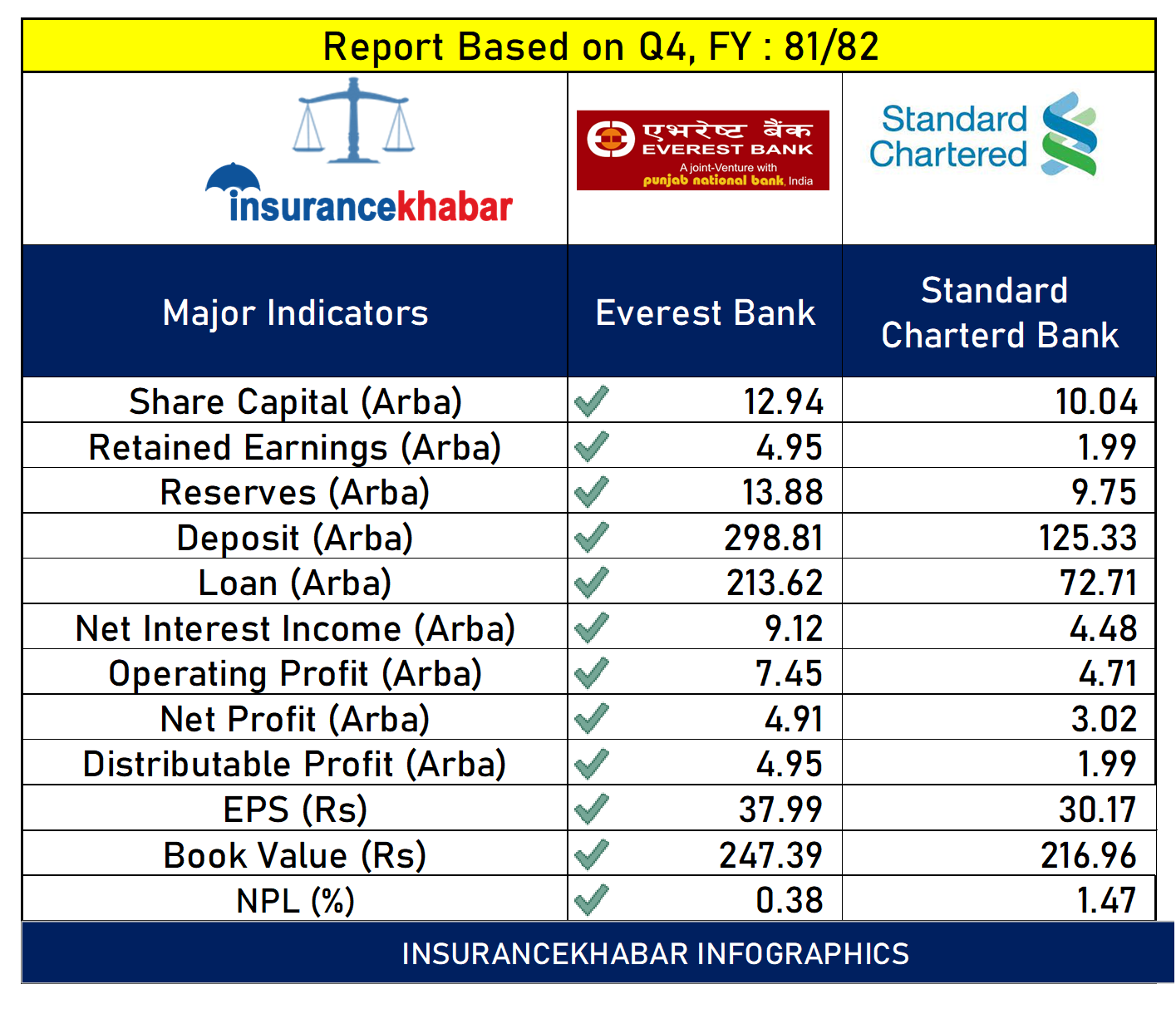

Kathmandu. Everest Bank and Standard Chartered Bank are two commercial banks with foreign investment. Banks last fiscal year 2081. A comparative study conducted by Insurance Khabar based on key financial indicators between the two banks when the financial statements of the fourth quarter of 82 were made public:

Paid-up Capital: Everest Bank has a paid-up capital of Rs 12.94 billion while Standard Chartered Bank has a paid-up capital of Rs 10.04 billion.

Reserve Fund: Everest Bank has a reserve fund of Rs 13.88 billion while Standard Chartered Bank has a reserve fund of Rs 9.75 billion.

retained earnings: Everest Bank’s retained earnings are Rs 4.95 billion while Standard Chartered Bank’s retained earnings are Rs 1.99 billion.

Deposits and loans: Everest Bank collected deposits of Rs 298 billion and disbursed loans worth Rs 213 billion, while Standard Chartered Bank collected deposits of Rs 125 billion and disbursed loans worth Rs 72.71 billion.

Net interest income: Everest Bank earned a net interest income of Rs 9.12 billion, while Standard Chartered Bank earned Rs 4.48 billion.

Operating profit: Everest Bank made an operating profit of Rs 7.45 billion, while Standard Chartered Bank earned an operating profit of Rs 4.71 billion.

Net profit: Everest Bank made a net profit of Rs 4.91 billion, while Standard Chartered Bank posted a net profit of Rs 3.02 billion.

Distributable profit: Everest Bank made a distributable profit of Rs 4.95 billion, while Standard Chartered Bank made a distributable profit of Rs 1.99 billion.

Book value: Everest Bank’s book price is Rs 247.39 while Standard Chartered Bank’s book value is Rs 216.96.

Annual earnings per share: Everest Bank’s annual earnings per share is Rs 37.99 while Standard Chartered Bank’s annual earnings per share is Rs 30.17.

Bad loans: Everest Bank’s bad loans are 0.38 percent, while Standard Chartered Bank’s bad loans are 1.47 percent.

(Note: The analysis based on available data is not complete.) Take a decision after further research. The above news is not for stock trading purposes. )