Kathmandu. The demand for car loans in banks has not improved much. Nepal Rastra Bank (NRB) has released the current fiscal year 2081 BS. The data shows this in the 10 months of April 2018.

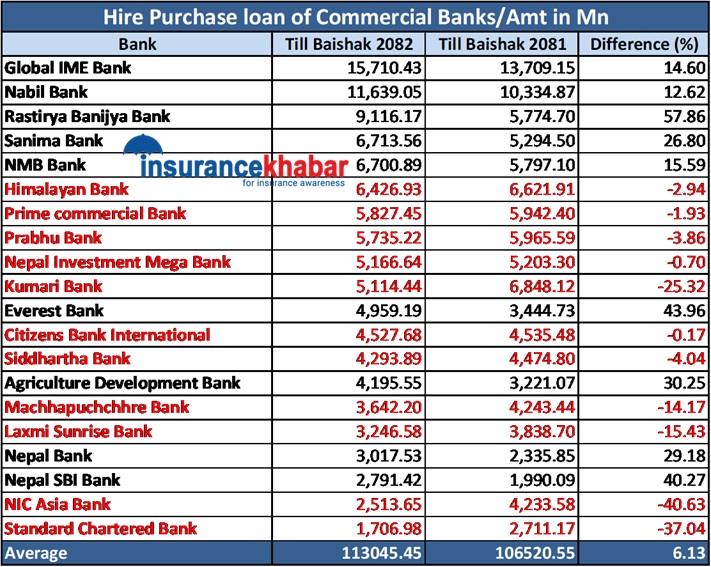

According to the data, 20 commercial banks have disbursed rs 113.45 billion in vehicle loans till Mid-April of the current fiscal year. A total of Rs 106.52 billion was disbursed under this head in the same period last year. Vehicle loans increased by only 6.13 percent in the review period compared to the previous year.

As compared to the previous year, 11 banks’ car loans decreased in the review period while the remaining nine increased. Global IME is at the forefront of providing the highest number of vehicle loans, while Rastriya Banijya Bank is ahead in terms of growth rate.

Global IME has disbursed the highest amount of vehicle loan of Rs 15.71 billion till April of the current fiscal year. In the same period last year, the bank had disbursed rs 13.70 billion in vehicle loans. The bank’s vehicle loan flow increased by 14.60 percent in the review period compared to the previous year.

In the second phase, Nabil has taken a car loan of Rs 11.63 billion. In the same period last year, the bank had disbursed rs 10.33 billion in vehicle loans. Nabil has provided 12.61 percent more vehicle loans in the review period as compared to the previous year.

Rastriya Banijya Bank is the third largest vehicle lending bank. The bank had disbursed rs 5.77 billion vehicle loan till April last year, while it has disbursed Rs 9.11 billion till the review period. The bank’s car loan increased by 57.86 percent in the review period compared to the previous year. This is the highest in terms of car loan growth rate.

Vehicle loans from commercial banks