Kathmandu. Commercial banks have disbursed Rs 216 billion more in loans to the tourism service sector by Magh of the current fiscal year.

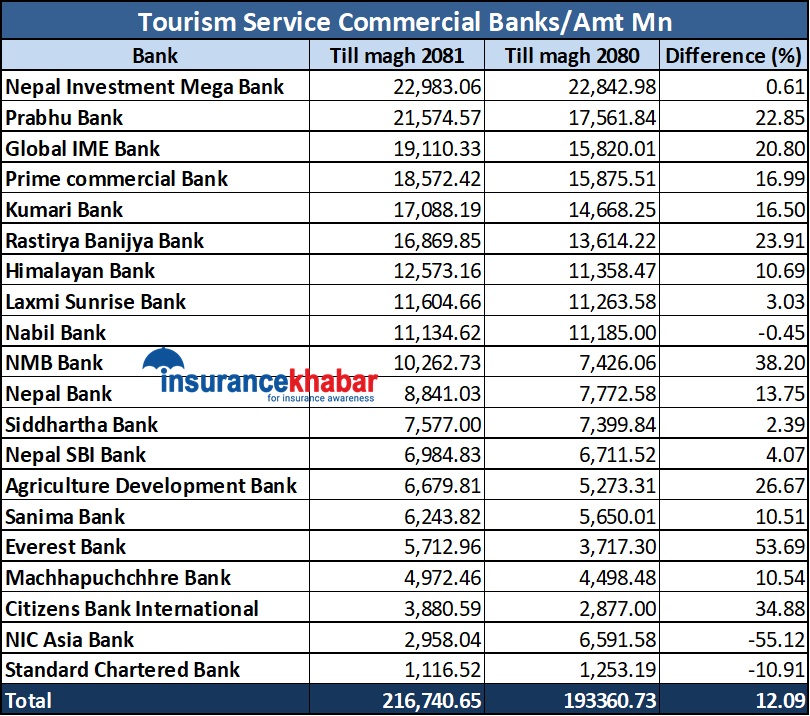

According to the data released by Nepal Rastra Bank, 20 commercial banks have disbursed Rs 216 billion 746 million in loans to the tourism sector by Magh. Last year, banks had disbursed Rs 193 billion 367 million in loans to this sector. This has increased by 12.09 percent during the review period compared to the previous year.

Nepal Investment Mega Bank is the largest lender to the tourism service sector. This bank has disbursed Rs 22 billion 983 million in loans until Magh of the current fiscal year. This is 0.61 percent more than the same period last year. The bank had disbursed Rs 22.84 billion 29 million in loans under this heading by the same period last year.

Prabhu Bank is in second place. This bank has disbursed Rs 21.57 billion 45 million in loans to the tourism sector by the review period. Last year, it had disbursed Rs 17.56 billion 18 million in loans. Compared to the previous year, the loans disbursed by the bank have increased by 22.85 percent during the review period.

The third bank disbursing the most loans to the tourism sector is Global IME Bank. The loan disbursement in this sector was Rs 15.82 billion last year, which increased by 20.80 percent to Rs 19.11 billion during the review period.

Similarly, till Magh, Prime Commercial Bank has disbursed loans of Rs 18.57 billion 24 million, Kumari Bank has disbursed loans of Rs 17.88 billion 81 million, and Rastriya Banijya Bank has disbursed loans of Rs 16.869 billion 98 million. Compared to the same period last year, Prime’s loans in this sector have increased by 16.99 percent, Kumari’s by 16.50 percent, and Rastriya Banijya Bank’s by 23.91 percent.

Until Magh of the current fiscal year, Himalayan Bank has disbursed loans of Rs 12.57 billion, Lakshmi Sunrise Bank Rs 11.60 billion, and Nabil Bank Rs 11.13 billion. Compared to the same period last year, Himalayan’s and Lakshmi Sunrise’s loan flow increased by 10.69 percent and 3.03 percent, respectively, while Nabil’s decreased by 0.45 percent.

Similarly, till Magh, NMB Bank has disbursed loans of Rs 10.26 billion 27 million, Nepal Bank Rs 8.84 billion 10 million, Siddhartha Bank Rs 7.57 billion 70 million, Nepal SBI Bank Rs 6.98 billion 48 million, Krishi Bikas Bank Rs 6.67 billion 98 million, Sanima Bank Rs 6.24 billion 38 million, Everest Bank Rs 5.71 billion 29 million, Machhapuchhre Bank Rs 4.97 billion 24 million, Citizens Bank Rs 3.88 billion 5 million, NIC Asia Bank Rs 2.95 billion 8 million and Standard Chartered Bank Rs 1.11 billion 65 million in the tourism services sector. Compared to the previous year, the credit flow of AIC Asia and Standard Chartered decreased during the review period, while that of others increased.