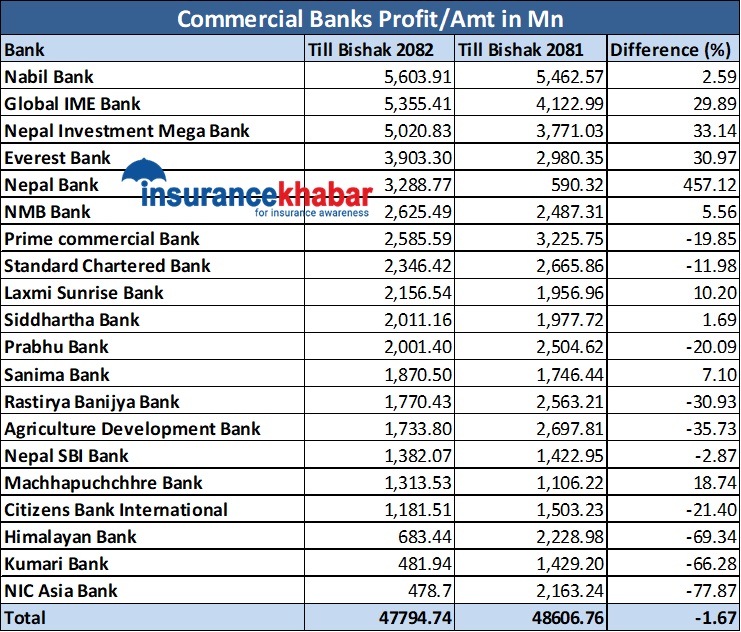

Kathmandu. Current fiscal year 2081. Commercial banks have been able to earn a profit of more than Rs 48 billion in the last 10 months (July-April).

According to the data released by the Nepal Rastra Bank (NRB) for the 10 months of the current fiscal year, 20 commercial banks have earned a profit of Rs 47.79 billion. In the same period last year, commercial banks had earned a profit of Rs 48.60 billion. Compared to the previous year, the profit of the banks decreased by 1.67 percent in the review period.

During the review period, the profit of 10 banks has increased while the profit of 10 banks has decreased. Nabil Bank is at the top of the list with the highest profit till the review period. Nepal Bank is ahead in terms of profit growth.

Nabil has earned a profit of Rs 5.60 billion till April this year. In the same period last year, the bank had earned a profit of Rs 5.46 billion. The bank’s profit increased by 2.59 percent in the review period compared to the previous year.

Global IME Bank is one of the top profit-making banks in the world. In the same period of the previous year, the bank had earned a profit of Rs 4.12 billion, while it earned a profit of Rs 5.35 billion in the review period. The bank’s profit has increased by 29.89 percent in the review period compared to the previous year.

Nepal Investment Mega Bank is the third most profitable bank. The bank has earned a profit of Rs 5.02 billion in the review period. The bank had posted a net profit of Rs 3.77 billion in the same period last year. The bank’s profit increased by 33.14 percent in the review period compared to the previous year.

Similarly, Everest Bank has earned a profit of Rs 3.90 billion, Nepal Bank Rs 3.28 billion, NMB Bank Rs 2.62 billion and Prime Bank Rs 2.58 billion in the current fiscal year. Everest Bank’s profit increased by 30.97 percent, Nepal Bank’s 457.12 percent and NMB Bank’s 5.56 percent compared to the same period last year.

Standard Chartered Bank has earned a profit of Rs 2.34 billion, Laxmi Sunrise Bank Rs 2.15 billion, Siddhartha Bank Rs 2.11 billion and Prabhu Bank Rs 2.14 billion in the current fiscal year. Standard Chartered and Prabhu Bank’s profit has decreased compared to the previous year, while Laxmi Sunrise and Siddhartha Bank have increased.

Similarly, Sanima Bank has earned a profit of Rs 1.87 billion, Rastriya Banijya Bank Rs 1.77 billion and Krishi Bikas Bank Rs 1.73 billion in the current fiscal year. Sanima Bank’s profit has increased compared to the previous year, while Rastriya Banijya Bank and Krishi Bikas Bank have decreased.

During the review period, Nepal SBI Bank earned a profit of Rs 1.38 billion, Machhapuchhre Bank Rs 1.31 billion, Citizens Bank Rs 1.18 billion, Himalayan Bank Rs 683.4 million, Kumari Bank Rs 481.9 million and NIC Asia Bank Rs 478.7 million. Machhapuchchhre Bank’ profit has increased compared to the previous year, while Nepal ABI Bank, Citizens Bank, Himalayan Bank, Kumari Bank and NIC Asia Bank have decreased.