Micro insurance is a specially targeted insurance for the economically backward poor and low-income marginalized communities. There are a variety of risks to human life, health, wealth, wealth, liabilities, and business.

As technology and modernity develop in the world, so is the risk. More than 20 percent of the people in Nepal are below the poverty line. Such people spend more than their income. Other communities, including such backward classes, also need economic protection against disasters and risks.

Nepal is at high risk of floods, landslides, earthquakes, fires, storms and droughts. Since Nepal is an agricultural country, agriculture is the source of livelihood for about two-thirds of the population. Natural hazards are also prevalent in agriculture. As a result, farmers have not been able to earn as much income from production as compared to investment. In this way, the marginalized communities living in rural and urban areas need economic security the most.

In this context, microinsurance can be used as a reliable tool of social security. Microinsurance provides full financial protection against the risk of future life, wealth, property and liability to someone in the community.

Regulatory body Nepal Insurance Authority (NEA) A feasibility study of micro-insurance business conducted in 1978 showed the need to establish a micro insurance company with a central office in the province to provide access to insurance to the people of backward and low-income marginalized groups of the country. Government of Nepal fiscal year 2079. Point no. 80 of the budget statement. Article 327 states that a micro insurance company will be established to include the poor, the disadvantaged and the agricultural sector to develop the insurance business as an important pillar of social protection. Prior to this, all insurers had to compulsorily do micro insurance of at least 5 percent, but even if some insurers did micro insurance up to a maximum of 2 percent, the target could not be fulfilled as expected. Therefore, on this basis, a proposal regarding the establishment of a microinsurance company was called by publishing a public notice.

According to Section 26 of the Insurance Act, 2079, the government’s policy and program and the Guidelines on Registration of Micro Insurance, 2079, a total of seven companies including micro-life insurance company 3 and micro-life insurance company 4 were licensed to operate micro-insurance business on the basis of the assessment determined by the Board of Directors of Nepal Insurance Authority. The micro-insurance companies established in this way have been providing insurance related services to the underprivileged sections and other sections of the society. The main feature of micro insurance is that microinsurance can be easily understood by the general public, so everyone has easy and easy access. Since the insurance premium of micro insurance is small, it is possible to buy the insurance policy by paying a small sum insured. Microinsurance plays a major role in inculcating the habit of saving for the poor and low-income people. In addition, you can get insurance services by paying a small insurance fee and covering a lot of protection according to your needs. Even a small amount of savings can pay the insurance fee. The terms of the micro-insurance policy are also small. The claim payment process is short and simple and hassle-free. For this reason, the popularity of microinsurance in the community is increasing day by day. Microinsurance guarantees financial fulfillment by protecting the target group against the risks that may arise.

Access to microinsurance

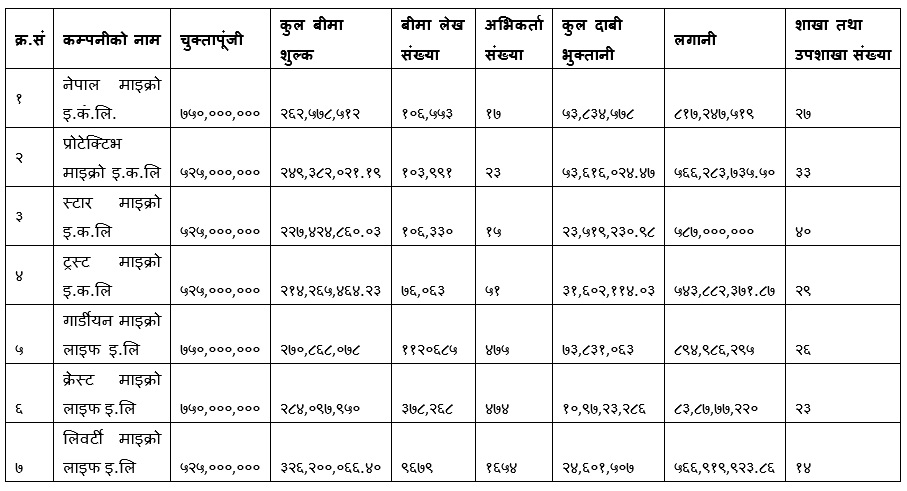

Large life and non-life insurance companies prefer to do city-centric business. Because their insurance and insurance fees are also large and it is easy to achieve business goals. On the contrary, micro-insurance is the best way to reach the low-income groups living in rural areas. Microinsurance insurance and insurance premium are small. Which easily meets the needs of the marginalized sections. Unless there is economic progress of such communities, the country cannot have economic growth rate. Microinsurance encourages individuals to make small savings and provides a basis for financial security. Micro-insurance continues to provide financial protection from risk to small businesses and businesses in rural areas. Microinsurance has great importance in expanding access to essential services including health, education among the marginalized sections of the society and maintaining inclusion in the society through microinsurance by expanding the scope of insurance. The status of microinsurance till Mid-July 2082 is as follows:

Details about microinsurance

Shortly after the establishment of micro insurance companies, they have been able to provide insurance services to the poor in rural and urban areas enthusiastically.

Topics to consider towards regulation

Nepal Insurance Authority (NEA) has made guidelines, directives, guidelines and orders and circulars to regulate insurers, especially three years ago based on large insurance companies. The micro-insurance company has come into operation only two years ago. In this way, it is necessary to change the existing situation in which companies with large and small capital are being regulated on the basis of the same criteria. Information technology has taken a big leap with the changes in human life on a daily basis. In the digital age, using software, websites, internet, mobile and computers, economic activities can be easily conducted at a low cost and in less time. Therefore, it is not appropriate to apply the criteria prescribed by the guidelines issued by the NRA towards the human resources and infrastructure of the branches and sub-branches of the micro-insurance company. Because very few employees of these micro insurance companies are providing insurance related services digitally.

Similarly, it is not appropriate to manage new human resources to give the right to settle claims up to the local level as per the claim payment guidelines. If the insurance claim has to be made according to the policy, the insurer immediately pays to the bank account of the concerned insured through electronic means on the basis of documents and evidence confirming the claim submitted by the insured.

Small-life insurers mainly sell non-par policies. Therefore, while preparing financial statements, 90 percent of the savings should be transferred to the life insurance fund and 10 percent to the profit-loss account. Short-life insurers sell non-par policies and fixed-term guaranteed bonus policies. According to the guidelines related to insurance, even the small life insurer has to arrange at least a future bonus reserve at the rate of bonus load included in determining the insurance rate. Since micro insurers are competing with large-capital insurers for business, it is natural for micro insurers to increase the cost. As a result, the time has come to consider the low insurance rate and problems in all pricing.

Although risk-based capital micro-insurance companies have been exempted this year, the fiscal year 2083. This will come into effect from 84. The factors used should also be regulated in such a way that they differ between large and small companies. A small life insurer can issue an insurance policy up to Rs 500,000. Supplementary contracts such as ADB, ABR, TPD, PWB cannot be maintained beyond Rs 5 00,000. As a result, the micro-insurance business seems to be shrinking. In the changed context, all the needs of the insured cannot be met with an insurance cover of Rs 5 00,000. In the context of the provision of not being insured by keeping the rider separately, the scope of insurance will definitely be expanded with the provision of additional rider facility of Rs 5 00,000 as the rider can be taken only by paying Rs 100-200. The micro non-life insurer should recognize the insured to maintain the sum assured up to the extent of the additional loan amount as there is a situation to cancel the sum assured due to the addition of the loan in the case of insurance related to banking transactions. Because small insurers sell insurance policies to the target low-income group from the beginning. Allowing motorcycle insurance and third-party insurance to be issued only to micro-life insurance companies can also reduce the unhealthy competition seen at present.

Insurance agent

Insurance agents are the backbone of the insurance business. Since the insurance company and the insured are connected, the insurance agent has his own importance in the insurance sector. Insurance agents work with a focus on marketing insurance. Their responsibility ranges from explaining what insurance is to the person to insuring them and also to help the insured for the transfer at the time of the claim. People don’t come to insure spontaneously.

Insurance agents have an important role to play as insurance force cells are sold all over the world. The more insurance agents are produced, the more insurance will expand. According to the Insurance Act, 2079 BS, micro insurance companies should do micro-insurance business targeting low-income groups and backward areas. Such classes live especially in remote and rural areas. They have less access to education.

According to the Insurance Regulations, 2081, to become an insurance agent, one must have passed 10 plus 2 or proficiency certificate level or equivalent from a recognized institution or board. In order to become an individual and institutional agent, it is difficult for people in rural areas to collect documents such as organization registration certificate, management letter, regulation, tax payment certificate, proof of not being blacklisted, permanent account number. In the case of individual agents, a fee of Rs 2,500 has been fixed and in the case of institutional agents, Rs 10,000 has been fixed for obtaining the license. Such people cannot collect the prescribed documents and fees. Because they are finding it difficult to avoid daily meals. And, in such a situation, how can more insurance agents be made? Micro insurers have been facing problems in making insurance agents in such areas. Unless there is an expansion of active agents in backward and rural areas, microinsurance will not take off. Residents of Kathmandu, Pokhara and Biratnagar cannot go to remote and distressed areas to sell small policies as agents. The time has come for the regulatory body to consider this.

In order to expand the scope of micro insurance, it may be better to make necessary arrangements so that the shops, counters, NGOs, financial institutions, other organized organizations near them can easily be made insurance agents to sell insurance policies, collect insurance fees and submit them to the insurer and complete the process of claim payment.

Unhealthy competition in the insurance business

Micro insurance companies have been established with the objective of providing insurance services targeting low income people, backward classes, poor people and working class. Although their capital and reserve funds and manpower are not the same as that of large insurance companies, they have to provide insurance services to individuals and groups in an easy, simple and quick manner. However, due to unhealthy competition in nepal’s insurance market, small insurance companies will have to struggle to survive in business with insurance companies with large capital. Complaints are heard everywhere that the insurer is taking low insurance rates. Foreign employment term life insurance, motor insurance, property insurance, maritime insurance and engineering insurance are seen to be carrying out insurance business with massive cashback. There has also been a problem with risk assessment. In this way, in the present situation of unhealthy competition, microinsurance has to struggle to survive. Because they are small in size of capital and budget, it is not easy to compete with large insurers.

Conclusion

In the present context, microinsurance should be understood as a major tool for risk transfer not only for low-income marginalized sections but also for other sections of the community. Nepal is one of the most vulnerable countries such as floods, landslides, earthquakes and fires. Low-income and backward communities seem to be suffering the most from such natural disasters. During natural disasters, people look to the government for relief. However, the government cannot provide financial assistance to all immediately. At the same time, the amount of financial relief from the government is also low. The low amount of money cannot meet the needs and expectations of such classes. Such a class is forced to take loans and loans from economically well-off people at high interest rates and build agricultural work, business and houses. This makes the poor poorer. In a country like ours, a family of 5-6 people is run with the earnings of one person. Accidents, illnesses and sudden deaths of the main earning person lead to financial crisis for family members. In such a situation, financial problems can be solved through microinsurance. Microinsurance can provide financial protection against the potential risks to the daily lives of the target community by expanding access to essential services, including health and education. Therefore, microinsurance plays a major role in maintaining inclusivity in insurance and expanding the scope of insurance.

The government, regulatory bodies and international organizations should conduct awareness programs on insurance to increase the access of the target group to micro insurance. At the same time, necessary cooperation should be made with the local levels. In order to encourage micro-insurance, the state should provide subsidy on micro-insurance fees, tax exemption and various types of concessions. Regulatory bodies should differentiate between large capital insurers and small insurers with small capital. Also, microinsurance should be encouraged through legal and policy arrangements. Only then can the government and regulatory bodies achieve the goal of providing financial protection from risk by providing insurance access to the country’s backward and low-income marginalized communities.

Dinesh Lal Karna is a former director of Nepal Insurance Authority. )