Kathmandu. Nepal Insurance Authority (INSURANCE) first introduced the provision of conducting a detailed audit (DDA) of insurance companies in 2073 BS. NeA had prescribed such a provision through the institutional good governance guidelines of the insurer.

The NRA also continued this provision in Section 27 of the Institutional Good Governance Guidelines 2075 BS. During this period, none of the companies that have been operating insurance business for more than 10 years got DDA done.

Although the insurer was instructed to implement the provisions of the directive, the insurer remained adamant. In the meantime, after the AUTHORITY fixed the paid-up capital of life insurer and non-life insurer at Rs 5 billion and Rs 2.5 billion respectively, the insurers who had opted to merge with each other to reach the capital had to compulsorily do DDA. Since detailed audit is mandatory to determine the assets and liabilities of the merged and merged insurers, the DDA of all the merged insurers was done.

In the case of two non-life insurers and three life insurers who are out of the merger process, the AUTHORITY itself took the initiative and carried out a detailed audit (DDA) of five insurance companies in 2080 BS. Apart from the merger, a detailed audit of non-life insurers Shikhar Insurance, Neco Insurance, Life Insurance Nepal Life, LIC Nepal and Asian Life Insurance, which did not choose the path of merger, was carried out.

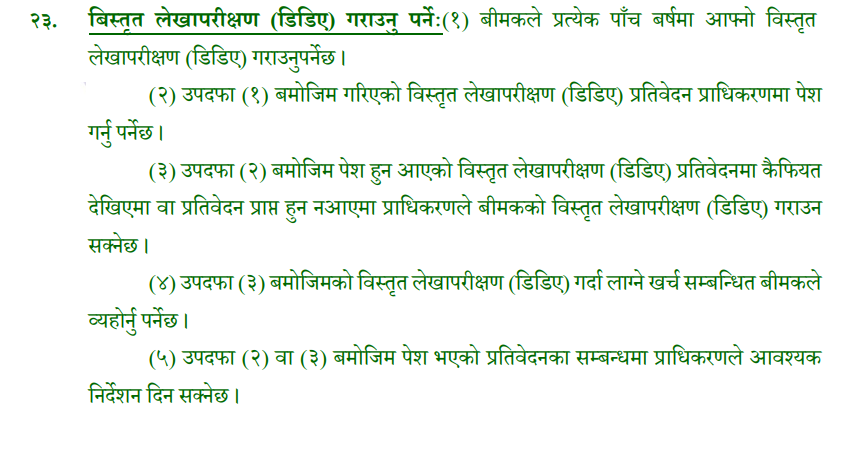

According to Section 23 of the Institutional Good Governance Guidelines 2080, the insurer has to conduct a detailed audit every five years. There is also a provision that the insurer should submit the report prepared in this way to the AUTHORITY.

IB selects 8 Insurers for First ever DDA in Insurance Industry

The AUTHORITY may direct the insurer to make necessary corrections regarding the amount received on the basis of the detailed audit report.

Detailed audit has become mandatory for all life and non-life insurers who came into operation before 2066 BS and in 2074 BS.

Life Insurance, which has been in operation since 2065 BS, has completed more than 15 to 25 years of operation. The insurer, who was licensed in 2074, has also completed 7 years.

Company yet to undergo detailed audit:

National Life, Citizen Life, IME Life and the state-owned National Life Insurance Company have DDA left among the insurers who have completed five years of operation. Similarly, Prabhu Insurance, Nepal Insurance and state-owned National Insurance Company are yet to do DDA.

Institutional governance is the weakest within both state-owned insurers. Since the long-standing annual financial reports of both these institutions have not been prepared, it is difficult to predict the actual financial health.

Nepal Reinsurance Company, a government-owned reinsurer, started the process of DDA in 2080 BS.

For a long time, the size of the transaction, the number of customers, human resources, operating practices, etc. may be constantly changing. In the meantime, negligence or negligence that the insurer considers normal can have a major negative impact on the insurer’s financial health or internal control system in the long run. Therefore, it is mandatory for the insurer to perform DDA at certain intervals.

Such a detailed study provides suggestions to the top management and board of directors of the insurer to correct internal shortcomings, decide future strategies, improve the weaknesses and utilize the strengths.