Kathmandu. Commercial banks have increased their lending in the stock market as the demand for loans from other sectors has slowed.

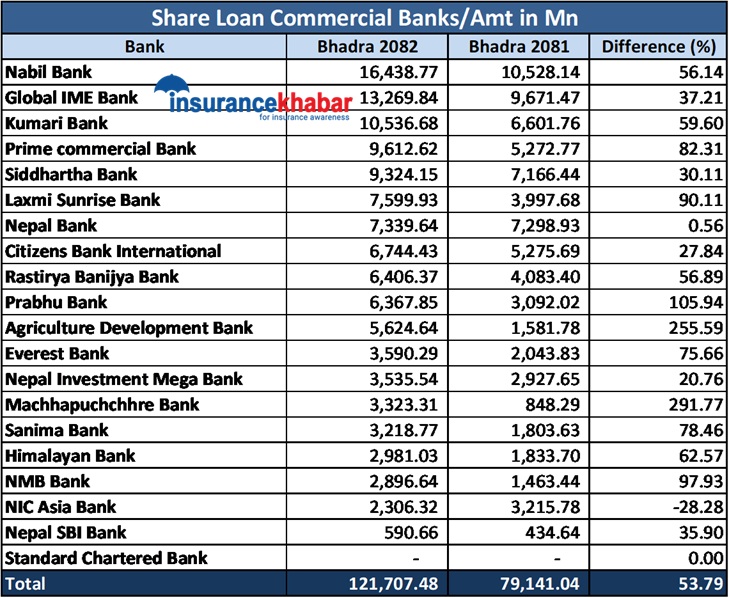

Nepal Rastra Bank (NRB) has released the current fiscal year 2082. According to the data till August 2018, 19 out of 20 commercial banks have issued share loans of Rs 121.74 billion. These banks were registered in the last fiscal year 2081. By August 1980, it had issued a share loan of Rs 79.14 billion. Accordingly, the share loans issued by banks during the review period increased by 53.79 percent compared to the previous year.

As of the review period, Nabil Bank is the largest lender in terms of share loan, while Machhapuchchhre is ahead in terms of growth rate. Share loans from 18 banks increased in the review period compared to the previous year. NIC Asia has reduced its share loan while Standard Chartered Bank has not issued loans under this head.

As of mid-August of the current FY, Nabil Bank has issued a loan of Rs 16.43 billion. This is 56.14 percent more than the previous year. The bank had issued loan of Rs 10.52 billion till mid-August last year.

Global IME Bank is the second largest lender in the world. The bank, which had provided loan of Rs 9.67 billion in the review period of the previous year, increased by 37.21 percent to Rs 13.26 billion in the review period.

Kumari is the third bank to offer a large number of share loans. The bank has issued a loan of Rs 10.53 billion till mid-August of the current fiscal year.

The bank had issued loan of Rs 6.60 billion till mid-August last year. Compared to the previous year, the share loan from the bank increased by 59.60 percent.

During the review period, Nepal SBI Bank was the lowest lender while NIC Asia Bank’s loan disbursement declined by 28.28 percent. Machhapuchchhre Bank is leading the bank with a growth rate of 291.77 percent.

Who gave how much share loan?