Kathmandu. Nepal Insurance Authority (NEA) has come up with ‘Guideline Related to Actuary Appointment for Insurers, 2024’ guideline for the development of manpower related to insurance, which is considered important in evaluating the financial liability of insurance companies.

The Actuarial Society of Nepal had also welcomed the nea’s move, saying that an environment would be created to provide production and work opportunities for insurer manpower in the country after issuing the directive.

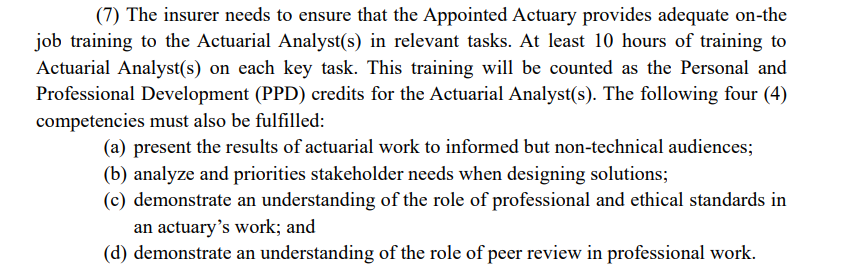

Among the various provisions of the guidelines, each insurer has to provide at least 10 hours of training to the trainee insurer from the applied actuary for every important task. Despite such provisions, trainee insurer analysts have not got training and training opportunities.

For such training, the insurer should provide service fee to the insurer. Although the insurer will be spent on enhancing the efficiency of the insurer, the insurer is not ready to spend for the training.

Although the guidelines provide for training for us, we have not yet got the opportunity to train, complains the trainee insurer analyst, requesting the top management in this regard, but we have not received a positive response.

The guidelines were issued on April 1, 2018. More than one year has been completed since the issuance of the guidelines.

Nepal Insurance Authority (INSURANCE) has directed each insurer to spend at least 2 percent of the total management expenditure on skill development, training and professional development of employees. Due to this directive, the insurer has enough funds for staff training. Although there is no shortage of resources and there is no significant manpower like insurers for insurance companies, insurers have not been generous in providing training opportunities to trainee insurers.

According to the guidelines, the life insurer should appoint a full-time insurer immediately after its implementation and a non-life insurer within six months. According to this provision, although the life insurer has been appointed, two non-life insurers have not yet been appointed. All the four micro non-life insurers are yet to appoint insurers.

For a long time after the issuance of the guidelines, the non-life insurer did not show interest in appointing insurers. The interest was finally shown after Insurance Khabar drew the regulator’s attention through the news.