Kathmandu. So far, insurance claims worth Rs 12.64 billion have been filed for the damage caused by the floods and landslides caused by the incessant rains in the second week of Asoj.

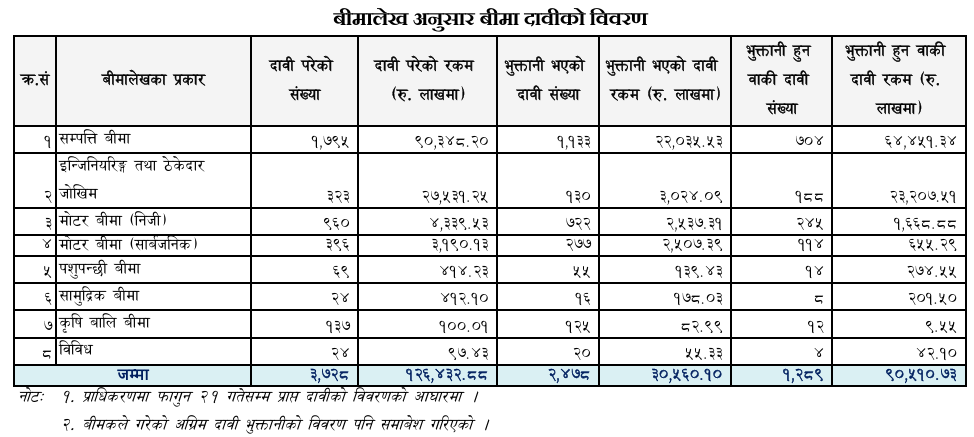

According to the Nepal Insurance Authority, as of Falgun 21, 14 non-life insurers and 4 small non-life insurers have filed 3,728 claims. The companies have to pay Rs 12.64 billion and 3.2 billion more for those claims. So far, insurers have paid Rs 3.56 billion out of 2,478 claims.

According to the authority, the highest number of claims has been filed in property insurance. It has been seen that companies have to pay Rs 9.34 billion out of 1,795 claims in property insurance. So far, companies have paid 2.2 billion 35 million rupees for 1,133 claims under property insurance.

Similarly, companies have to pay 2.75 billion 31 million rupees for 323 claims under engineering and contractor risks, the second largest category. So far, companies have paid only 302.4 million rupees for 130 claims.

960 claims have been filed under motor insurance (private) and 396 claims under motor insurance (public). Companies have to pay 433.9 million rupees and 319 million rupees respectively for those claims. So far, the companies have paid 253.7 million rupees for 722 claims under motor insurance (private) and 257 million rupees for 277 claims under motor insurance (public).

Similarly, the companies have paid 68 claims (41.4 million rupees) under livestock insurance, 24 claims (41.1 million rupees) under marine insurance, 137 claims (10 million rupees) under agricultural crop insurance, and 24 claims (41.1 million rupees) under miscellaneous. So far, the companies have paid Rs 13.9 million for 55 claims under livestock insurance, Rs 17.8 million for 16 claims under marine insurance, Rs 8.2 million for 125 claims under agricultural insurance, and Rs 5.5 million for 20 claims under miscellaneous insurance.