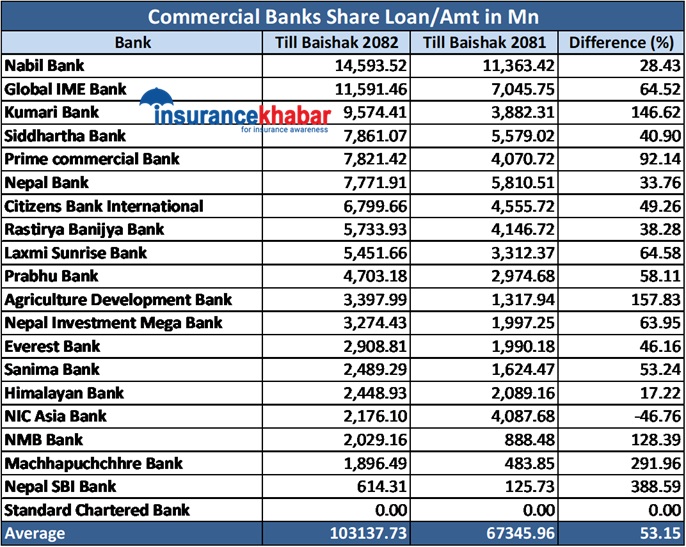

Kathmandu. Commercial banks have disbursed more than Rs 100 billion in share loans in the 10 months of the current fiscal year (July-April).

According to nepal rastra bank data, 19 out of 20 commercial banks have disbursed share loans worth Rs 103.13 billion till Mid-April. In the same period last year, banks had disbursed rs 67.34 billion in share loans. The demand for share loans has increased by 53.15 percent compared to the previous year.

Compared to the previous year, the share flow of 18 banks has increased and one has decreased. Standard Chartered Bank has not given any share loan.

Nabil Bank has received the highest number of share loans till Mid-April of the current fiscal year. Nabil has disbursed rs 14.59 billion in share loans till April this year. In the same period last year, the bank had given a loan of Rs 11.36 billion. The bank’s share loan has increased by 28.43 percent compared to the previous year.

Global IME Bank is in second place. The bank has extended a loan of Rs 11.65 billion till Mid-April of the current fiscal year. This is an increase of 64.52 percent compared to the same period last year. In the same period last year, Global IME had given a share loan of Rs 7.04 billion.

Kumar Bank is in third place. Kumari Bank has extended a loan of Rs 9.57 billion till Mid-April of the current fiscal year. In the same period last year, the bank had extended a loan of Rs 3.88 billion. Compared to the previous year, the bank’s share loan has increased by 146.62 percent.

Similarly, siddhartha bank has taken rs 7.86 billion, Nepal Bank Rs 7.77 billion, Prime Commercial Bank Rs 7.82 billion, Citizens Bank Rs 6.79 billion, Rastriya Banijya Bank Rs 5.73 billion and Laxmi Sunrise Bank Rs 5.45 billion. Siddhartha Bank’s share loan flow increased by 40.90 percent, Prime’s 92.14 percent, Nepal Bank’s 33.76 percent, Citizens’ 49.26 percent, Rastriya Banijya Bank’s 38.28 percent and Laxmi Sunrise’s 64.58 percent.

Prabhu Bank, Agriculture Development Bank, Nepal Investment Mega Bank, Everest Bank and Sanima Bank have extended loans of Rs 4.70 billion, Rs 3.39 billion, Rs 3.27 billion, Rs 2.90 billion and Rs 2.48 billion respectively. In the previous fiscal year, Prabhu Bank gained 58.11 per cent, Krishi Bikas Bank 157.83 per cent, Nepal Investment Mega Bank 63.95 per cent, Everest Bank 46.16 per cent and Sanima Bank 53.24 per cent.

As of April 2018, Himalayan Bank has disbursed Rs 2.44 billion, NIC Asia Bank Rs 2.17 billion, NMB Bank Rs 2.02 billion, Machhapuchhre Bank Rs 1.89 billion and Nepal SBI Bank Rs 614.3 million. During the review period, NIC Asia Bank declined by 46.76 percent, Himalayan Bank by 17.22 percent, NMB Bank by 128.39 percent, Machhapuchhre Bank by 291.96 percent and Nepal SBI Bank by 388.59 percent.