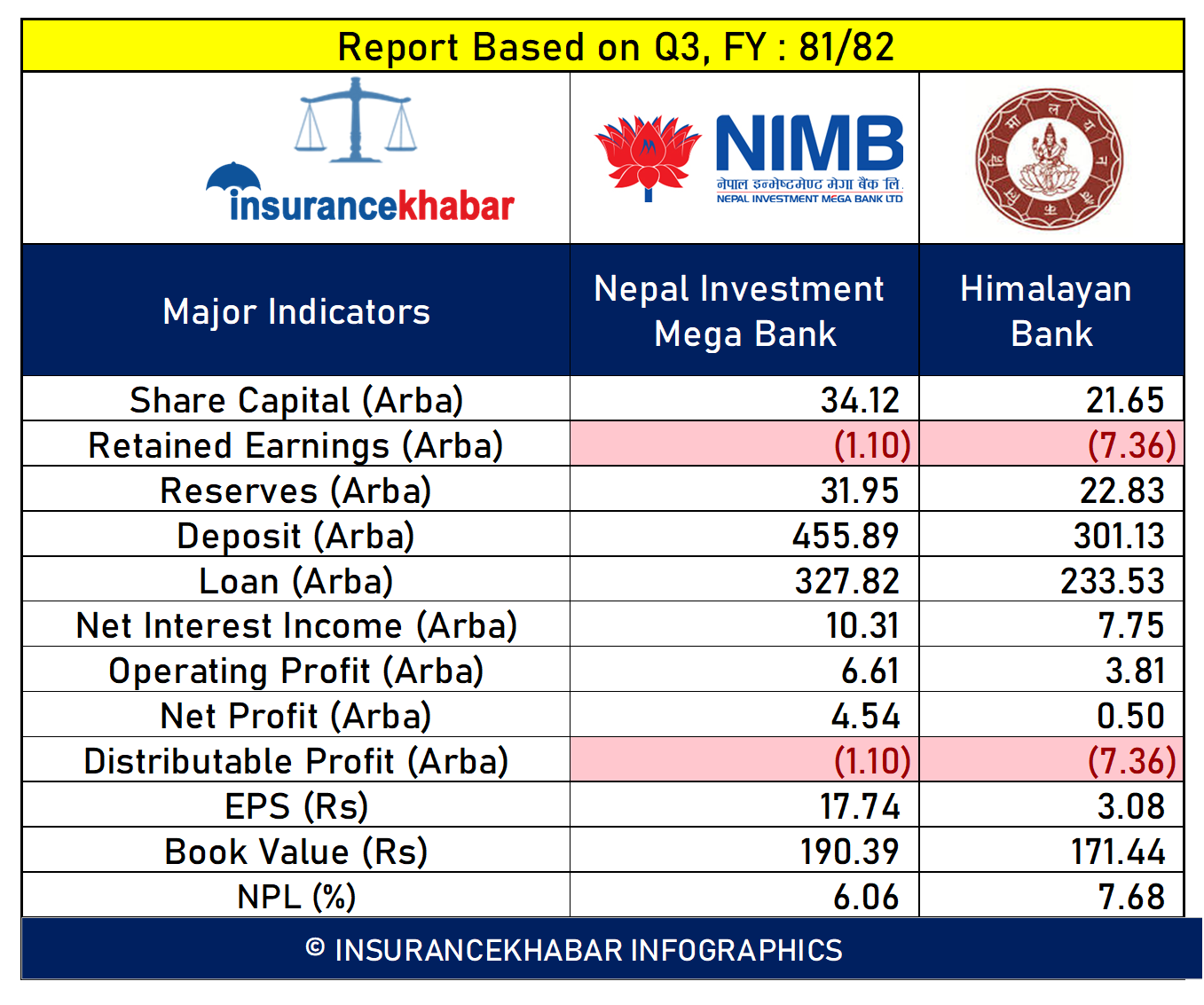

Kathmandu. The merger process of the erstwhile Nepal Investment Bank and Himalayan Bank, which was once close to merger, was broken at the last minute. After the merger process was broken, Nepal Investment Bank completed the merger process with Mega Bank while Himalayan Bank acquired Civil Bank. Both the banks are in the current fiscal year 2081. A comparative study conducted by Insurance Khabar on the basis of major financial indicators between the two banks in the third quarter of 82 years:

#

inline_tags_PLACEHOLDER_3#चुक्तापुँजीःनेपाल Investment Mega Bank has a paid-up capital of Rs 34.12 billion and Himalayan Bank has a paid-up capital of Rs 21.65 billion.

inline_tags_PLACEHOLDER_3#चुक्तापुँजीःनेपाल Investment Mega Bank has a paid-up capital of Rs 34.12 billion and Himalayan Bank has a paid-up capital of Rs 21.65 billion.

#inline_tags_PLACEHOLDER_4##जगेडा Fund: Nepal Investment Mega Bank has a reserve fund of Rs 31.95 billion and Himalayan Bank has a reserve fund of Rs 22.83 billion.

#inline_tags_PLACEHOLDER_4##रिटेन्ड Earnings:#inline_tags_PLACEHOLDER_6##नेपाल Investment Mega Bank has a negative earning of Rs 1.10 billion, while Himalayan Bank’s retained earnings are negative at Rs 7.36 billion.

inline_tags_PLACEHOLDER_3 #नेपाल #निक्षेप inline_tags_PLACEHOLDER_4 Investment Mega Bank has collected Deposits of Rs 455 billion and disbursed inline_tags_PLACEHOLDER_6 inline_tags_PLACEHOLDER_5 Rs 327 billion while Himalayan Bank has disbursed Rs 233 billion by collecting Deposits of Rs 301 billion.

#inline_tags_PLACEHOLDER_4##खुद interest income: #inline_tags_PLACEHOLDER_6##नेपाल Investment Mega Bank earned a net interest income of Rs 10.31 billion, out of which Himalayan Bank earned Rs 7.75 billion.

#inline_tags_PLACEHOLDER_4##सञ्चालन Profit: Nepal Investment Mega Bank has earned an operating profit of Rs 6.61 billion, while Himalayan Bank has made an operating profit of Rs 3.81 billion.

inline_tags_PLACEHOLDER_3 Nepal Investment Mega Bank has posted a net profit of Rs 500 million against a net profit of Rs 4.54 billion by inline_tags_PLACEHOLDER_5 inline_tags_PLACEHOLDER_4#inline_tags_PLACEHOLDER_6 #खुद profit.

#inline_tags_PLACEHOLDER_4##वितरणयोग्य Profit: Nepal Investment Mega Bank has a negative distributable profit of Rs 1.10 billion, while Himalayan Bank has a negative distributable profit of Rs 7.36 billion.

#inline_tags_PLACEHOLDER_4##किताबी Price: Nepal Investment Mega Bank’s book price is Rs 190.39 and Himalayan Bank’s book price is Rs 171.44.

#inline_tags_PLACEHOLDER_4##वार्षिक earnings per share: inline_tags_PLACEHOLDER_6## Based on financial statements, Nepal Investment Mega Bank’s annual earnings per share is Rs 17.74 while Himalayan Bank’s annual earnings per share is Rs 3.08.

#inline_tags_PLACEHOLDER_4##खराब loan: #inline_tags_PLACEHOLDER_6## Nepal Investment Mega Bank’s bad loans are 6.06 per cent while Himalayan Bank’s bad loans are 7.68 per cent.

inline_tags_PLACEHOLDER_71##(Note: The analysis based on available data is not complete. Take a decision after further research. The above news is not for stock trading purposes. )