Kathmandu. Commercial banks last fiscal year 2081. He has invested more than Rs 4.65 trillion in loans.

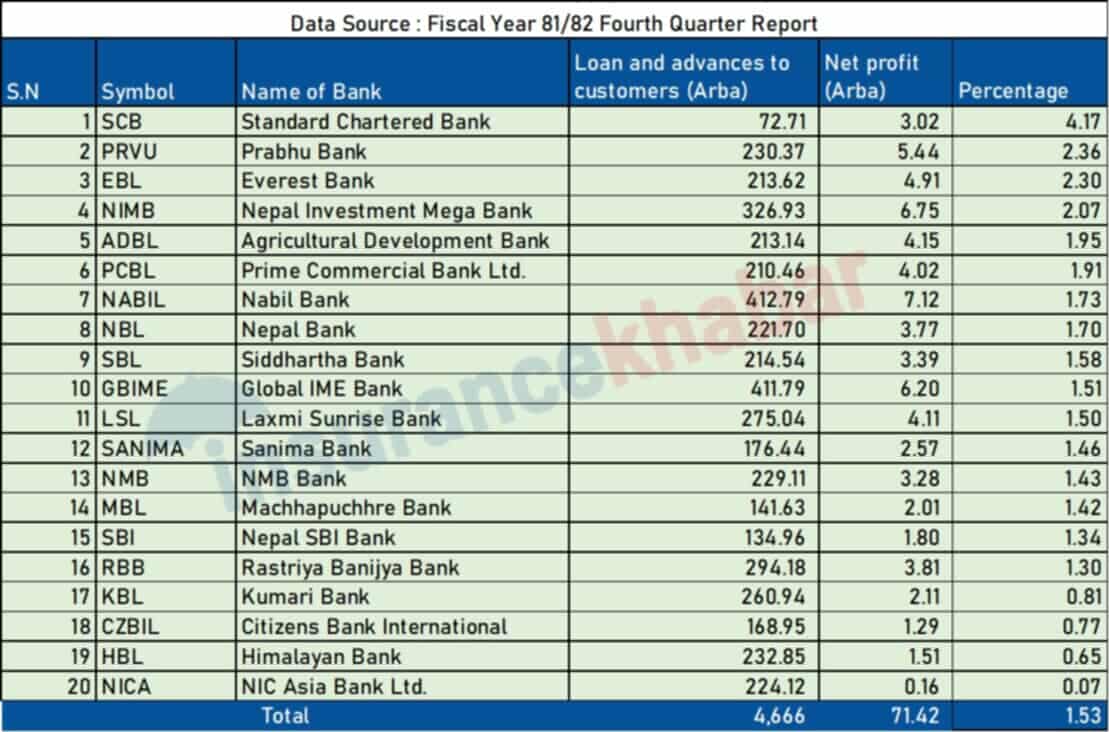

According to the financial statements released recently for the last fiscal year, 20 commercial banks have invested Rs 4.666 trillion in loans. In the review year, these banks earned a profit of Rs 71.42 billion. The ratio of profit to the total loan investment of the banks is 1.53 percent.

Standard Chartered Bank has the highest profit ratio compared to loan investment in the review year. The bank has earned a profit of Rs 3.02 billion out of loans of Rs 72.71 billion. The bank’s profit ratio against loans is 4.17 percent.

Prabhu Bank is in the second place. The bank has a profit ratio of 2.36 percent against the loan flow. In the review year, the bank earned a profit of Rs 230.37 billion and a profit of Rs 5.44 billion.

Everest Bank is in third place. Everest Bank has disbursed loans worth Rs 213.62 billion and earned a profit of Rs 4.91 billion. The bank’s profit ratio is 2.30 percent compared to loans.

Nabil bank has the highest amount of loan investment and profit in the review year. Nabil has earned a profit of Rs 7.12 billion out of loans of Rs 412.79 billion. The bank’s profit ratio is 1.73 percent against the loan investment.

Similarly, Global IME Bank is the second largest lender. The bank has disbursed loans worth Rs 411.79 billion.

In the review year, the bank earned a profit of Rs 6.20 billion. The bank’s profit ratio to loan investment is 1.73 percent.

In the review year, Nepal Investment Mega Bank has disbursed loans worth Rs 326.93 billion and earned a profit of Rs 6.75 billion. The bank’s profit ratio to the loan investment is 2.07 percent.