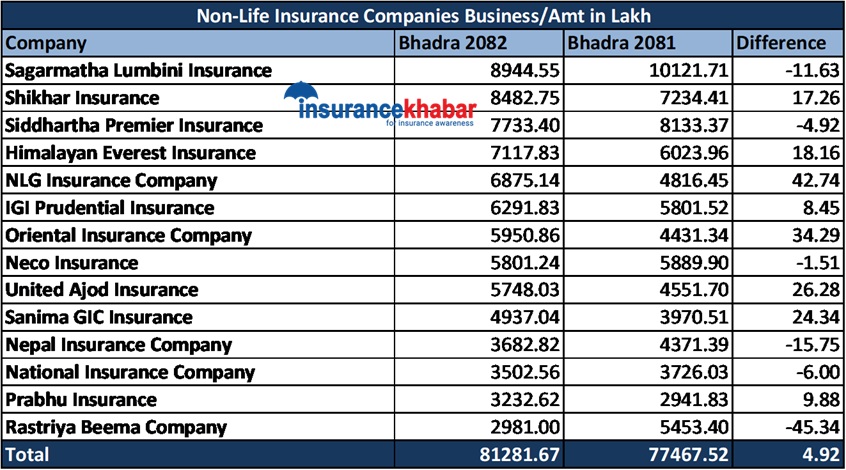

Kathmandu. Non-life insurers in the current fiscal year 2082. In the first second month of ’83, the company has been able to do business of more than Rs 8.12 billion.

According to the NRA in the review year 2018-19, 14 non-life insurance companies have earned a total of Rs 4.12 billion in insurance premium by issuing 4,32,069 policies. Last year, 2081. In August 2018, the companies earned Rs 7.74 billion in total insurance premiums. The company’s turnover increased by 4.92 percent in the review period compared to the previous year.

During the review period, the business of 8 insurers increased while that of 6 insurers decreased. Sagarmatha Lumbini Insurance has brought the most business while NLG Insurance is ahead in terms of business growth.

In the current fiscal year, Sagarmatha Lumbini Insurance has earned a total insurance premium of Rs 89.44 crores. The company had earned Rs 1.1 billion in insurance premiums in the same quarter last year. The company’s business declined by 11.63 percent in the review year compared to the previous year.

Shikhar Insurance has become the second largest business buyer. During the review period, the company earned a total insurance premium of Rs 84.82 crores. The company had earned a net profit of Rs 72.34 crore in the same period last year. The company’s turnover increased by 17.26 percent in the review period compared to the previous year.

Similarly, Siddhartha Premier Insurance is the third biggest gainer in the company. The company has earned Rs 77.33 crore in insurance premiums till mid-September of the current fiscal year. The company had posted a net profit of Rs 81.33 crore in the previous year. The company’s business declined by 4.92 percent in the review period compared to the previous year.

Similarly, Himalayan Everest Insurance has earned Rs 71.17 crore, NLG Insurance Rs 68.75 crore, IGI Prudential Insurance Rs 62.91 crore, Oriental Insurance Rs 59.5 crore, Neco Insurance Rs 58.1 crore and United Ajod Insurance Rs 57.48 million. Himalayan Everest Insurance, NLG Insurance, IGI, Oriental Insurance, United Ajod Insurance, Himalayan Everest Insurance Ltd (18.16 per cent), NLG Insurance (42.47 per cent), United Ajod Insurance (34.29 per cent), Neco Insurance (1.51 per cent) and Neco Insurance (1.51 per cent) increased in the review period.

Sanima GIC Insurance has earned Rs 49.37 crore, Nepal Insurance Rs 36.82 crore, National Insurance Rs 35.02 crore, Prabhu Insurance Rs 32.32 crore and Rastriya Insurance Rs 29.81 million. Compared to the previous year, the business of Nepal, National Insurance Company and National Insurance Company decreased in the review period. Sanima Insurance and Prabhu Insurance have also increased.