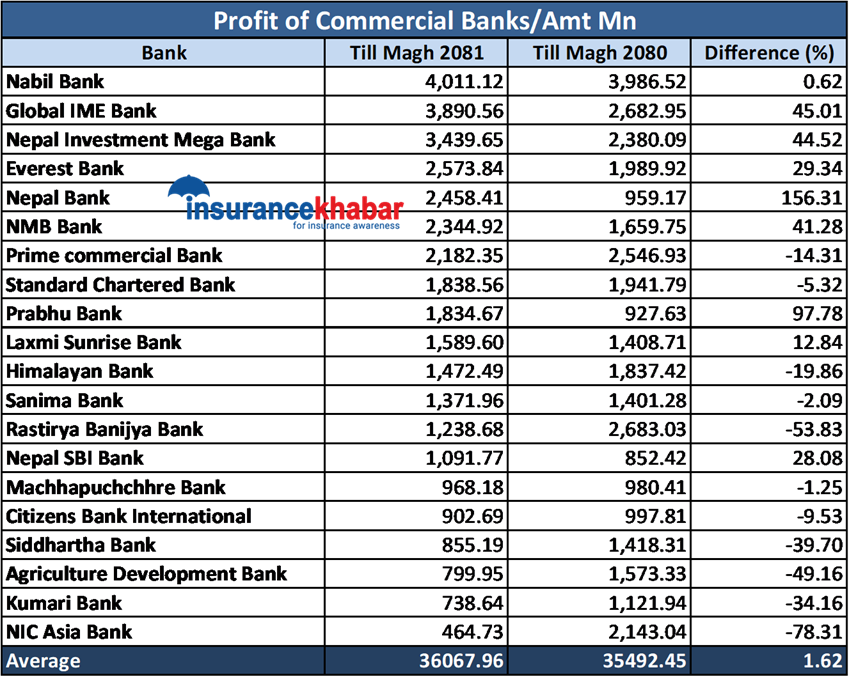

Kathmandu. Commercial banks have managed to earn a profit of Rs 36 billion more than the previous fiscal year.

According to the data released by Nepal Rastra Bank today for the first seven months of the current fiscal year, 20 commercial banks earned a profit of Rs 36.679 billion. Last year, commercial banks earned a profit of Rs 35.492 billion. Banks’ profits decreased by 1.62 percent during the review period compared to the previous year.

Until the review period, the profits of 9 banks increased while those of 11 decreased. Nabil Bank, which earned the highest profit until the review period, is at the forefront. This bank has earned a profit of Rs 4.111 billion until the previous fiscal year. Last year, the bank earned a profit of Rs 3.9865 billion. The bank’s profit increased by 0.62 percent during the review period compared to the previous year.

The second highest profit earner is Global IME Bank. This bank, which earned a profit of Rs 2.68 billion 29 million in the same period last year, has earned a profit of Rs 3.98 billion 5 million in the review period. The bank’s profit increased by 45.01 percent during the review period compared to the previous year.

The third highest profit earner is Nepal Investment Mega Bank. This bank has earned a profit of Rs 3.43 billion 96 million in the review period. The bank had earned a profit of Rs 2.38 billion in the same period last year. The bank’s profit has increased by 44.52 percent during the review period compared to the previous year.

Similarly, till Magh of the current fiscal year, Everest Bank has earned a profit of Rs 2.57 billion 3.8 million, Nepal Bank Rs 2.45 billion 8.4 million, NMB Bank Rs 2.34 billion 4.9 million and Prime Bank Rs 2.18 billion 2.3 million. Compared to the same period of the previous year, Everest Bank’s profit has increased by 29.34 percent, Nepal Bank’s by 156.31 percent and NMB Bank’s by 41.28 percent, while Prime Bank’s has decreased by 14.31 percent. Nepal Bank is at the forefront in terms of profit growth rate.

As of Magh of the current fiscal year, Standard Chartered Bank has earned a profit of Rs 1.8385 billion, Prabhu Bank has earned a profit of Rs 1.8386 billion, Lakshmi Sunrise Bank has earned a profit of Rs 1.5896 billion, Himalayan Bank has earned a profit of Rs 1.4724 billion, and Sanima Bank has earned a profit of Rs 1.3719 billion. Compared to the previous year, Prabhu Bank increased by 97.78 percent, Laxmi Sunrise Bank by 12.85 percent, while Standard Chartered, Himalayan and Sanima Banks decreased.

Similarly, till Magh, Rastriya Banijya Bank has earned a profit of Rs 1.23 billion 86 million, Nepal SBI Bank Rs 1.61 billion 17 million, Machhapuchhre Bank Rs 960 million 81 million, Citizens Bank Rs 900 million 26 million, Siddhartha Bank Rs 850 million 51 million, Krishi Bikas Bank Rs 790 million 99 million, Kumari Bank Rs 730 million 86 million and NIC Asia Bank Rs 460 million 47 million. While Nepal SBI Bank’s profit increased by 28.08 percent, the profits of Rastriya Banijya Bank, Machhapuchhre, Citizens, Siddhartha, Krishi Bikas Bank, Kumari and NIC Asia have decreased.

Among commercial banks, NIC Asia has seen the highest decline in profit. This bank’s profit has decreased by 78.31 percent during the review period compared to the previous year.