Kathmandu. KATHMANDU: National Life Insurance (NLIC) has created history in Nepal’s insurance industry by acquiring additional 12.93% promoter stake of Himalayan Bank from Pakistani shareholder Habib Bank.

With this acquisition, National Life Bank has become the largest promoter with 13.81% stake in Himalayan Bank.

The company has 14.18 percent ownership including promoter and ordinary shares. As per the Nepal Rastra Bank (NRB) provision, a single shareholder can own up to 15 percent of the shares in a bank or financial institution.

Insurance experts say that this investment has not only led to share ownership but also strategic benefits. With the purchase of shares of Himalayan Bank, National Life has diversified its investment and got a new opportunity. Not only as a life insurer, but also as a promoter of the bank.

With the acquisition of a large shareholding of the bank, Nepali insurers have established a new identity as a budding institutional investor. This can also motivate other insurers to invest in banks and financial institutions.

Benefit to the Insured

}

Life insurers in Nepal are expected to give an average return of 6% to fulfill their commitment to the insured. Insurance companies have been attracted to share capital investment after the interest rate of fixed deposits for institutional investors has fallen below 4 percent in recent times.

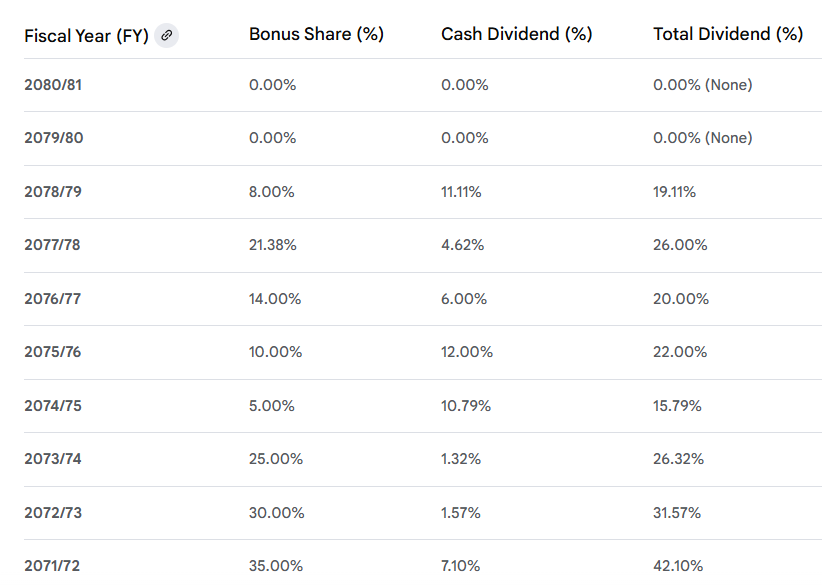

A part of the life insurance fund, before the merger with Civil Bank, FY 2078. National Life expects to increase its return on investment by investing in Himalayan Bank, which has been distributing dividends in double digits up to Rs 79.

In the last fiscal year, National Life earned a total return of Rs 5.84 billion from fixed deposits and investments made in various sectors.

As the investment in the banking sector increases, National Life will be able to provide more bonuses and assured returns to the insured.TAG_OPEN_p_50 With the increase in the return of Himalayan Bank, the policyholders of National Life Insurance will also get a better bonus.

Benefits for shareholders:

The shareholders of National Life will also be able to benefit from this investment.TAG_OPEN_p_49 As soon as the news of investment in the bank was made public, there was a positive impact on the stock market. Shares of National Life Insurance Ltd (NLIC) rose 4.1 percent to Rs 637 per share on the Nepal Stock Exchange (NEPSE) today.

This transaction indicates that investors are optimistic about the returns from National Life.TAG_OPEN_p_48

National Life’s Financial Strength:

National Life is the second-largest life insurer by market share.TAG_OPEN_p_47 In the last fiscal year, the company had collected Rs 21.47 billion in net premium.

Its life insurance fund has reached Rs 89.TAG_OPEN_p_46 91 billion. It has a long-term fixed deposit of Rs 68.89 billion and a short-term investment of Rs 7.20 billion. The company has assets worth Rs 90 billion.

According to the investment guidelines of the life insurer, National Life can invest around Rs 13 billion in the shares of the listed company.TAG_OPEN_p_45 Its investment in Himalayan Bank has now reached Rs 3.30 billion.

High Return Safe Investment:

By investing in Himalayan Bank, which has a long TAG_OPEN_p_44 history of high returns, National Life seems to have a strategy to increase its overall return income.

At a time when the interest rate on the bank’s 1-year fixed deposit is limited to 3 to 4 percent, National Life Insurance has acquired the share ownership of Himalayan Bank.TAG_OPEN_p_43

in 2079. The bank, which has not been able to declare dividend continuously since 80 years, is likely to achieve higher returns than the bank’s term term in the short term, given that the bank has increased its profitability with the management of non-banking assets.

Stakeholders will be waiting to see how Himalayan Bank performs under its new share structure – and whether the deal will indeed be a milestone for Nepal’s life-insurance sector.TAG_OPEN_p_40