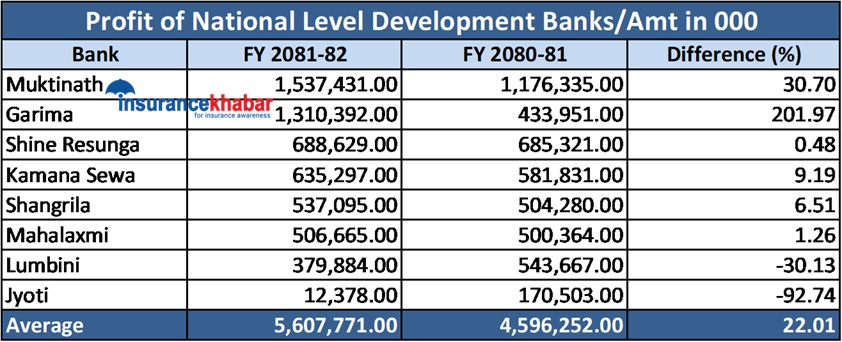

Kathmandu. National level development banks last fiscal year 2081. They have earned a profit of Rs 5.60 billion in 2018.19.

According to the financial statements released by eight national level development banks, the total profit has been rs 5.60 billion. Last year 2080. These development banks have rs 4.59 billion in 81. Compared to the previous year, the profit of the banks increased by 22.01 percent in the review year.

Out of the national level development banks, the profit of six has increased and the profit of two has decreased. Muktinath is among the highest profiteers while Garima is at the forefront in terms of growth rate.

According to the financial statement, Muktinath earned a profit of Rs 1.53 billion in the review year. In the previous fiscal year, the bank had posted a profit of Rs 1.17 billion. The bank’s profit increased by 30.70 percent in the review year compared to the previous year.

The second is dignity. Garima earned a profit of Rs 1.31 billion in the review year as compared to Rs 433.9 million in the previous fiscal year. The bank’s profit has increased by 201.97 percent compared to the previous year.

Shine Resunga is the third highest earner. In the review year, the bank earned a profit of Rs 688.6 million. In the previous fiscal year, the bank had posted a profit of Rs 685.3 million. The bank’s profit increased by 0.48 percent in the review year compared to the previous year.

In the review year, Kamana Sewa earned a profit of Rs 635.2 million, Shangri-La Rs 537 million, Mahalaxmi Rs 506.6 million, Lumbini Rs 379.8 million and Jyoti Rs 12.3 million. Compared to the previous year, the profit of Kamana Service decreased by 9.19 percent, Shangri-La by 6.51 percent and Mahalaxmi by 1.26 percent, while Lumbini’s 30.13 percent and Jyoti’s 92.14 percent decreased.

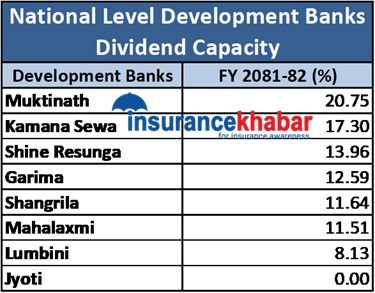

Who has what dividend potential?

Muktinath has the ability to pay the highest dividend from the profits of the last fiscal year. The bank has a dividend capacity of 20.75 percent.

The second highest dividend potential has been seen in The Kamna Service. The bank is expected to pay a dividend of 17.30 per cent.

Similarly, Shine Resunga has the capacity to pay 13.96 percent, Garima 12.59 percent, Shangri-La 11.64 percent, Mahalaxmi 11.51 percent and Lumbini 8.13 percent for the review year.

Jyoti Bikas Bank, however, is unable to pay dividend. The bank’s net profit stood at Rs 780.4 million.