Kathmandu. The use of commercial vehicles in Nepal has been increasing lately. From big projects, industries, businesses to small businessmen, now even small businessmen are using vehicles by taking loans from banks for commercial purposes.

If we look at the data of Nepal Rastra Bank, it seems that loans have increased more in commercially used vehicles than in individuals. In the 10 months of the current fiscal year, rs 86.83 billion has been borrowed from banks on commercially used vehicles. While only Rs 42.33 billion has been spent on personally used vehicles.

Insurance has been made mandatory for all, be it personal or commercial vehicles. Nepal Insurance Authority (NEA) has introduced a separate insurance scheme for commercial vehicles. The term of this commercial vehicle insurance is 1 year. The policy has to be renewed every year.

After insurance, the insurer has to pay compensation for the damage caused by fire, lightning, earthquake, flood, landslide, storm, hail, snow or frost, accidental or accidental causes, loss of wear and tyre or mechanical or electrical obstruction, failure, damage to the vehicle due to breakdown, theft, sandal or damage and transportation on road, rail, inland waterways, lift or elevator. is.

Insurance of the vehicle cannot be claimed in the absence of potential damage as envisaged in the policy. It will have to be renewed again next year.

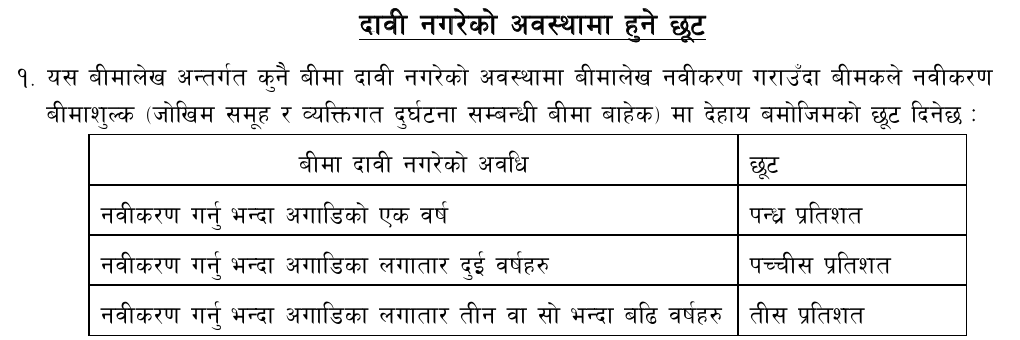

There is also a discount facility for renewal of commercial vehicles next year in case there is no claim in the insurance policy. If there is no insurance claim, the insurer gets a discount on renewal insurance (except for risk group and personal accident insurance) when renewing the policy.

According to the policy policy, if the insurance claim is not made for one year before renewal, then there is a provision of 15 percent discount on the insurance premium while renewing it the next year.

Similarly, if there is no claim for two consecutive years before renewal, then there is a facility of 25 percent discount on renewal insurance and 30 percent discount for three or more consecutive years.

The insurance company should give a discount to the insured only if he renews it within 30 days of the expiry of the policy. If more than one vehicle is mentioned in the schedule of this policy, then the insurer will provide a discount on each such vehicle in case there is no claim as insured.

Similarly, if the insurer approves to change the insured’s insurance interest under this policy, then the insurance premium exemption facility available to the former insured will not be available to the changed insured.