Kathmandu. The leadership of the Nepal Insurance Authority, which should play a sensitive role as a regulator of the insurance sector, has fallen into the hands of an inexperienced person. None of the people on the board of directors of the authority are experts in insurance.

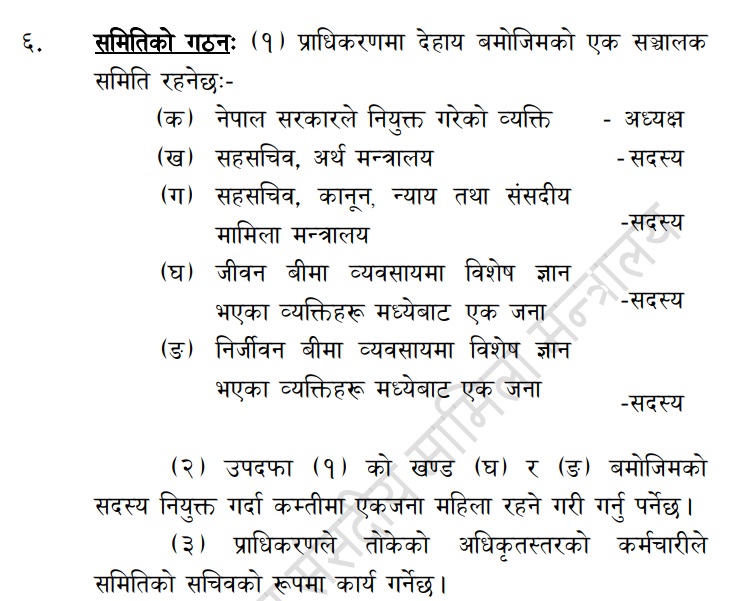

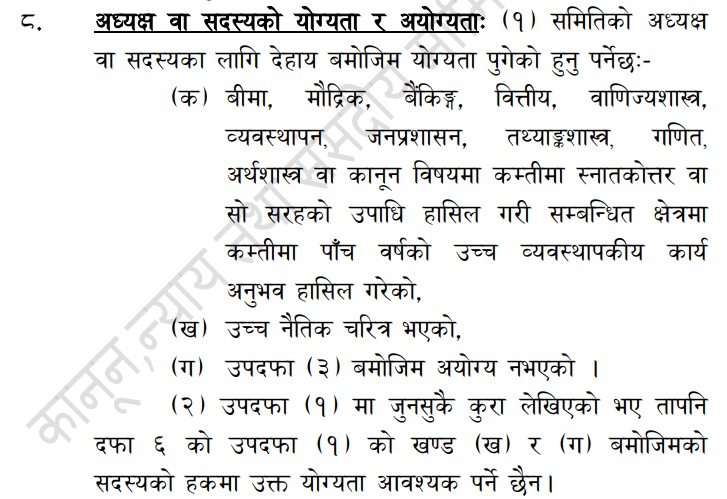

The Insurance Act, 2079 BS, has a provision that two directors representing the Ministries of Finance and Law among the five-member board of directors of the Insurance Authority do not require any experience. Although the post of chairman of the authority requires at least 5 years of experience in high-level managerial work in the insurance sector, the ruling party has been repeatedly trying to override this provision.

Recently, Radha Kumari Pokharel, who was nominated as an expert woman member from the quota of the ruling coalition party CPN-UML, also has no experience in the insurance sector. His identity has been criticized on social media, saying that he is only an investor who invests in the secondary market.

A complaint has already been filed with the Commission for the Investigation of Abuse of Authority, challenging the qualifications of Sharad Ojha, who was appointed as the chairman of the authority from the quota of the ruling coalition party, the Congress. Earlier, a writ petition was filed in the Supreme Court to annul the appointment of the then chairman Chiranjivi Chapagain, saying that he did not meet the qualifications. The Supreme Court had dismissed the writ petition, stating that Chapagain had already attained his qualifications within that period, as the writ petition was filed only after almost 2 years of working for the authority.

The Nepal Insurance Authority is responsible for regulating two reinsurance companies licensed by it, 14 life, 14 non-life, 7 micro-insurance companies, 15 domestic reinsurance brokers, 66 foreign reinsurers, 49 foreign reinsurance brokers, 26 agricultural insurance surveyors, 329,000 agents, and 1,250 surveyors. Not only this, the authority is also responsible for the safety of more than 300 billion rupees of savings given by the common citizen to invest their hard-earned money safely, and the investment of nearly 100 billion rupees made by the shareholders.

The presence of a group of people who are unaware of insurance and unknown about the technical aspects of insurance at the leadership level of the authority, a legal institution that has to shoulder so many sensitive responsibilities, makes it impossible to clarify the guidelines for the overall insurance sector in Nepal.

Considering the sensitivity of the insurance sector’s contribution to the national economy and poverty alleviation in neighboring India, the central government has stipulated a provision that candidates for the post of Chairman of the Insurance Regulatory and Development Authority of India (IRDAI) must have at least 30 years of work experience. 6. The criteria have also been set that the applicant should have worked as a secretary in the Government of India or its equivalent and in the State Government or other organizations. Based on the experience of working in the private sector, it has been made mandatory for the person applying for candidacy to have experience of working as a Chief Executive or equivalent position in a financial institution.