Kathmandu. Non-life insurers have not been able to extend the benefits of agricultural insurance to farmers other than livestock farmers.

Although the government provides 50 to 80 percent subsidy on agricultural insurance to promote agricultural production, 99.98 percent of the total insurance policies are related to livestock insurance only. Although animal husbandry contributes little to the production of agriculture sector, the farmers of this region have benefited the most from agriculture insurance.

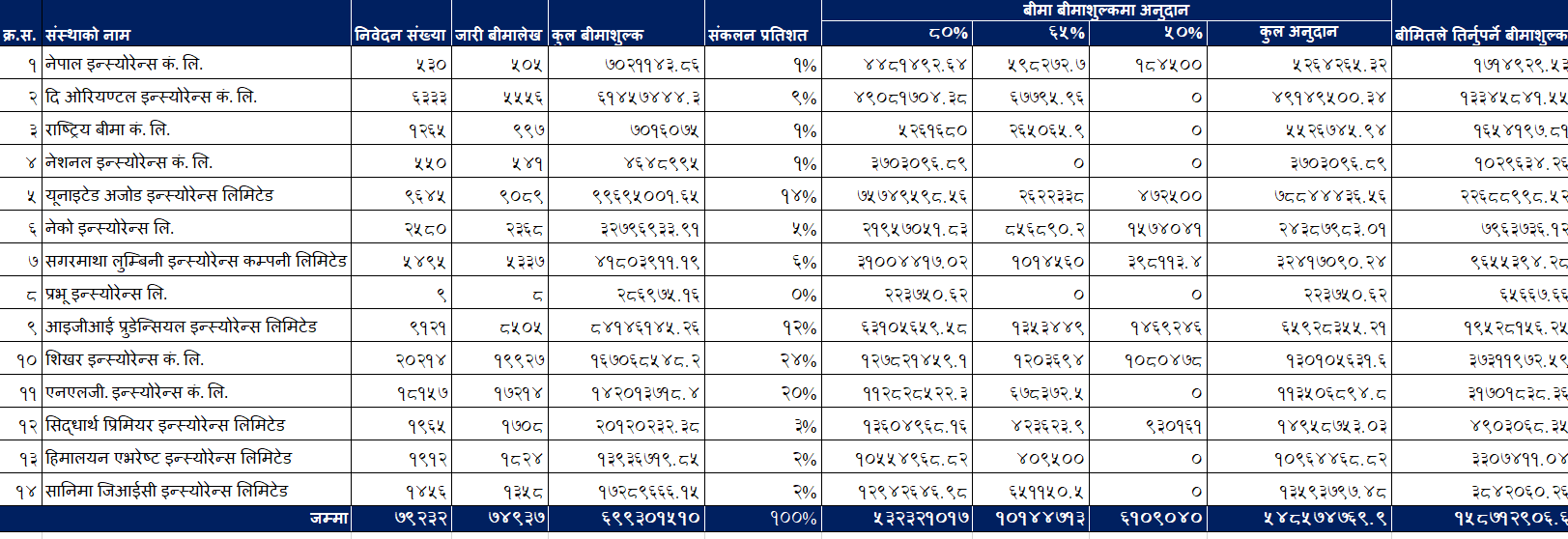

Last fiscal year 2081. Of the 74,937 non-life insurance policies issued in 1982, 74,802 are related to livestock insurance. The remaining 135 policies are related to fruits, vegetables and pulses crops.

The non-life insurers have not been able to insure the paddy crop, wheat crop and maize crop even though there is a significant production across the country. Farmers who produce crops, deprived of insurance facilities, it is clear that they are also deprived of agricultural credit facilities provided by banks and financial institutions.

At a time when farmers in most of the districts of the Tarai, including Madhes province, are suffering due to drought this year, the lack of insurance has made the farmers even poorer.

If the facility of crop insurance based on seasonal index had been extended to drought affected areas, farmers would have had the opportunity to claim compensation on the basis of seasonal indicators. This would have helped them reduce their economic losses.

Farmers who have taken loans for farming are unable to pay the burden of debt due to lack of crops in their fields. Not only this, in the absence of food production, the pressure of buying food to earn a living on a daily basis will increase the pressure of spending more.

Although 14 large and four small insurers are active for the expansion of agricultural insurance, only a limited number of farmers have been able to take advantage of the insurance. It has been observed that the benefits of agricultural insurance will not reach the fields of farmers who work hard in crop production unless the Nepal Insurance Authority, which is entrusted with the responsibility of promoting insurance, makes mandatory policy arrangements.

Since livestock insurance is easier than other insurance, there is a tendency for insurers not to take risks. Non-life insurers have been on duty as crop insurance requires technical evaluation and special technical study survey at the time of compensation.

Apart from this, the Nepal Insurance Authority has not been able to spread awareness among the common farmers regarding agricultural crop insurance

। Last year, the Government of Nepal has created a liability of more than Rs 548.5 million towards agricultural insurance subsidy. According to the data published by the Insurance Authority, the last fiscal year 2081. The Government of Nepal has to provide a grant of Rs 548.57 million to non-life insurers for agricultural insurance. In the last fiscal year, farmers paid Rs 158.7 million as insurance premium.

The government has been providing insurance subsidy at the rate of 80 percent, 65 percent and 50 percent respectively on the basis of the sum assured as per the provisions of the Agriculture Insurance Subsidy Guidelines.

In the last fiscal year, the amount of subsidy created by the government was 78.44 percent of the total insurance premium amount. Out of the grant limit, 80 percent of the subsidized policies are the highest. Out of the insurance premium collected from the insurance policy selected for the grant, 97 percent of the grant will be distributed as 80 percent of the grant.

The government has been providing insurance subsidy to non-life insurers not immediately but after a fixed period of time. Due to lack of resources, there has been a dispute between the non-life insurer and the Government of Nepal from time to time due to the delay in reimbursement of the amount of insurance subsidy.

Last fiscal year 2081. The non-life insurer collected Rs 699.3 million through a total of 94,937 insurance policies. Out of this, Shikhar Insurance collected 24 percent, NLG Insurance 20 percent, United Ajod Insurance 14 percent and IGI Prudential Insurance 12 percent.

According to the NRA, 5 percent of the insurance policies registered by the non-life insurers on the agricultural insurance portal have been rejected. A total of 79,232 insurance proposals were registered by non-life insurers on the portal, out of which only 74,937 proposals were approved.