Kathmandu. The umbrella organisations of investors have demanded immediate implementation of the provision of issuing separate icons to different types of shares.

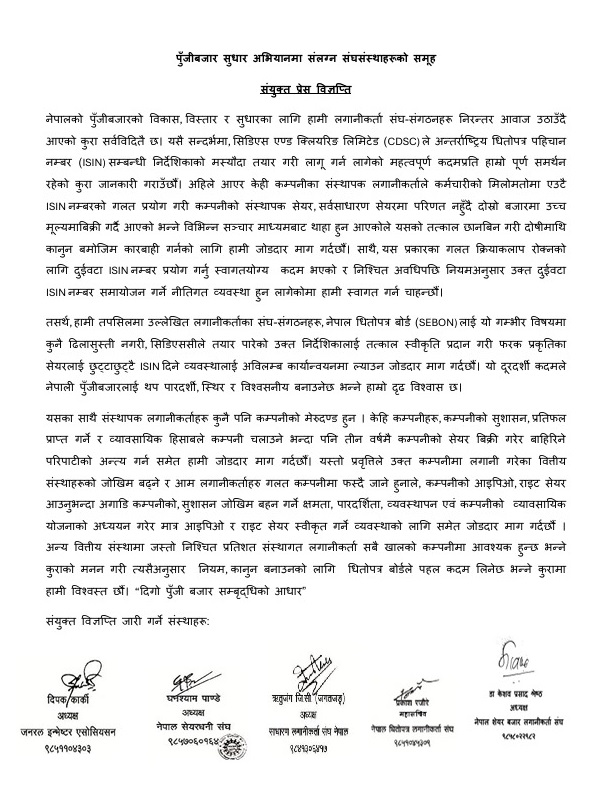

General Investors Association, Nepal Shareholders Association, General Investors Association Nepal, Nepal Securities Investors Association and Nepal Stock Market Investors Association made the demand in a joint statement on Wednesday. “It is well known that we investors’ associations have been continuously raising their voice for the development, expansion and improvement of Nepal’s capital market,” the statement said, adding, “In this context, we fully support the important steps being taken by the CDSC to prepare and implement the guidelines related to international securities identification number (IGN).” ’

It has now come to light from various media that the founder investors of some companies have been selling the company’s founder shares at a higher price in the secondary market without converting them into ordinary shares by misusing the same iGen number in connivance with the employees. “The use of two IGene numbers to prevent such malpractices is a welcome step and we would like to welcome a policy arrangement to adjust the two IGN numbers in accordance with the rules after a certain period of time,” the statement said.

The investors have demanded that the Securities Board should immediately approve the guidelines related to the IGN prepared by the CDSC without any delay in this serious matter and implement the provision of giving separate IGNs to shares of different nature. “We firmly believe that this far-sighted step will make the Nepali capital market more transparent, stable and reliable.”

The statement clarified that the founder investor is the backbone of any company. “We strongly demand an end to the practice of selling shares of some companies, companies, rather than getting returns and running the company commercially,” the statement said, adding, “We strongly demand an end to the practice of selling the shares of the company within three years rather than running the company in a professional manner.” We also demand transparency, management and the arrangement to approve the IPO and right shares only after studying the business plan of the company. ’

The statement expressed confidence that the Securities Board would take initiative to formulate rules and regulations accordingly considering that a certain percentage of institutional investors are required in all types of companies like other financial institutions.