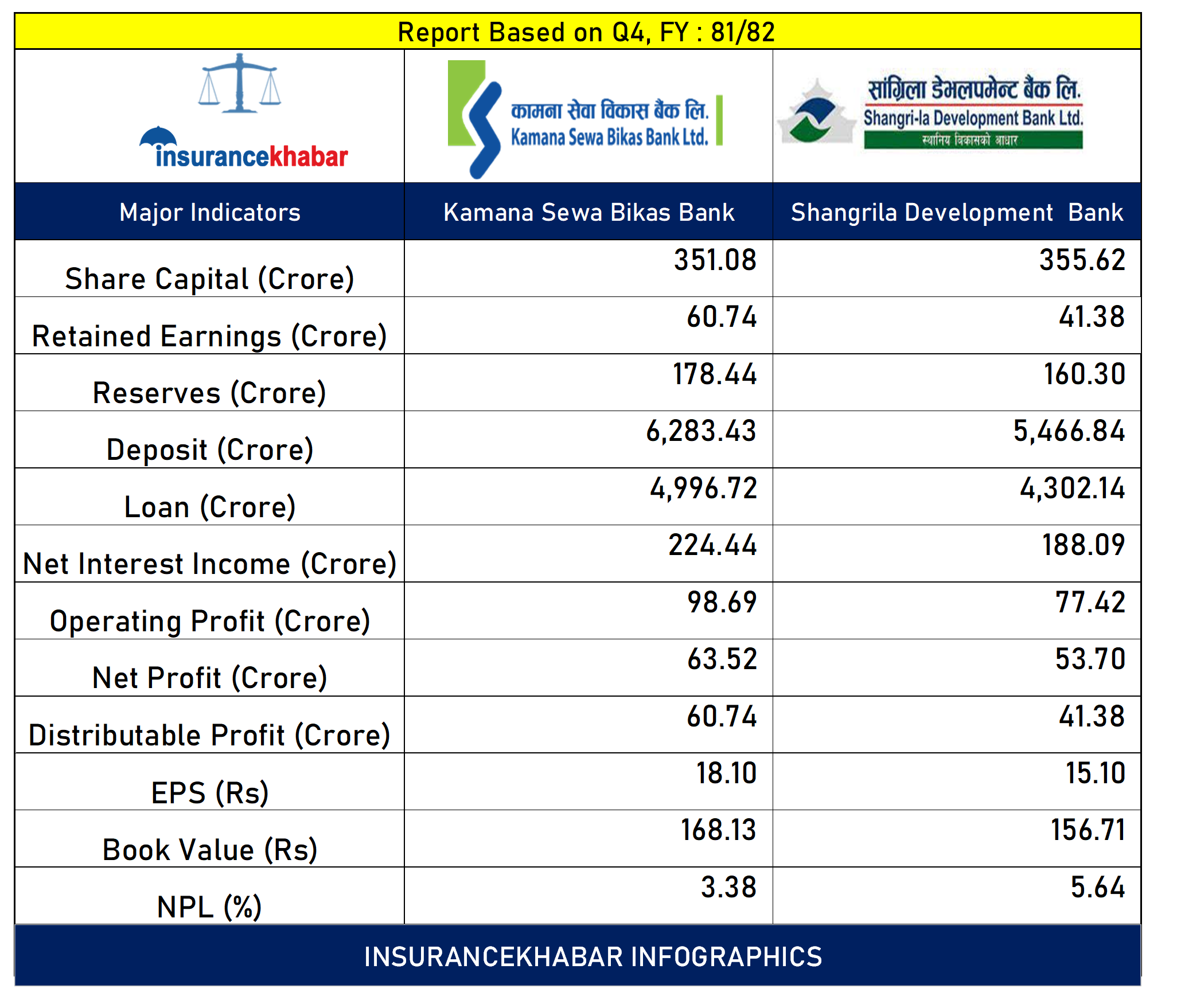

Kathmandu. Kamana Sewa Bikas Bank and Shangri-La Development Bank released the financial statements for the fourth quarter of the last financial year 81/82, while the insurance news conducted a comparative study based on major financial indicators between the two banks:

TAG_OPEN_strong_39 Kamana Service Development Bank has a paid-up capital of TAG_CLOSE_strong_39 Rs 3.51 billion while Shangri-La Development Bank has a paid-up capital of Rs 3.55 billion.

retained earnings: Kamana Sewa Bikas Bank has a retained earning of Rs 607.4 million while Shangri-La Development Bank has a retained earning of Rs 41.38 billion.

TAG_OPEN_strong_37 Kamana Service Development Bank has a reserve fund of TAG_CLOSE_strong_37 Rs 1.78 billion while Shangri-La Development Bank has a reserve fund of Rs 1.6 billion.

TAG_OPEN_strong_36 Kamana Service Development Bank has collected Deposits of TAG_CLOSE_strong_36 Rs 62.83 billion and disbursed Loans of Rs 49.96 billion, while Shangri-La Development Bank has collected Deposits of Rs 54.66 billion and disbursed Rs 43.2 billion.

TAG_OPEN_strong_35 Kamana Service Development Bank earn TAG_CLOSE_strong_35 ed Rs 2.24 billion in net interest income, while Shangri-La Development Bank earned Rs 1.88 billion in net interest income.

TAG_OPEN_strong_34 Kamana Sewa Bikas Bank has TAG_CLOSE_strong_34 earned an operating profit of Rs 986.9 million, while Shangri-La Development Bank has made an operating profit of Rs 774.2 million.

Net Profit: Kamna Sewa Bikas Bank has made a net profit of Rs 635.2 million while Shangri-La Development Bank has made a net profit of Rs 537 million.

Distributable profit: Kamana Service Development Bank has a distributable profit of Rs 607.4 million, while Shangri-La Development Bank has made a distributable profit of Rs 413.8 million.

Based on financial statements TAG_OPEN_strong_31 TAG_CLOSE_strong_31, Kamana Service Development Bank has an annual earnings of Rs 18.10 per share while Shangri-La Development Bank’s annual earnings per share is Rs 15.10.

Book price TAG_OPEN_strong_30 TAG_CLOSE_strong_30 of Kamana Service Development Bank is Rs 168.13 and Shangri-La Development Bank is Rs 156.71.

Bad loans: Kamana Service Development Bank’s bad loans are 3.38 percent while Shangri-La Development Bank’s bad loans are 5.64 percent.

Note: The analysis based on the available data is not complete, do more research and make an investment decision! The above news is not for stock trading purposes.