Kathmandu. National level development banks in the current fiscal year 2082. As of the first quarter of 2018, it has issued about Rs 17.5 billion in collateral loans.

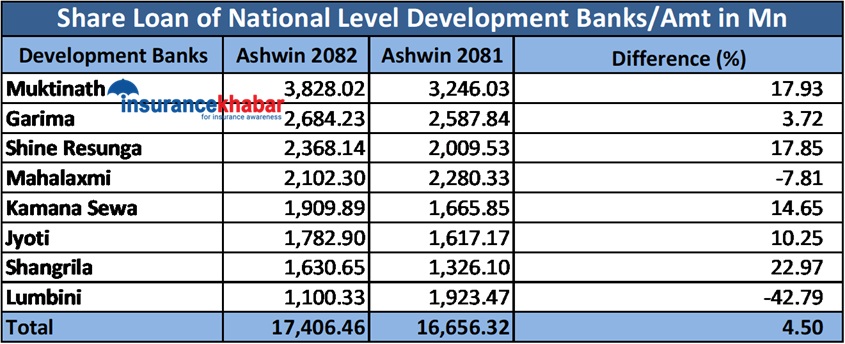

According to the data released by Nepal Rastra Bank, eight national level development banks have issued shares worth Rs 17.40 billion in the first three months of the current fiscal year. Previous fiscal year 2081. In the first three months of the current fiscal year, these banks had disbursed Rs 16.65 billion as collateral loans. Compared to the previous year, the share loan of banks increased by 4.5 percent in the review period.

Compared to the previous year, the share loan of 6 development banks increased while the loan of 2 decreased in the review period. Muktinath Bikas Bank is the largest lender of the shares, followed by Shangrila Development Bank in terms of growth rate.

Muktinath Bikas Bank has issued Rs 3.82 billion as collateral loan in the review period. In the same period last year, the bank had issued Rs 3.24 billion as collateral. The bank’s collateral loan increased by 17.93 percent in the review period compared to the previous year.

Similarly, Garima Bikas Bank is the second largest lender in the world. In the review period of the previous year, the bank disbursed loans of Rs. 2.58 billion and Rs. 2.68 billion in the review period. In the review period, the bank’s loan disbursement increased by 3.72 percent compared to the previous year.

Similarly, Shine Resunga Development Bank is the third largest lender in the company. The bank has issued Rs 2.36 billion as collateral loan during the review period. The bank had disbursed Rs 2.95 billion in the same period in the previous year. In the review period, the bank’s loan disbursement increased by Rs 17.85 crore compared to the previous year.

Likewise, Mahalaxmi Bikas Bank has disbursed shares worth Rs 2.10 billion, Kamana Sewa Bikas Bank Rs 1.90 billion, Jyoti Bikas Bank Rs 1.78 billion, Shangrila Development Bank Rs 1.63 billion and Lumbini Bikas Bank Rs 1.10 billion in the review period. Compared to the previous year, the share loans of Mahalaxmi and Jyoti companies decreased while the share of other banks increased.