Kathmandu. It has been exactly a decade since the Nepal Insurance Authority (INSURANCE AUTHORITY) announced the establishment of an Insurance Interest Protection Fund with the objective of extracting the amount from the ‘Unclaimed Fund’ of the insurer and spending it for the benefit of the insured.

Even after the completion of a decade, the NRA has not yet set up the fund. It has been two and a half years since this issue was included in the Insurance Act. The NRA is yet to finalize the fund.

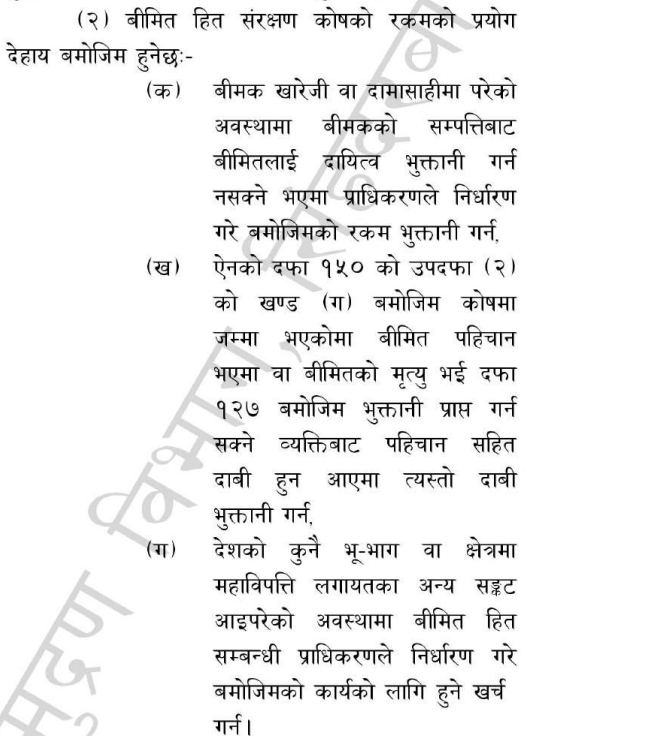

For the first time through the Insurance Act 2079, the issue of Insured Interest Protection Fund was formally addressed. Section 150 of the Act provides for the establishment and operation of the Insured Interest Protection Fund under the Nepal Insurance Authority for the protection of the interest of the insured.

The Rule 103 of the Insurance Rules 2081 provides for the insured interest protection fund. According to this rule, money has to be deposited by opening a separate account in a category A bank for the operation and management of the fund.

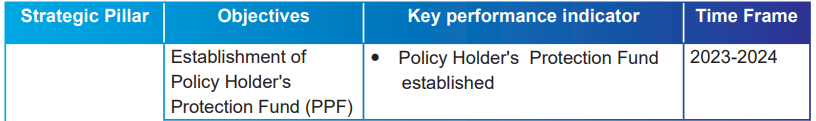

Apart from this, the second strategic plan 2023-2027 of the NRA has also included the issue of setting up an insurance interest protection fund on priority. On page 22 of the scheme, which is publicly available on the NEA’s website, the issue of setting up a fund has been included in the first point of the strategic pillar related to the development of the insurance sector.

In the second strategic plan, nea has decided to implement the previous fiscal year 2080 BS. The deadline for setting up the fund was 81. This deadline has also been set.

After the implementation of the Insurance Act, the Insurance Authority had formed a study committee under the coordination of the then Executive Director Raju Raman Poudel in November 2080. At present, Padel has got compulsory retirement from his job, and the authority has not brought to the public notice whether the study committee submitted its report or not.

Even a decade ago, when Poudel was in the post of director, the NRA had started preparing a study and working procedure saying that it would establish an insurance interest protection fund.

It is a way to free the insurer from liability by transferring the ‘unclaimed fund’ to the Insured Interest Protection Fund, which is not paid by the insured and remains a liability in the account of the insurer for a long time. It has also been emphasized on the establishment of the fund as the NRA will also utilize the money deposited in the fund by conducting various programs to protect the interests of the insured.

Even if the money is transferred to the fund, in the case of a claim made by the concerned insured or his or her right holder, there is a provision to give the insurance claim from the fund in case the insurer recommends after conducting necessary investigation.

The International Association of Insurance Supervisors, an international body of insurance regulators, has published a issue paper{TAG_CLOSE_a_45}} on the role and operation of the Insurance Interest Protection Fund in 2023. This includes important information regarding the purpose and operation of the fund.

What is unclaimed fund(unclaimed fund fund)

The insurance company has to deposit the amount to be paid in a different account account due to the failure to identify the insured, its entitlement or the insured is not in contact with the insured, such amount is called an unclaimed fund.

Apart from the amount that has been created to be paid to the insured, a large amount of renewal insurance deposited in the insurer’s account without disclosing the identity of the insured or mentioning the policy number is also lying unused.

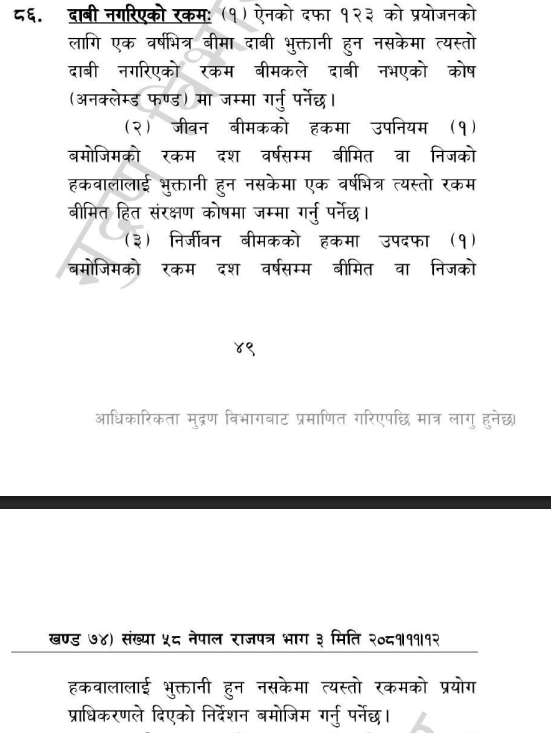

There is a provision to deposit the amount of the claim in the ‘Unclaimed Fund’ after at least one year of the creation of the liability to pay.

According to the insurance rules, if such amount has not been paid to the insured party even after 10 years of deposit, then it should be deposited in the Insured Interest Protection Fund in the 11th year.