Kathmandu. In the first quarter of the current fiscal year, commercial banks have invested around Rs 2.25 billion in loans in the tourism service sector.

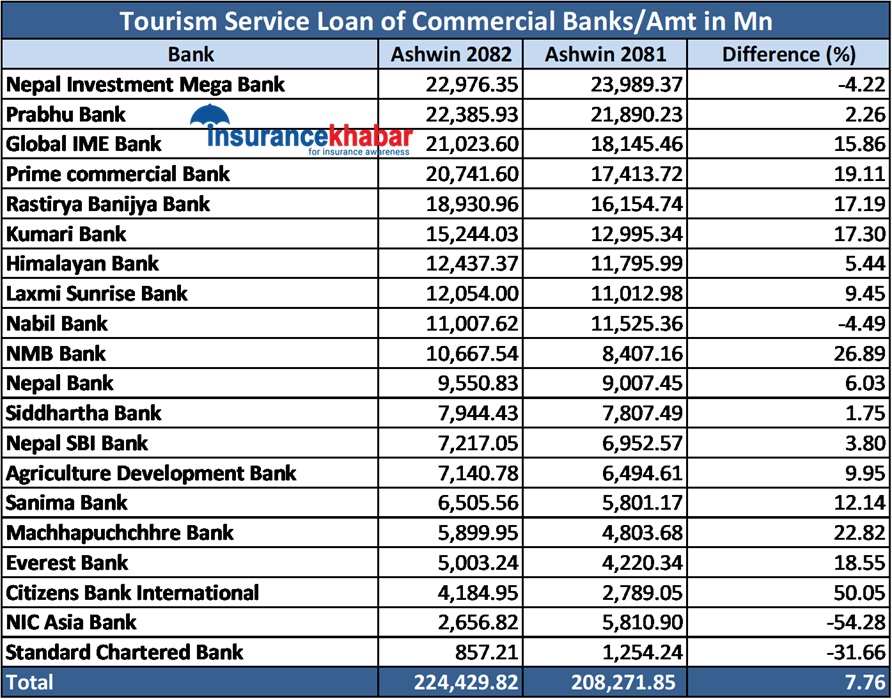

According to the data made public by Nepal Rastra Bank, 20 commercial banks have invested Rs 224.42 billion in the tourism sector till mid-October of the current fiscal year. In the same period of the previous FY, banks had invested Rs 208.27 billion. In the review period, the loan investment of banks increased by 7.76 percent compared to the previous year.

Nepal Investment Mega Bank (NIBL) has invested the highest amount of loan in the tourism service sector till mid-September of the current fiscal year. Compared to the previous year, credit investment of 16 commercial banks increased while four decreased in the review period. Citizen Bank is ahead in terms of loan investment growth.

Nepal Investment Mega Bank (NIBL) has disbursed Rs 22.97 billion in the tourism sector as of mid-September of the current fiscal year. The bank had disbursed loans of Rs 23.98 billion in the same period of the previous year. The bank’s loan investment decreased by 4.22 percent in the review period compared to the previous year.

Prabhu Bank is the second largest lender in the world. The bank has invested Rs 22.38 billion in the sector during the review period. The bank had invested Rs 21.89 billion in the same period last year. The bank’s loan investment increased by 2.26 percent in the review period compared to the previous year.

Global IME Bank is in the third position. The bank had invested Rs 18.14 billion in the tourism sector till mid-September of the previous year, which increased by 15.86 percent to Rs 21.02 billion in the review period.

Similarly, Prime Commercial Bank and Rastriya Banijya Bank have invested Rs 20.74 billion in the tourism sector while Rastriya Banijya Bank has invested Rs 18.93 billion in the tourism sector in the review period. Prime Bank’s loan investment increased by 19.11 percent and Rastriya Banijya Bank’s by 17.19 percent in the review period compared to the previous year.

Standard Chartered Bank, the lowest in the sector, invested Rs 857.2 million in the sector during the review period, while Citizens Bank increased by 50.05 percent to Rs 4.18 billion in the review period.