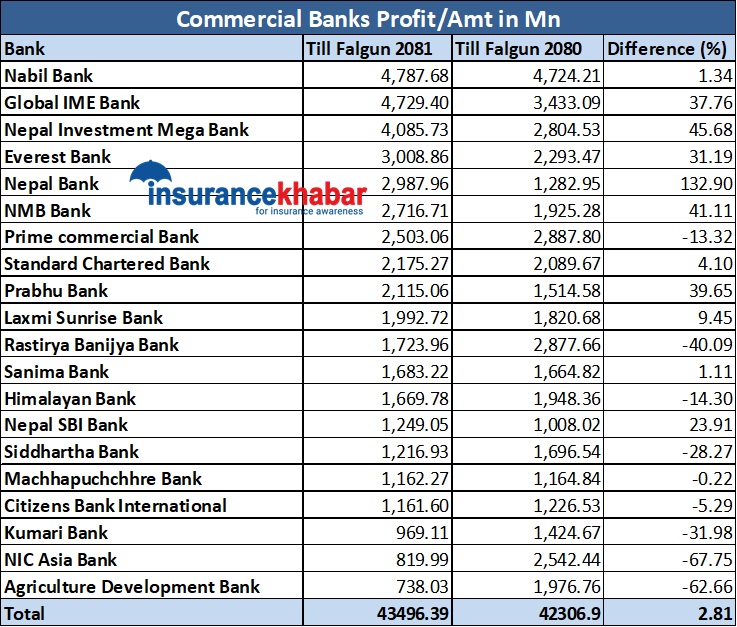

Kathmandu. Commercial banks have managed to earn a profit of about 43.5 billion rupees in the 8 months of the current fiscal year (Shrawan-Falgun).

According to the data released by Nepal Rastra Bank on Wednesday for the 8 months of the current fiscal year, 20 commercial banks earned a profit of 43.49 billion 6.3 million rupees. Last year, commercial banks earned a profit of 42.30 billion 6.9 million rupees in the same period. Compared to the previous year, the profit of banks has increased by 2.81 percent during the review period.

The profit of 11 banks has increased while that of 9 has decreased. Nabil Bank, which has earned the highest profit during the review period, is at the forefront. Nepal Bank is ahead in terms of profit growth.

Nabil has earned a profit of Rs 4.7876 billion till Falgun of the current year. The bank has earned a profit of Rs 4.7242 billion till the same period last year. The bank’s profit has increased by 1.34 percent during the review period compared to the previous year.

Global IME Bank is the second highest profit earner. This bank, which earned a profit of Rs 4.7294 billion till the same period last year, has earned a profit of Rs 3.433 billion till the review period. The bank’s profit has increased by 37.76 percent during the review period compared to the previous year.

The third bank with the highest profit is Nepal Investment Mega Bank. This bank has earned a profit of Rs 4.857 billion during the review period. The bank had earned a profit of Rs 2.804 billion during the same period last year. The bank’s profit has increased by 45.68 percent during the review period compared to the previous year.

Similarly, till Falgun of the current fiscal year, Everest Bank has earned a profit of Rs 3.88 billion, Nepal Bank has earned a profit of Rs 2.987 billion, NMB Bank has earned a profit of Rs 2.716 billion and Prime Bank has earned a profit of Rs 2.53 billion. Compared to the same period last year, Everest Bank’s profit increased by 31.19 percent, Nepal Bank’s by 132.90 percent and NMB Bank’s by 41.11 percent, while Prime Bank’s decreased by 13.32 percent.

As of February of the current fiscal year, Standard Chartered Bank has earned a profit of Rs 2.175 billion, Prabhu Bank has earned a profit of Rs 2.115 billion, Lakshmi Sunrise Bank has earned a profit of Rs 1.992 billion and Rastriya Banijya Bank has earned a profit of Rs 1.723 billion. Compared to the previous year, during the review period, Standard Chartered Bank’s profit increased by 4.10 percent, Prabhu Bank’s by 39.65 percent, and Lakshmi Sunrise Bank’s by 9.45 percent, while Rastriya Banijya Bank’s decreased by 40.09 percent.

Similarly, Sanima Bank has earned a profit of Rs 1.68 billion 32 million and Himalayan Bank has earned a profit of Rs 1.66 billion 97 million till Falgun of the current fiscal year. While Sanima Bank’s profit increased by 1.11 percent, Himalayan Bank’s decreased by 14.30 percent.

As of Falgun, Nepal SBI Bank has earned a profit of Rs 1.249 billion, Siddhartha Bank Rs 1.216 billion, Machhapuchhre Bank Rs 1.162 billion, Citizens Bank Rs 1.161 billion, Kumari Bank Rs 969 million, NIC Asia Bank Rs 819 million, and Krishi Bikas Bank Rs 738 million. While Nepal SBI Bank’s profit increased compared to the previous year, the rest have decreased.