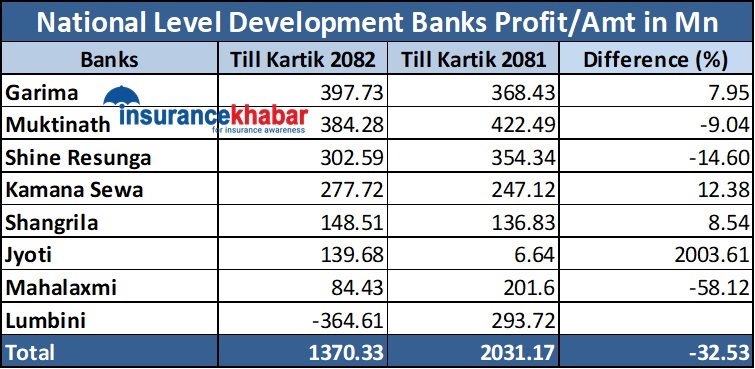

Kathmandu. National level development banks in the current fiscal year 2082. In the first four months of the current fiscal year, the company has earned a net profit of Rs 1.37 billion.

According to the data released by Nepal Rastra Bank, the eight national level development banks have earned a net profit of Rs 1.37 billion till mid-November of the current fiscal year. Previous fiscal year 2081. In the same period of 1982, these banks earned a profit of Rs 2.03 billion. In the review period, the profit of the banks decreased by 32.53 percent compared to the previous year.

Compared to the previous year, the profit of 4 development banks has increased and 3 have decreased. One bank has incurred losses. Garima Bikas Bank was the top gainer in the review period, followed by Jyoti Bikas Bank in terms of growth rate.

The bank has earned a net profit of Rs 39.77 crore in the current fiscal year. It was 7.95 percent more than the previous year. The company had posted a net profit of Rs 36.84 crore in the same period a year ago.

Similarly, Muktinath is the second development bank to make the most profit. Muktinath has earned a net profit of Rs 38.42 crore in the review period. Muktinath had posted a net profit of Rs 42.24 crore in the same period last year. The bank’s net profit declined by 9.04 percent in the review period compared to the previous year.

Shine Resunga Development Bank is in the third position. During the review period, the bank earned a net profit of Rs. 30.25 crores. The bank had posted a net profit of Rs 35.43 crore in the same period last year. The bank’s net profit declined by 14.60 percent in the review period compared to the previous year.

Similarly, Shangrila Development Bank, Jyoti Bikas Bank and Mahalaxmi Development Bank earned Rs 8.44 crore in the same period of the current fiscal year.

In comparison to the previous year, the profit of Kamana Sewa increased by 12.38 percent, Shangrila by 8.54 percent and Jyoti by 2003.61 percent, while that of Mahalaxmi decreased by 58.12 percent.

Jyoti Bikas Bank has posted a net loss of Rs 36.46 crore in the review period. The bank had posted a net profit of Rs 29.37 crore in the same period last year.