– Sudarshan Basnet

With every activity of life, there are many possibilities of disasters and risks on a daily basis. Insurance is the process of transferring the financial burden of the risk that the insured may face in his life, property or liability to the insurer in order to protect against financial losses that may arise from such risks.

Insurance provided for the economically backward, poor and low-income marginalized communities is called micro insurance. Insurance provided for individuals and communities who are at risk due to low income, economic, social and geographical reasons and with a minimum insurance premium to protect their lives and property falls under micro insurance. According to the Micro Insurance Directive, 2079, micro insurance refers to insurance policies issued targeting the poor, low-income groups, residents of backward areas and marginalized communities in the state of Nepal. The directive divides micro insurance into two parts: life micro insurance and non-life micro insurance. Micro non-life insurance includes insurance policies such as micro health insurance, livestock micro insurance, crop micro insurance, accident micro insurance, critical illness micro insurance, household micro insurance, business micro insurance, motor micro insurance, engineering micro insurance, liability and monetary damage micro insurance, while life micro insurance includes lifelong micro life insurance, term micro life insurance, term micro life insurance and other micro life insurance. Which are directly related to the risks of rural areas.

Micro insurance focuses on how to directly protect low-income families, especially those living in rural areas, from the risks they face in their daily lives through micro insurance. It is important to see this as a special insurance service suitable for solving the temporary needs of people seeking protection from a particular risk. Which can be easily purchased as per the principles of insurance in small packages as per the needs and desires of the general public. For example, medical insurance for seasonal health problems like dengue, cholera, kala-azar, etc., for risky travel, accident insurance for the entire period of travel in vehicles, insurance against damage caused by wild animals, insurance for post-death care, etc. can be done under this micro insurance.

Key features of small insurance

- Group small insurance policies can be issued,

- Simple and easy to access and clear protection,

- Insurance claim process is simple and fast Will be,

- A lot of protection will be included in a small insurance fee,

- Can be insured by maintaining a low insurance score,

- Insurance will be provided based on simple terms and few conditions,

- Provides protection against risks that may occur to the target group,

- It will also be presented as a social responsibility,

- ##The sum insured is fixed and the insured understands its importance

- ##It can be trusted and done at a low cost while doing insurance work.

## In order to build a society with a culture of insurance in the future, microinsurance has become a reliable and effective tool by increasing the access of insurance to the general public and helping to instill the habit of purchasing insurance policies. This has become a strong foundation for social security. While the sum insured of a micro insurance policy is relatively low, micro insurance is expected to increase public awareness and encourage people to take out insurance. How is it directly linked to the risks faced in the daily life of a family? Having analyzed this matter, the risks covered by this insurance policy are as follows:

- Protection from financial family stability and disruption,

- Damage to house, crops and livestock due to natural disasters (floods, landslides, inundation, drought, earthquake, lightning, etc.),

- Death, dismemberment or injury due to accidents or other causes,

- Business and property damage due to fire, theft and other causes

- Damage to livestock or poultry etc. due to disease and accident,

- Damage to crops due to external causes such as insects, diseases, natural disasters, sudden accidents,

- Long-term damage due to human and natural disasters,

- Fatal Disease and medicine insurance.

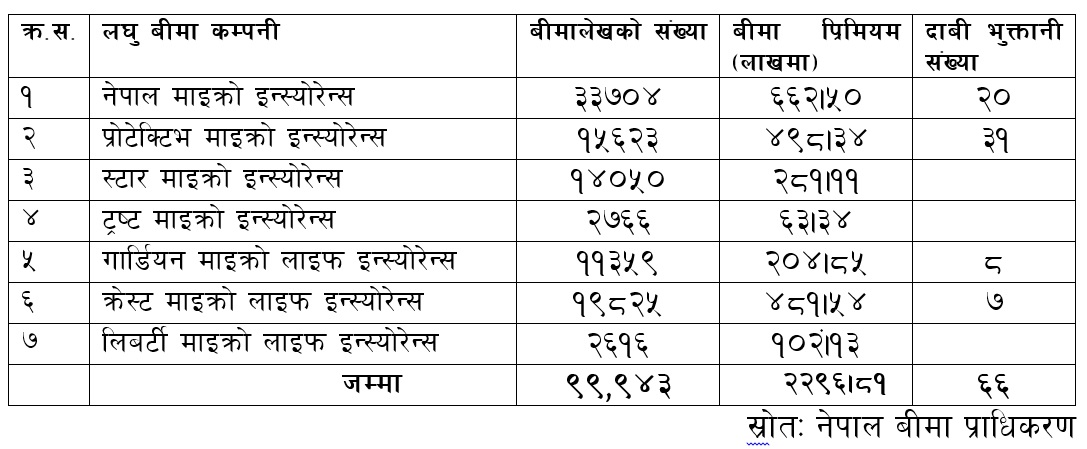

Keeping this in mind, after joining health insurance through micro insurance, it should be ensured that ‘it is my responsibility not to let the disease occur, and if the disease occurs, it is the company’s responsibility to provide financial facilitation for health treatment up to the specified limit’ through insurance policies under micro insurance. This helps the insured to focus on improving their health by relieving them of the stress of expenses during times of risk. Which is real risk management for the target group. The regulatory body targeting low-income people; Nepal Insurance Authority has been regulating all life and non-life insurance companies by making provisions for issuing micro insurance policies, but based on the data that has not achieved the expected results, 7 micro insurance companies have been granted permission since last year to only do micro insurance. There are 4 micro non-life insurance companies, namely Trust Micro Insurance, Nepal Micro Insurance, Star Micro Insurance and Protective Micro Insurance, and 3 micro life insurance companies, namely Guardian Micro Life, Crest Micro Life and Liberty Micro Life. In addition, these companies have been divided into 7 provinces and have been granted operating permits with their head offices in separate provinces. Accordingly, all 7 micro insurance companies have started their operations. According to the data published by the Nepal Insurance Authority, the progress achieved by these companies till mid-Chait 2080 is as follows:

Looking at the above data, it is seen that the micro insurance business of the recently opened companies is increasing. However, if the microinsurance branches were expanded to rural areas and the service delivery could be linked to the local level, the need for microinsurance would be felt by the general public and the trust and importance of insurance would increase.

Looking at the above data, it is seen that the micro insurance business of the recently opened companies is increasing. However, if the microinsurance branches were expanded to rural areas and the service delivery could be linked to the local level, the need for microinsurance would be felt by the general public and the trust and importance of insurance would increase.

##Importance of Microinsurance

The importance of microinsurance seems even more profound with the policy and program of the Government of Nepal for the fiscal year 2080. 81 to extend microinsurance to the local level, the 15th Plan to expand insurance services to rural areas through microinsurance schemes by relaxing the scope of insurance, and the Labor Act, 2074 BS to ensure financial security for every working citizen through life insurance.

If the word insurance refers to a legal contract or agreement between the risk taker and the risk transferor, then the answer to the question of who is most at risk at present? It is understood that the answer is definitely the low-income and marginalized groups. Insurance is an indispensable means as a sustainable and appropriate means of bearing the risks of such communities. They can enter into agreements with life insurance, non-life insurance and micro insurance companies to transfer their risks. Due to the weak saving capacity of the target group and irregular income sources, they have not been able to join life insurance as expected, even if they have joined, they have not taken insurance as per their needs, and even those who have taken it as per their needs are not able to continue for various reasons. Problems may arise in such communities, whether to save on life insurance or to make ends meet.

For the above community, the only option in terms of cost, in terms of the contracting process, in terms of the means of obtaining compensation, in terms of simplicity and ease of understanding, and in terms of availability and insurance policies that match their risks is microinsurance. However, there is a need for timely and extensive improvements in the distribution system and claims process of the currently in circulation microinsurance policies. According to the data published in the Nepal Living Standards Survey Fourth (2079. 80) published by the National Statistics Office, 20.27 percent of the population in Nepal is below the poverty line. It is also mentioned that those employed in the agricultural sector are the highest, that is, 37.81 percent, poor. Thus, community-targeted poverty alleviation programs are indispensable to improve the living standards of communities below the poverty line, and microinsurance acts as a tool in the field of poverty alleviation for such communities. This also makes it clear that microinsurance is indispensable for individuals and communities living in rural areas and leading a medium and low standard of living. In such communities, when an unpleasant incident or damage occurs, the ability to manage the damage is weak, and microinsurance is a sustainable and reliable means of compensation.

On the one hand, when financial damage occurs in such communities, it creates a compelling situation to seek help from local bodies or organizations, and on the other hand, microinsurance acts as an indispensable means to minimize it. Microinsurance companies, keeping farmers at the center, issue insurance covering livestock insurance, crop insurance and other cash crops based on their needs and capabilities. This ensures that they are present in the areas and communities where poverty is the main concern and bear the risk of the target group. Since the group below the poverty line is also socially and geographically weak, debt is naturally prevalent in such groups.

If someone has taken a loan to cultivate or raise livestock and their crops are damaged or something happens to their livestock, on the one hand their livelihood may be disrupted and on the other hand they may not be able to repay the loan. In such a situation, the poor may become even poorer and their financial situation may be miserable. If such communities can be included in microinsurance, microinsurance can act as a disaster asset for them and can play an important role in economic and social upliftment.

##In addition, the importance of microinsurance can be clarified by the following points

##

- ##To increase access to insurance,

- ##Provides financial protection against risks to life and property of low-income and backward marginalized groups,

- Provides a basis for savings and financial security,

- Helps in expanding access to essential services including health, education,

- Inclusion in insurance is maintained by expanding the scope of insurance,

- To clarify the importance of insurance in the true sense,

- Insuring services are provided simply and conveniently from the local level To take,

- To take the facility as a disaster asset,

- To give meaning to the slogan of insurance for all,

- To develop the idea that insurance premiums are not an expense but an investment,

- To increase awareness about insurance,

- To provide financial security to the potential risks that may arise in the daily lives of the target community,

##

##

##

Some of the weaknesses seen in small insurance are as follows

- Inconvenient distribution process

- In the claims process Ambiguity

- Not reaching the target group

- Limited insurance policy

- Low involvement of local bodies

- Low priority of the state

Unhealthy Competition

While analyzing the above-mentioned points, it is seen that although the importance and contribution of micro insurance is great, the companies currently licensed in Nepal are motivated to expand their branches to local and remote areas and remain focused on doing insurance business in cities. In addition, it is seen that the current insurance companies are not working effectively in the micro sector due to unhealthy competition in the insurance business of existing insurance companies, and the inability to bring different insurance policies according to the needs of the people and the needs of the people according to new studies and research.

In addition, to increase the access to microinsurance, the Government of Nepal, regulatory bodies, insurance companies and affiliated organizations should do the following:

- Just as the regulatory body envisioned microinsurance companies to increase access to the insurance market, it should also make its implementation effective.

- The area for the expansion of microinsurance should be mandatorily determined with local bodies.

- Small insurance companies should come up with a policy to conduct their insurance business in new areas rather than competing in the insurance business that life and non-life insurance companies are continuously doing.

- ##Encourage agents and organizations selling small insurance policies.

- ##Conduct a large-scale public awareness program to increase the access of the target group to small insurance.

- ##Delegate additional authority to local bodies to regulate and control small insurance companies.

- Make necessary arrangements for cooperation between small insurance companies and local bodies and make policy arrangements for micro insurance. Issue insurance policies under micro insurance and make the claim process modern technology-friendly.

- Develop a culture of celebrating the day of insurance policy renewal as a celebration, just as we celebrate various anniversaries in our own families.

- Develop the habit of buying insurance policies. Develop the awareness that ‘insurance’ is not an expense but an investment.

- Since the operating costs of microinsurance are high, the state and regulatory bodies should look into it accordingly. For this, tax exemptions, concessions or similar packages should be announced.

- Necessary coordination should be made for free technical work through government service technicians working at the local level for crop and livestock insurance.

- In times of disaster, microinsurance should be made mandatory rather than waiting for the government.

- Implement the provisions of the Small Insurance Act, 2079 BS.

##Suggestions and Conclusions

## When we say small insurance, we immediately understand it as an insurance service specifically targeted for poor households or individuals with low income or savings. In fact, this is the main feature of small insurance, but in the current situation, it seems necessary to change the concept of small insurance. It needs to be developed as an insurance that meets the special needs of all sections of society, not just the poor. Since the insurance premium of microinsurance is low, for its sustainability, insurance services should be made effective through digital means or in collaboration with local cooperatives or microfinance institutions or women’s groups. In this, a system should be developed so that it can be easily purchased along with the needs of the general public of the society and that claims are paid on time in case of loss. Microinsurance helps to build an insurance-oriented society in the future by developing a culture of insurance in rural and urban areas. Which helps in building a strong, secure and sustainable economy of the country.

Although microinsurance is an option for classes and communities that are not covered by other insurance, are backward due to geographical, economic and social reasons, have weak income levels, and are operating small businesses, there are some difficulties in implementing microinsurance. Due to the comparatively low educational level and lack of easy access to modern technology in such classes and communities, there is a lack of awareness about insurance and therefore it does not seem to be associated with the target. Keeping this in mind, it seems that simple and easy insurance policies should be issued for them and the claim process should be made easier. In addition, it is the need of the day to address such shortcomings that the current system is not fully technology-friendly and to involve the target class in microinsurance and manage the risks that may arise in their daily lives.

Accepting that various risks can arise in our lives at any time, making them aware that it is essential to take insurance protection while living, developing the habit of insuring through microinsurance and gradually bringing them within the scope of other large insurance companies can improve their living standards. If arrangements are made to buy and claim insurance policies from non-profit organizations, financial institutions, shops or counters operating in one’s neighborhood, microinsurance can become a means of providing access to insurance to about 57 percent of the population who are still outside the scope of insurance. This can be a plan to reach out to groups, communities, areas, etc. that are not covered by other insurance in urban areas and to connect microinsurance businesses to reach every citizen in remote rural areas. The insurance policy of the Government of Nepal, the long-term thinking of the Authority, and the insurance market of insurance companies would expand and the overall insurance sector would become dynamic, ensuring the economic and social security of the common citizen.

(The author is the Deputy Manager of Basnet National Insurance Company)