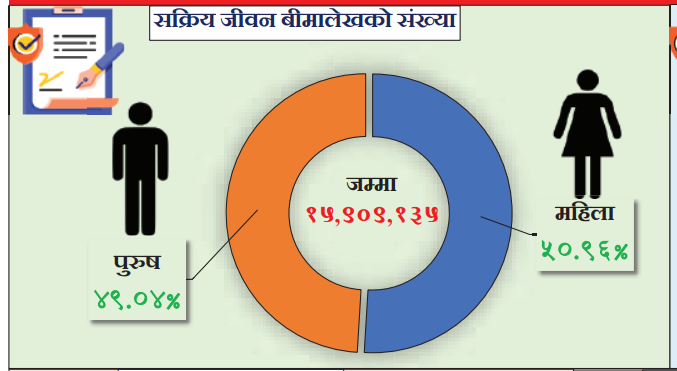

Kathmandu. In Nepal, the number of active insurance policies issued in the name of women is more than that of men.

According to the quarterly details published by the Nepal Insurance Authority, the share of life insurance of women in the total active insurance policy is 50.96 percent. Current fiscal year 2082. As of the first quarter of 2018, there are 1,59,09,135 active insurance policies. Of this, only 49.04 percent of the insurance policies issued in the name of men are the same.

Since the periodic installments of women’s life insurance are being paid regularly, the share of women in the active insurance policy is not high. This is because the number of term insurance policies issued in the name of women is less than that of men and the number of term insurance policies is high.

According to the Insurance Authority, the number of micro and term life insurance policies other than foreign employment term insurance is the highest in the total number of insurance policies. In such a policy, the number of insurance policies issued in the name of women is double than in the name of men. That’s why women are ahead of the list of active insurance policies.

Most term insurance policies are issued for a period of one year. In order to issue such a policy, the insured or the authorized party on behalf of the insured pays the lump sum premium for the entire period. In this way, the insurance policy is counted as an active insurance policy throughout the insurance period and does not go into a dormant state.

The number of women availing micro loans from microfinance, small farmers’ groups and women savings groups is higher than men. The microfinance company also collects a term life insurance policy in the name of the saving member woman at the time of approval of the loan application.

The amount of insurance will be borne by the borrower. In the event of death or complete disability of the insured during the term of the policy, the insurance company pays the principal and interest on the loan on behalf of the insured.