Kathmandu. Asian Life Insurance has invested in the hotel business in partnership with its promoter shareholders.

The company has invested in the shares of City Hotels Limited, which is the main owner of Shakti Kumar Golyan. The company has bought 20 lakh units of shares of City Hotels Limited through an auction.

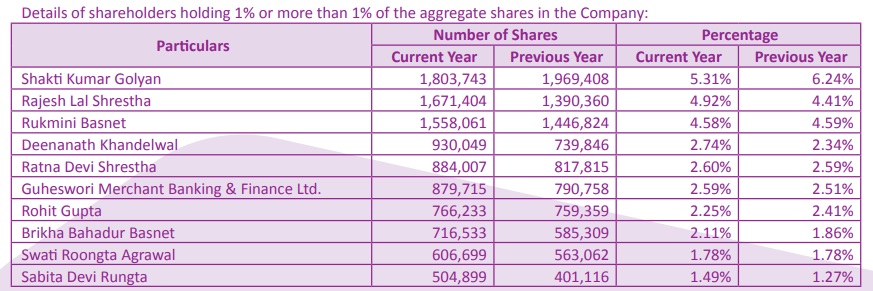

FY 2080. According to its annual report, Golyan owns 1,803,743 units of shares, equivalent to 5.31 percent of Asian Life’s shares. Asian Life Insurance has 10 shareholders with more than 1 percent shareholding.

He is the largest sole promoter shareholder with 26 percent ownership in City Hotels. He is also the Chairman of the Board of Directors of Golyan City Hotels Limited.

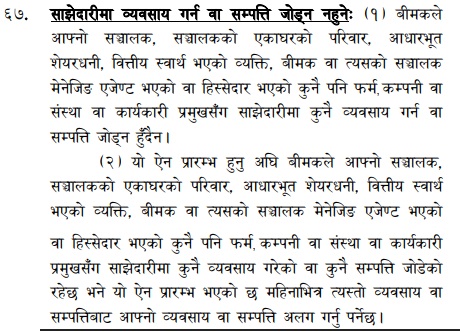

The Insurance Act 2079 prohibits an insurer from doing business in partnership with a person or institution, basic shareholder, director or chief executive officer having financial interest. Section 67 of the Act states that an insurer shall not carry on any business or attach property in partnership with any firm, company or institution in partnership with a director, fundamental shareholder or a person having a financial interest.

The Act defines a financial interest as a financial interest between a director or a principal shareholder or the chief executive or a member of his family and the insurer.

A shareholder who owns more than 1 percent of the shares in an organization is considered a fundamental shareholder of such an organization.

Despite the provisions of the Act, Asian Life has invested in the business in partnership with Golyan in a conflict of interest.

Out of the promoter shares, the insurance company got 19 lakh units of promoter shares. Rs. 19 lakh per share. 10 Lakh units at the rate of Rs. 306 and Rs. The company has purchased 9 lakh units of shares at a price of Rs 276. Apart from this, Rs. The company has received 1 lakh units of ordinary shares at the rate of 480 units.

Chief Executive Officer of the company, Dinesh Lal Shrestha, said that the commercial bank had applied to buy the shares through auction as an alternative to investment after the bank stopped renewing its deposits.

A total of 2117 firms, companies and individuals had applied to buy these shares.

The lock-in period of the promoters and employees of City Hotels, listed on the Nepal Stock Exchange (NEPSE), is coming to an end. A significant number of applications have been received after the opening of the trading of the promoter shares in the secondary market after the completion of this period on May 19, 2083.

When the interest rate of the bank’s fixed deposits is very low and the bank is refusing to accept fixed deposits, institutional investors have given priority to investment in the secondary market as an alternative investment.

In this regard, a director of the regulatory body Nepal Insurance Authority has said that this is a violation of the Act.

City Hotels operates a five-star hotel in Tahachal under the Hyatt-centric brand. The company continues to incur losses. The company had decided to increase its paid-up capital to raise bank loan and operating capital. Based on the decision, the company has issued 6,000 units of right shares in the ratio of 1:0.8 to increase the paid-up capital of the company.

The balance sheet of City Hotels will be strengthened by the sale of unsold right shares through the auction. Rs. The company has raised an additional paid-up capital of Rs 21,50,41,800 through the issue of face value of Rs 100. The highest amount of Rs 40 crore has been collected from the applicants who have agreed to buy the promoter shares. City Hotels will have to deposit Rs 46.86 crore in the premium fund for the amount above the face value.