Kathmandu. Global IME Bank and Prabhu Bank in the current fiscal year 2081. A comparative study conducted by Insurance Khabar on the basis of major financial indicators between the two banks in the third quarter of 82 th quarter:

#

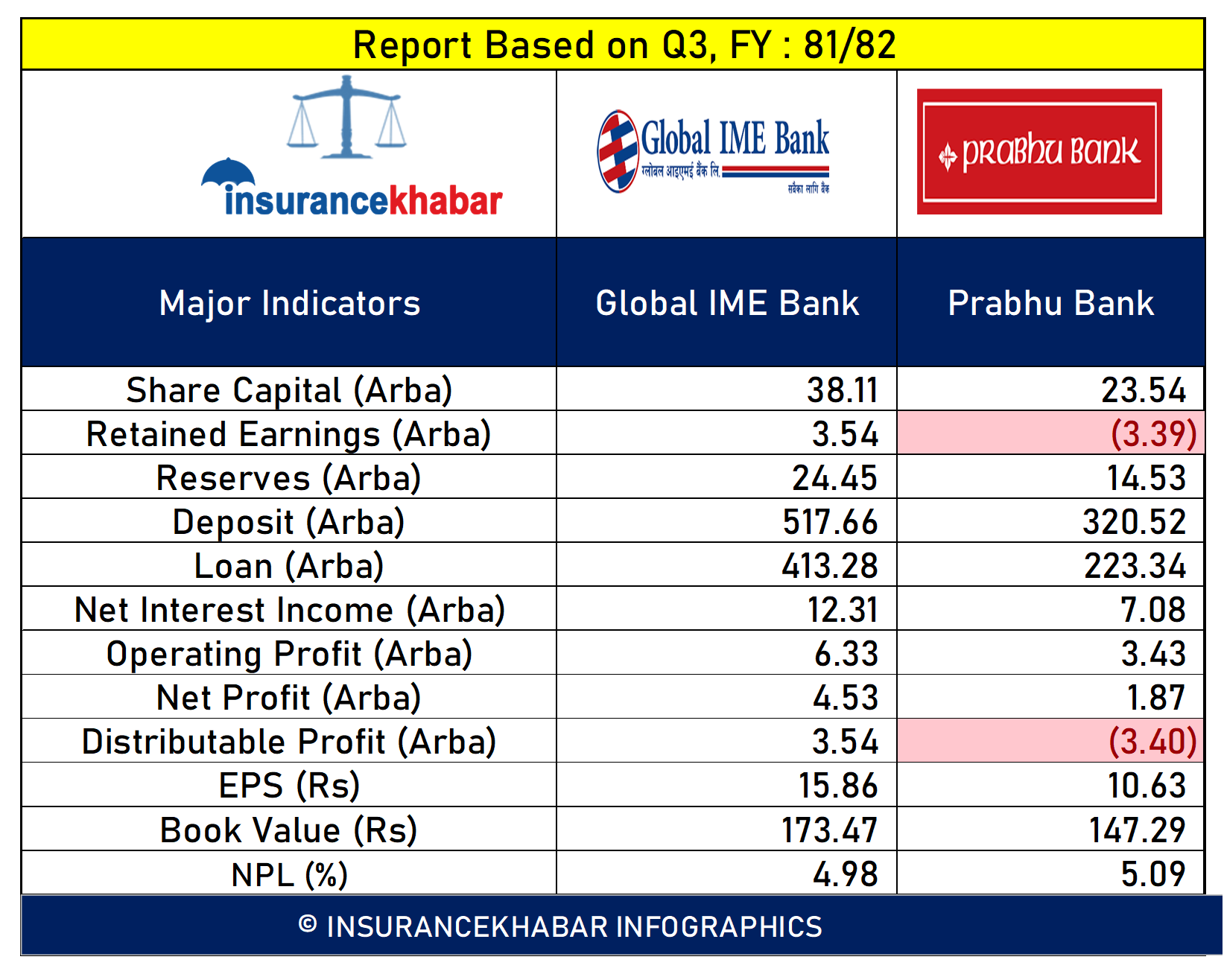

inline_tags_PLACEHOLDER_5#चुक्तापुँजीः Global IME has a paid-up capital of Rs 38.11 billion while Prabhu has a paid-up capital of Rs 23.54 billion.

inline_tags_PLACEHOLDER_5#चुक्तापुँजीः Global IME has a paid-up capital of Rs 38.11 billion while Prabhu has a paid-up capital of Rs 23.54 billion.

#inline_tags_PLACEHOLDER_6##जगेडा Fund: ##inline_tags_PLACEHOLDER_7#inline_tags_PLACEHOLDER_8## Global IME has a reserve fund of Rs 24.45 billion while Prabhu’s reserve fund is Rs 14.53 billion.

#inline_tags_PLACEHOLDER_6##रिटेन्ड Earnings: Global IME has retained earnings of Rs 3.54 billion while Prabhu’s retained earnings are negative at Rs 3.39 billion.

#inline_tags_PLACEHOLDER_6##निक्षेप and loans:#inline_tags_PLACEHOLDER_8## Global IME has collected Deposits of Rs 517 billion and disbursed Rs 413 billion, while Prabhu has collected Rs 320 billion and disbursed Rs 223 billion.

#inline_tags_PLACEHOLDER_6##खुद interest: #inline_tags_PLACEHOLDER_8## Global IME earned a net interest income of Rs 12.31 billion, out of which Prabhu earned Rs 7.08 billion.

#inline_tags_PLACEHOLDER_6##सञ्चालन Profit: Global IME has made an operating profit of Rs 6.33 billion, while Prabhu has made an operating profit of Rs 3.43 billion.

#inline_tags_PLACEHOLDER_6##खुद Profit:#inline_tags_PLACEHOLDER_8#Global IME has earned a net profit of Rs 4.53 billion, while Prabhu has earned a net profit of Rs 1.87 billion.

#inline_tags_PLACEHOLDER_6##वितरणयोग्य Profit: Global IME has a distributable profit of Rs 3.54 billion, while Prabhu’s distributable profit of Rs 3.4 billion is negative.

##inline_tags_PLACEHOLDER_5 किताबी price: Global IME’s book price is Rs 173.47 while Prabhu’s book price is Rs 147.29.

##inline_tags_PLACEHOLDER_6वार्षिक earnings per share: ##inline_tags_PLACEHOLDER_8 Based on financial statements, Global IME’s annual earnings per share is Rs 15.86 while Prabhu’s annual earnings per share is Rs 10.63.

##inline_tags_PLACEHOLDER_6#खराब loan: ##inline_tags_PLACEHOLDER_8#Global IME bad loans are 4.98 per cent while Prabhu’s bad loans are 5.09 per cent.

(Note: The analysis based on available data is not complete. Take a decision after further research! The above news is not for stock trading purposes. )