Kathmandu. In the first eight months of the current fiscal year, non-life insurers have managed to generate a business worth over Rs 28 billion.

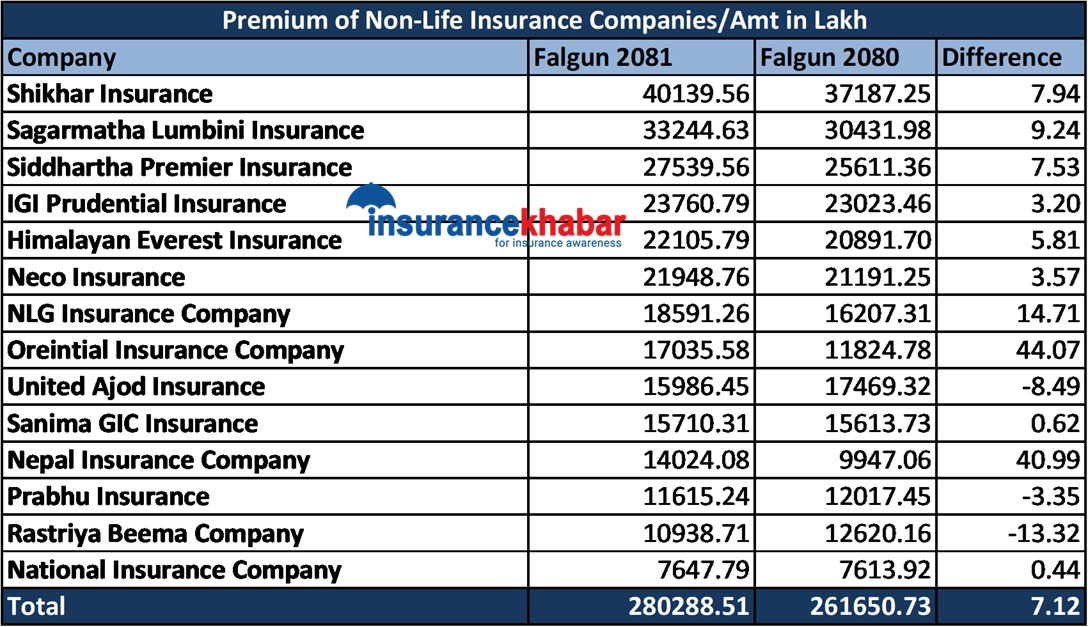

According to the data released by the Nepal Insurance Authority today, 14 non-life insurers have issued 1,843,456 insurance policies and earned a total insurance premium of Rs 28.288 billion. Last year, in the same period, companies had issued 1,916,666 insurance policies and earned a total insurance premium of Rs 26.165 billion. The companies’ business has increased by 7.12 percent during the review period compared to the previous year.

Until Falgun, the business of 11 insurers has increased while that of 3 insurers has decreased. Shikhar Insurance has generated the most business during this period, while Oriental Insurance is ahead in terms of business growth.

Shikhar Insurance has earned a total insurance premium of Rs 4.139 billion till Falgun of the current fiscal year. The company had earned a total insurance premium of Rs 3.7187 billion till the same period last year. The company’s business has increased by 7.94 percent during the review period compared to the previous year.

Sagarmatha Lumbini Insurance is the second largest business generator. This company has earned a total insurance premium of Rs 3.3244 billion till Falgun of the current fiscal year. The company had earned a total insurance premium of Rs 3.431 billion during the same period last year. The company’s business has increased by 9.24 percent during the review period compared to the previous year.

Siddharth Premier has become the third company to bring in the most business. Up to the review period, the company has earned a total insurance premium of Rs 2.75 billion 3.9 million. The company had earned a total insurance premium of Rs 2.56 billion 1.1 million during the same period last year. The company’s business has increased by 7.53 percent during the review period compared to the previous year.

Similarly, as of Falgun of the current fiscal year, IGI Prudential Insurance has earned a total insurance premium of Rs 2.376 billion, Himalayan Everest Insurance Rs 2.215 billion, Neco Insurance Rs 2.1948 billion, NLG Insurance Rs 1.859 billion and Oriental Insurance Rs 1.703 billion. Compared to the same period last year, IGI Prudential’s business increased by 3.20 percent, Himalayan Everest’s by 5.81 percent, Neco’s by 3.57 percent, NLG’s by 14.71 percent and Oriental’s by 44.07 percent during the review period.

Until Falgun of the current fiscal year, United Ajod Insurance has earned a total insurance premium of Rs 1.59 billion 8.6 million, Sanima GIC Insurance Rs 1.57 billion 1.0 million and Nepal Insurance Rs 1.40 billion 2.4 million. Compared to the same period of the previous year, during the review period, United Ajod’s business decreased by 8.49 percent, while Sanima GIC’s increased by 0.62 percent and Nepal Insurance’s increased by 40.99 percent.

During the review period, Prabhu Insurance has earned a total insurance premium of Rs 1.16 billion 15 million, Rastriya Bima Company Rs 1.09 billion 38 million and National Insurance Rs 764.7 million. Compared to the previous year, Prabhu Insurance’s business decreased by 3.35 percent, Rastriya Bima Company Rs 13.32 percent, while National Insurance increased by 0.44 percent.