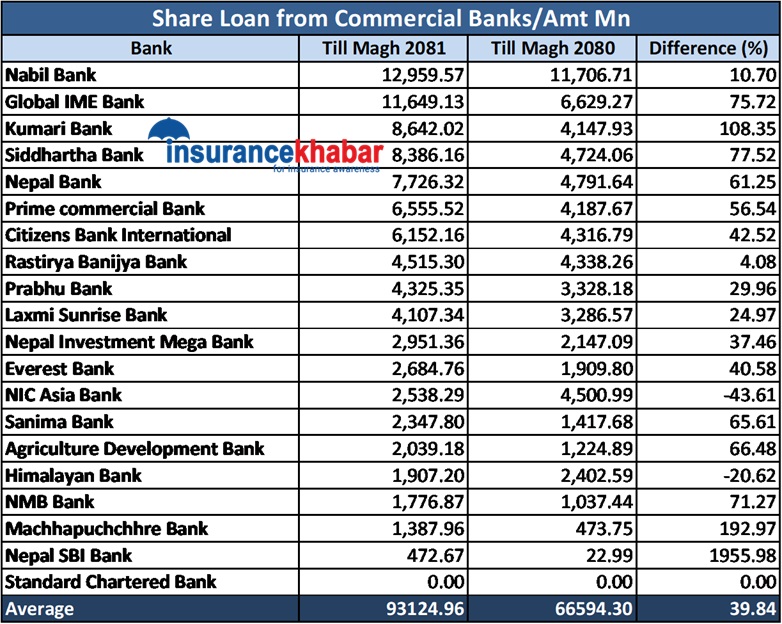

Kathmandu. Commercial banks have disbursed share loans worth Rs 93.12 billion more till Magh of the current fiscal year.

According to the data released by Nepal Rastra Bank, 19 out of the 20 commercial banks currently operating have disbursed share loans worth Rs 93.12 billion 49 lakh till Magh. Last year, banks had disbursed share loans worth Rs 66.59 billion 43 lakh till the same period. Share loans have increased by 39.84 percent compared to the previous year.

Compared to the previous year, 17 banks have increased their share loan flows while 2 have decreased. Standard Chartered Bank has not given share loans.

Nabil Bank has given the highest share loans till Magh of the current fiscal year. Till Magh of this year, Nabil has disbursed share loans worth Rs 12.95 billion. Last year, the bank had given share loans worth Rs 11.70 billion.67 billion. This bank’s share loans have increased by 10.70 percent compared to the previous year.

Global IME Bank is in second place. Till Magh of the current fiscal year, the bank has disbursed share loans worth Rs 11.64 billion.91 billion. This is 75.72 percent more than the same period of the previous year. Global IME had given share loans worth Rs 6.6292 billion by the same period last year.

Kumar Bank is in third place. Kumari Bank has given share loans worth Rs 8.642 billion till Magh of the current fiscal year. Last year, the bank had given share loans worth Rs 4.1479 billion till Magh. The share loans given by the bank have increased by 108.35 percent compared to the previous year.

Similarly, this year till Magh, Siddhartha Bank has given share loans worth Rs 8.3861 billion, Nepal Bank has given share loans worth Rs 7.7263 billion, Prime Commercial Bank has given share loans worth Rs 6.5555 billion, Citizens Bank has given share loans worth Rs 6.1521 billion and Rastriya Banijya Bank has given share loans worth Rs 4.5153 billion. Compared to the same period last year, Siddhartha’s share loan flow has increased by 77.52 percent, Nepal Bank’s by 61.25 percent, Prime’s by 56.54 percent, Citizens’ by 42.52 percent, and Rastriya Banijya Bank’s by 4.08 percent.

As of Magh of the current fiscal year, Prabhu Bank has disbursed share loans worth Rs 4.32 billion 5.3 million, Lakshmi Sunrise Bank has disbursed Rs 4.10 billion 7.3 million, Nepal Investment Mega Bank has disbursed share loans worth Rs 2.95 billion 1.3 million, Everest has disbursed Rs 2.68 billion 4.8 million, and NIC Asia Bank has disbursed share loans worth Rs 2.53 billion 8.2 million. Compared to the previous year, share loans of Prabhu, Laxmi Sunrise, Nepal Investment Mega and Avest have increased, while those of NIC Asia have decreased.

Similarly, till Magh of the current fiscal year, Sanima Bank has disbursed share loans worth Rs 2.3478 billion, Krishi Bikas Bank Rs 2.391 billion and Himalayan Bank Rs 1.9072 billion. During the review period, compared to the same period of the previous year, Sanima and Krishi Bikas Bank have increased, while Himalayan Bank has decreased.

Until Magh, NMB Bank has disbursed share loans worth Rs 1.7768 billion, Machhapuchhre Bank Rs 1.3879 billion and Nepal SBI Bank Rs 4726 billion. Share loan flow of NMB, Machhapuchhre and Nepal SBI Bank has increased during the review period compared to the previous year.