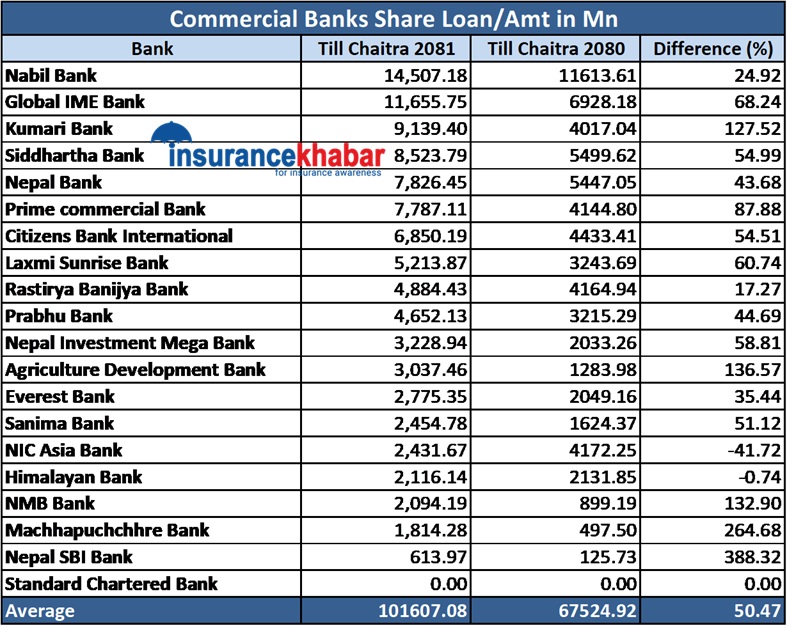

Kathmandu. Commercial banks have disbursed more than Rs 100 billion in share loans till the third quarter of the current fiscal year (July-April).

According to the data released by the Nepal Rastra Bank( NRB), 19 out of the 20 commercial banks in operation have disbursed rs 101.60 billion in share loans till Mid-April. In the same period last year, banks had disbursed rs 67.52 billion in share loans. The demand for share loans has increased by 50.47 percent compared to the previous year.

Compared to the previous year, the share flow of 17 banks has increased and the flow of loans of two banks has decreased. Standard Chartered Bank has not given any share loan.

Nabil Bank has the highest number of share loans till Mid-April of the current fiscal year. Nabil has disbursed rs 14.50 billion in share loans till March this year. In the same period last year, the bank had given a loan of Rs 11.61 billion. The bank’s share loan has increased by 24.92 percent compared to the previous year.

Global IME Bank is in second place. The bank has extended a loan of Rs 11.65 billion till Mid-April of the current fiscal year. This is an increase of 68.24 percent compared to the same period last year. In the same period last year, Global IME had given a share loan of Rs 6.92 billion.

Kumar Bank is in third place. Kumari Bank has extended a loan of Rs 9.13 billion till Mid-April of the current fiscal year. In the same period last year, the bank had extended a loan of Rs 4.01 billion. Compared to the previous year, the bank’s share loan has increased by 127.52 percent.

Similarly, Siddhartha Bank has extended rs 8.52 billion, Nepal Bank Rs 7.82 billion, Prime Commercial Bank Rs 7.78 billion, Citizens Bank Rs 6.85 billion, Laxmi Sunrise Bank Rs 5.21 billion and Rastriya Banijya Bank Rs 4.88 billion. Siddhartha Bank’s share loan flow increased by 54.99 percent, Nepal Bank by 43.68 percent, Prime Bank by 87.88 percent, Citizens by 54.51 percent, Laxmi Sunrise by 60.74 percent and Rastriya Banijya Bank by 17.27 percent compared to the same period last year.

Prabhu Bank, Nepal Investment Mega Bank, Agriculture Development Bank, Everest Bank and Sanima Bank have extended loans worth Rs 4.65 billion, Rs 3.22 billion, Rs 3.03 billion, Rs 2.77 billion and Rs 2.45 billion respectively. In the previous fiscal year, Prabhu Bank’s share flow increased by 44.69 percent, Nepal Investment Mega Bank by 58.81 percent, Agriculture Development Bank by 136.57 percent, Everest Bank by 35.44 percent and Sanima Bank by 51.12 percent.

As of March 2018, NIC Asia Bank has disbursed Rs 2.43 billion, Himalayan Bank Rs 2.11 billion, NMB Bank Rs 2.09 billion, Machhapuchhre Bank Rs 1.81 billion and Nepal SBI Bank Rs 613.9 million. During the review period, NIC Asia Bank declined by 41.72 percent and Himalayan Bank by 0.74 percent, nmb bank by 132.90 percent, Machhapuchhre Bank by 264.68 percent and Nepal SBI Bank by 388.32 percent.