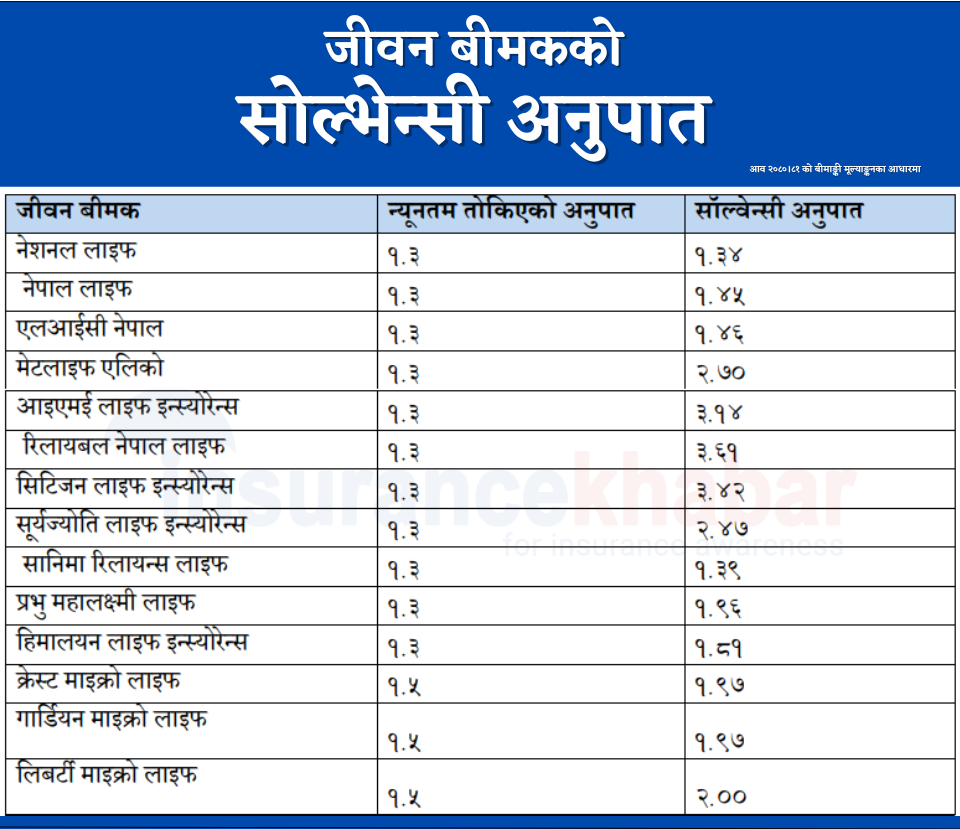

Kathmandu. The Nepal Insurance Authority (INSURANCEA) has released the schedule of solvency ratio determined on the basis of the actuarial assessment of 14 of the life insurers for the last fiscal year. NeA has made public the solvency ratio of life insurers through a monthly special issue called ‘Bima Pratibimb’.

NeA has made public the solvency ratio of life insurers whose insurance evaluation has been approved till May 15. A total of 14 life insurers, including three short life insurers, are included in this list.

According to the NRA, reliable Nepal Life has the highest solvency ratio of 3.61 among life insurers based on the approved risk-based actuarial assessment report for the fiscal year 2080/81 BS. The authority has maintained a solvency ratio of 1.3 for life insurers, which is more than double. The solvency ratio is 3.42 for Citizen Life and 3.14 for IME Life.

Similarly, National Life has the lowest solvency ratio of 1.34. This is close to the minimum limit set by the AUTHORITY. In recent times, National Life’s financial liquidity may have shrunk due to increased investment in office buildings and large building infrastructure even for commercial purposes.

The ratio of all the three small life insurers is close to 2.0, compared to 1.5 for short-life insurers. Liberty Micro Life has a ratio of 2.0, Guardian and Crest Micro Life has a ratio of 1.97.

According to the NRA, all life insurers (including micro) have been found capable of meeting potential financial liabilities based on the insurance assessment for the last fiscal year.

Fixing the solvency ratio at 1.3 by the NEA means that the insurer has at least Rs 1.30 worth of financial assets available to repay the liability of Rs 1.

Solvency for a life beam refers to its long-term liabilities, especially the liability on the insured, the ability to repay from its own assets. It is an important financial measure used to evaluate the financial health of a company and the strength of its assets. The high ratio indicates a strong financial position and a strong ability to suffer unexpected losses and meet future obligations.

Why is this important:

For insurers: The high ratio assures that the company will be able to pay immediately when claims arise.

For regulators: Solvency ratio helps regulators monitor the financial health of insurance companies and prevent potential bankruptcy.

For investors: The collateral ratio is a key indicator of a company’s financial stability, which affects investment-related decisions.