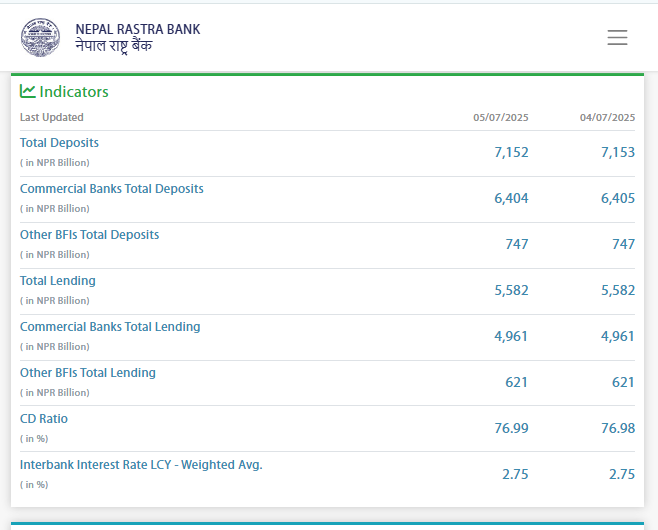

Kathmandu. Liquidity is piling up in the bank day by day. The CD ratio has dropped below 77 per cent as credit flow has slowed down compared to deposit collection. According to the latest nrb data, the CD ratio has come down to 76.99 percent.

It is easy to assume that banks are more focused on recovery than on credit flow after the month of June. It can be understood that if the recovery process is positive before the fourth quarter report, then the provision should be reduced and profits will improve.

The low demand for credit in the country is another reason for the accumulation of money in banks. As a result, the demand for loans in banks has decreased as the economy is not moving when the youth are concentrated abroad.

According to nrb data, the total deposits of banks have reached Rs 7,152 billion and the total loan investment has reached Rs 5,582 billion. As of Saturday, the total deposits in commercial banks have reached Rs 6.44 trillion, while loans worth Rs 4.961 trillion have been disbursed from commercial banks.