Kathmandu. According to the latest statistics made public by the Nepal Insurance Authority, women’s access to savings insurance schemes in Nepal is lower than that of men.

According to the data on access to life insurance made public by the NRA for the first quarter of the fiscal year 2082/83, the proportion of women included in term insurance insurance is less than that of men. The participation of men in the insurance is more than that of women as the amount of premium is higher than that of the term insurance policy.

In Nepal’s social structure, women are weaker than men in terms of earnings, savings and expenditure as women take responsibility for household chores and men participate in economic earnings. In contrast, women’s participation in purely risk-only term insurance policies is twice as high as that of men.

It can be assumed that women are covered under the protection umbrella of term insurance because of the compulsory insurance related to small and micro loans. In rural areas, women self-help groups, small farmers’ groups, rural self-help groups and microfinance have more women members than men. There is a tendency to use small loans in the name of women as microfinance also provides concessions on the interest of women loans. The participation of women in this type of insurance has been seen more as it is mandatory to insure the amount of such loans.

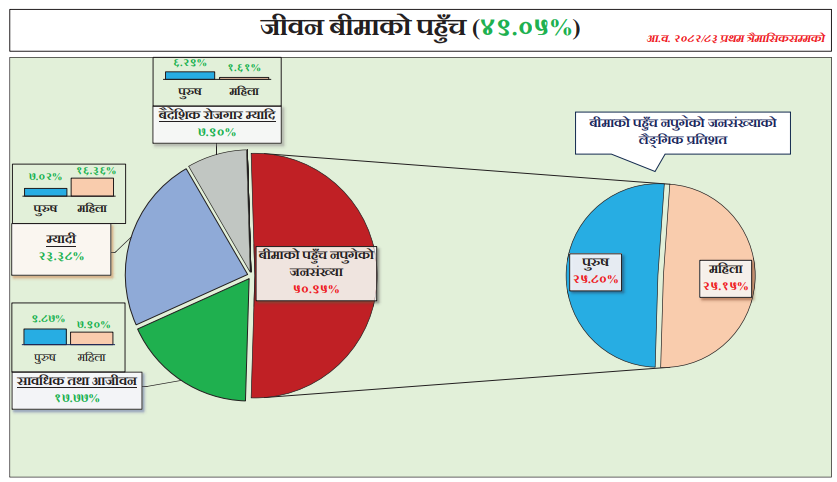

According to the Insurance Authority, 49.05 percent of the total population has access to life insurance. Of this, 17.77 percent of the population is covered under term and life insurance. The participation of men is 9.87 percent and the participation of women is only 7.9 percent. On the other hand, the share of term insurance policies is 23.38 percent, of which women are 16.36 percent and men are 7.02 percent.

The number of men in foreign employment insurance is almost three times more than women. Foreign term insurance accounts for 7.9 percent of the total insurance penetration. Males constitute 6.25 per cent and females 1.69 per cent.

If we look at the composition of the population that is not covered by insurance, then the access of women is slightly higher than that of men. Out of the 50.95 percent uninsured, the share of men is about 25.80 percent and the remaining 25.15 percent is women. This shows that women are less likely than men to be uninsured.

According to the National Census 2078 conducted by the Central Bureau of Statistics, the total population of the country is 2,91,61,577. Of them, 51.02 per cent are females and 48.98 per cent are males.

Although women are more in the total population, their participation in the access to life insurance is not proportionate. This is due to economic, social and informational limitations. Major causes of gender gap:

- Gender gap in economic autonomy and employment stability,

- Lack of adequate access to insurance plans and financial literacy,

- The income of a woman engaged in domestic work is not formal,

- Insurance decisions in social settings are usually made by male members,

}

These factors have hindered the expansion of women’s access to insurance.

Special programs, awareness campaigns, and women-friendly insurance products are needed to ensure gender equality in the insurance sector. In addition, initiatives such as women-targeted micro-insurance programs, easy payment and claim processing through digital access, and expansion of financial literacy at the local level can significantly increase women’s participation.

The data diagram made public by the authority confirms that Nepal’s life insurance sector is still facing the challenge of gender inequality. Policy reforms, targeted programs and expansion of financial literacy will only make it possible to bring women under the ambit of insurance.