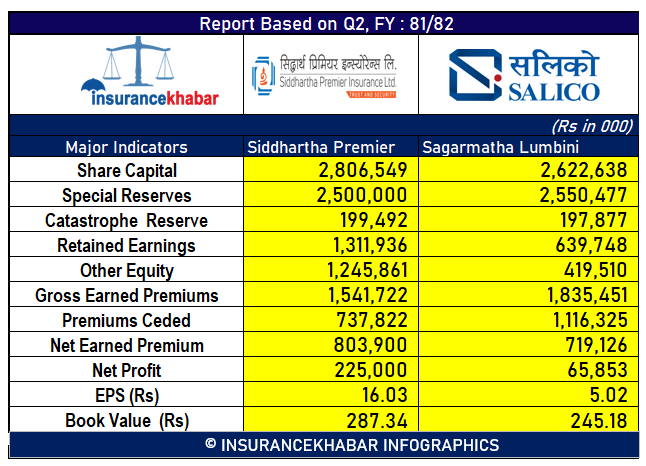

Kathmandu. Siddhartha Premier Insurance and Sagarmatha Lumbini Insurance (Salico) have released their financial statements for the second quarter of the current fiscal year 2081/82. Siddhartha Insurance and Premier Insurance merged to form Siddhartha Premier Insurance, while Sagarmatha and Lumbini General Insurance merged to form Sagarmatha Lumbini Insurance. Comparative study based on the key financial indicators of both companies:

Paid-up capital : Based on the financial statements of the second quarter of the current fiscal year 81/82 published by the companies, the paid-up capital of Siddhartha Premier Insurance Limited is 2.80 billion rupees, while the paid-up capital of Sagarmatha Lumbini Insurance Company Limited is 2.62 billion rupees. .

Special Reserve : Siddhartha Premier Insurance Limited has 2.5 billion rupees in its special reserve, while Sagarmatha Lumbini Insurance Company Limited has 2.55 billion rupees in its special reserve.

Mahabidpatti Kosh : Siddhartha Premier Insurance Limited has 1994 million rupees in its special reserve. Lakhs, while Sagarmatha Lumbini Insurance Company Limited has 197.8 million in its disaster fund.

Retained Earnings : Siddhartha Premier Insurance Limited has 1.31 billion 19 million in retained earnings, while Sagarmatha Lumbini Insurance Company Limited has 639.7 million in retained earnings.

Others Equity: Siddharth Premier Insurance Limited has 1.24 billion 5.8 million in other equity, while Sagarmatha Lumbini Insurance Company Limited has 419.5 million in other equity.

Total insurance premium income: Siddharth Premier Insurance Limited has earned 1.54 billion in total insurance premiums until the second quarter of the current fiscal year, while Sagarmatha Lumbini Insurance Company Limited has earned 1.83 billion in total insurance premiums. Yes.

Earning of net insurance premiums : Siddhartha Premier Insurance Limited has earned a net insurance premium of Rs 803.9 million till the second quarter of the current fiscal year, while Sagarmatha Lumbini Insurance Company Limited has earned a net insurance premium of Rs 719.1 million.

Earning of net profit : While Siddhartha Premier Insurance Limited has made a net profit of Rs 225 million in the second quarter, Sagarmatha Lumbini Insurance Company Limited has made a net profit of Rs 65.8 million.

Earnings per share: Siddhartha Premier Insurance Limited’s annual earnings per share are Rs 16.03, while Sagarmatha Lumbini Insurance Company Limited’s are Rs 5.02.

##Per share Networth : Siddhartha Premier Insurance Limited has a net worth of Rs 287.34 per share, while Sagarmatha Lumbini Insurance Company Limited has a net worth of Rs 245.18.

“The available data has been prepared from the financial statements published by the company. This analysis is not complete and investors should do further research before making a trading decision.”