millionaire in an instant with the shares his father bought and forgotten. The news is now going viral on social media.

According to a report published in Business Today, a Reddit user suddenly inherited millions of rupees after finding a certificate of shares of GSW Steel bought by his father 30 years ago. This share was bought by the man’s father in the 90s and invested Rs 1 lakh. Then he forgot. Now this investment made by his father three decades ago has increased to about Rs 80 crore according to the current value of the shares.

Saurabh Dutt, a stock market investor, shared a related post and picture on social networking platform Twitter (now X). This post is becoming increasingly viral and users are commenting on it. “Don’t rush to sell a good business, let time take its course if the fundamentals are right,” wrote an X user, focusing on the benefits of long-term investments. ’

This issue related to GSW shares has demonstrated the power of long-term investment. Another user wrote, “Now he can retire and live his life peacefully.” ’

Another user wrote, “People don’t know how stock divisions, bonuses and dividends are added over time, it’s really magical. ’

GSW Steel is an Indian company. This company rs. Rs 2.46 lakh crore. On the first trading day of the week on Monday, the company’s shares were traded at Rs 100.000 per share. It is being traded at Rs 1009.50. The company’s shares have given long-term investors a huge advantage in the long run.

If we look at the data of the last 20 years, the return of investors is 2484.34 percent. In the last five years, the company’s share price has increased by 433.69 percent.