Kathmandu. Vehicles used in public transport should not only have third party insurance, but also intensive insurance with drivers and passengers.

In case of an accident involving jeeps, buses and micro buses used for public transport, there is a risk of loss or death not only to third parties but also to the bus driver, co-driver and passengers. Therefore, the owner of the vehicle must get insurance to bear all these liabilities.

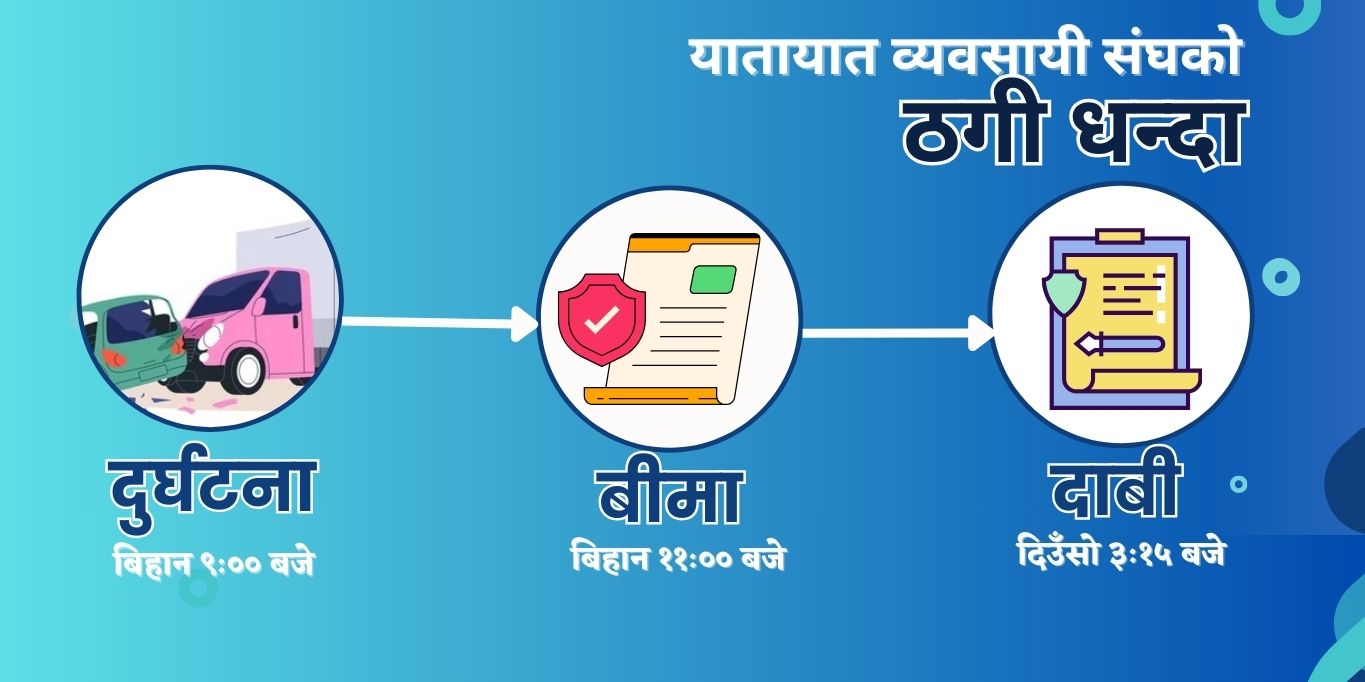

Most of the transport entrepreneurs’ associations are trying to evade the liability of compensation by influencing the police or threatening the victim or by claiming the insurance company on the basis of fake documents.

A similar case was seen in the case of a vehicle accident insurance claim in Shikhar Insurance Company a few years ago.

Event Details:

The accident took place when a truck (Lu 1 Kha 4792) insured by Shikhar Insurance collided with a car (Ba 8 Cha 4520) coming from the opposite direction at Thakali Chowk of Kawasoti Municipality-3 in Nawalparasi on October 7, 2018. 3 people in the car were injured.

The accident took place at 3:15 pm on the highway and the police had certified the accident and the certified documents related to the treatment of the injured were also submitted to the insurance company, but the insurance company refused to pay the claim. The application was rejected.

Yam Prasad Pandey, chairman of Western Region Transport Butwal, filed an application at the Nepal Insurance Authority (NEA) on April 17, 2080 alleging that he had not received the claim amount for the insurance claim.

Shikhar Insurance:

Initiating a preliminary investigation into the complaint, the authority sought a written reply from Shikhar Insurance asking why the claim payment was not made. In response, Shikhar Insurance informed that the insurance policy for the truck (Lu 1 Kha 4972) owned by Khagaraj Gautam has been issued for a period of one year from 11:00 am to October 1, 2019. Likewise, the letter dated Jestha 18, 2077 from the District Police Office, Nawalparasi, Bardaghat Susta-East stated that the actual date of the accident occurred at 9:00 am on October 7, 2075 and the claim could not be paid as the accident occurred before the term of the insurance policy came into force.

TAG_OPEN_span_19Reply of District Police Office to the Authority:

}

On March 1, 2080, the NRA sought written information from the District Police Office, Nawalparasi, Bardaghat Susta East. According to the District Police Office, the accident took place at 9:00 am on October 7, 2018. According to the information sought by Shikhar Insurance, the police office had mentioned the time of the accident at 9 am. A letter submitted by the Western Regional Transport Entrepreneurs Association, Butwal while claiming the insurance was mentioned at around 3:15 pm to lie to the insurance company.

Immunity to the Cracker{

Here, the transport association may have influenced the staff of the District Police Office to mention the wrong time of the accident or submitted a fake letter. The NRA should have recommended to the concerned body for action against the office-bearers of the Transport Entrepreneurs Association or the police personnel who issued the letter from the District Police Office for mentioning false details or issuing fake letters.