Kathmandu. After a long time, the Nepal Insurance Authority (INSURANCE AUTHORITY) has made public the updated details of insurance claims and payments for the damage caused by floods and landslides caused by the incessant rain in the second week of October last year.

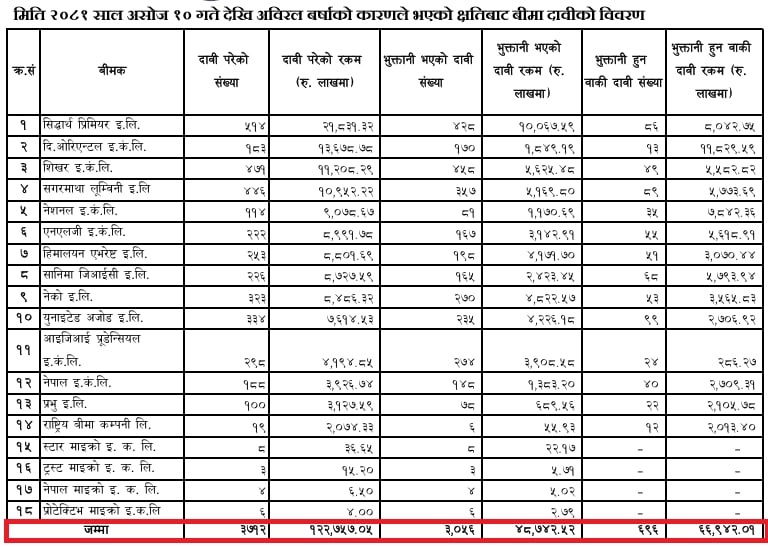

The Insurance Authority has made public the details of insurance claims and payments made in 14 non-life insurers and 4 micro-life insurers till June 30. According to the details made public by the NRA, the accounts of about Rs 710 million have been found to be different. According to the data, 3,712 claims have been made in 18 companies. The companies have to pay Rs 12.27 billion for these claims.

According to nea data, these insurance companies have paid Rs 4.87 billion for 3,065 claims. The companies have paid only 39.71 percent of the total claim amount.

Similarly, according to nea’s statistics, the companies are yet to pay Rs 6.69 billion to the companies with 696 claims. The remaining amount is 54.53 per cent of the total claim amount.

Authority error!

According to nea data, 3,712 claims have been made in the companies so far. Of these, 3,056 claims have been paid and 696 are yet to be paid. After reducing the number of claims paid in the total number of claims, only 656 claims are yet to be paid. However, nea data shows that 696 claims are yet to be paid. In this way, there are 40 different claims here.

On the other hand, when it comes to the amount of claim payment, there is a difference. According to nea data, rs 4.87 billion has been paid for 3,056 claims from the companies. Similarly, rs 6.69 billion of 696 claims are yet to be paid by the companies.

On the other hand, the companies have to pay Rs 12.27 billion for a total of 3,712 claims so far. The amount paid in the total claim amount has been reduced by Rs 4.87 billion, while the outstanding payment is Rs 7.40 billion. According to nea data, the outstanding claim amount is Rs 6.69 billion. In this way, the claim amount of Rs 707.25 million seems to be different. Which is equal to 5.76 percent.

According to nea data, Siddhartha Premier Insurance is the largest claim payer. The company has paid Rs 1.67 billion for 428 claims. Now the company is yet to pay Rs 804.27 million for 86 claims.

An official of the Insurance Authority said that the claim payment process of the companies is slightly different. Therefore, the official said that it may be in the data.