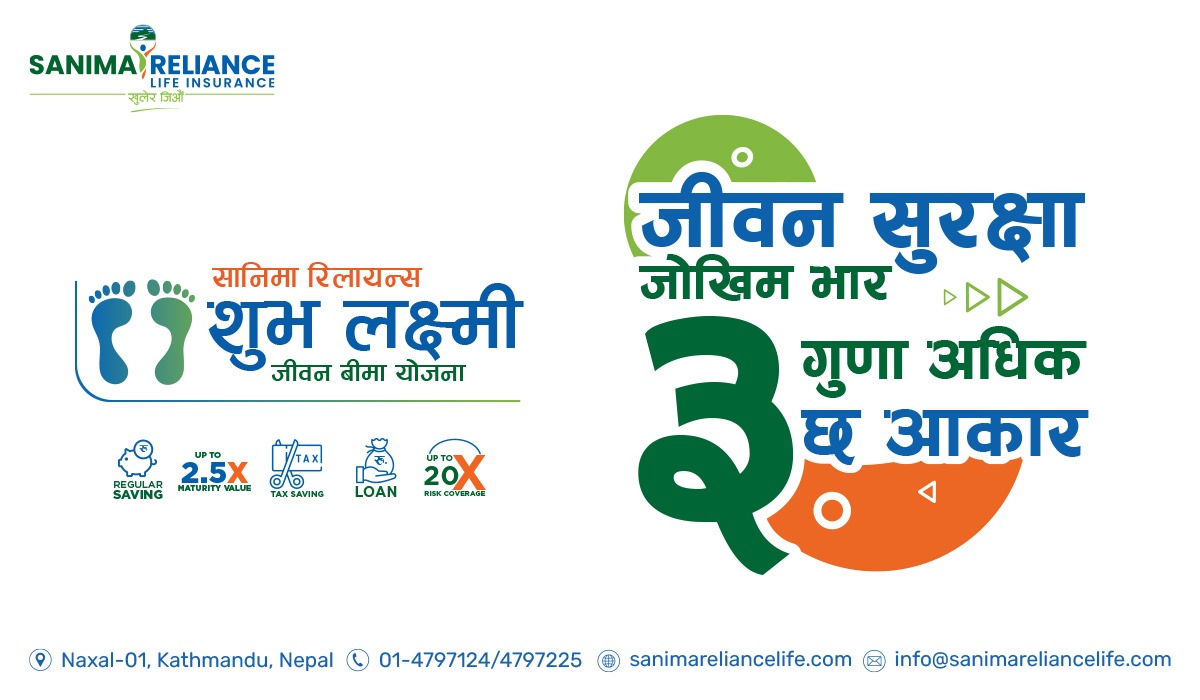

Kathmandu. Sanima Reliance Life Insurance’s Shubhalaxmi Life Insurance Scheme is becoming popular. This policy has become the choice of the customers as it carries a risk of up to three times the sum assured at a low insurance rate. This is an excellent plan from both savings and protection point of view. This is an excellent plan for people who earn a normal level of income and have adopted a relatively high-risk occupation.

Feature of the scheme

The scheme carries a risk of up to three times the sum assured at low insurance premium. In case of death due to natural cause of the insured, 2 times of the sum assured and 3 times in case of death due to accident is paid to the entitled. Similarly, if any one of the 18 deadly diseases is diagnosed, then a lump sum of up to Rs 1 million will be paid. This relieves the insured from the stress of raising money for treatment.

If an insured buys Shubh Laxmi Jeevan Bima Yojana with a sum insured of Rs 1 million, then after the expiry of the insurance period, he will get a bonus earned throughout the entire period along with Rs 1 million. If the insured dies due to accident before the expiry of the insurance period, then the entitled person will be paid Rs 30 lakh and the accrued bonus in lump sum as per this policy. In case of natural death, the owner will get Rs 2 million and the accrued bonus in lump sum.

Eligibility for insurance plans

This insurance plan can be purchased by anyone who has completed 18 years and is not more than 60 years of age. The term of this insurance plan can be from a minimum of 10 to a maximum of 52 years. Under this scheme, the insured will be able to buy an insurance policy with an sum insured of Rs 25,000 to Rs 10 lakh depending on their financial capacity. At the age of 18, the insured who buys the insurance policy for the maximum period of this insurance plan will be mature when he is 70 years old.

How to pay premium

The way premium payments are also flexible in this scheme. The insured can pay the premium in three ways – yearly, half yearly and quarterly. You will be able to save one burger every day and get a lump sum payment of Rs 1 million at the time of your retirement and the bonus amount earned.

Why Sanima Reliance is the TAG_OPEN_strong_24 for insurance?

Since life is uncertain, life insurance can be done only by being fearless and finding a way to earn regular income. But since income cannot be long-term amid the uncertainty of life, the need of the hour is to maintain the certainty of economic security, savings and progress through life insurance. This scheme will prove fruitful in managing family and other financial responsibilities efficiently and easily. All those who want to build a prosperous and strong family can buy this insurance policy.

Sanima Reliance has been providing excellent life insurance policies in Nepal. The company has been successful and able to identify the needs of The Nepali society and introduce different and new types of insurance. The company is financially strong and prosperous, while transparency and good governance have always been the main mantra of insurance. Therefore, sanima Reliance Life has a customer’s insurance cover in every way.

With a network of 169 branches across the country, the company has a capital of more than Rs 5 billion, an investment of more than Rs 20 billion and more than 20,000 agents working in the company.