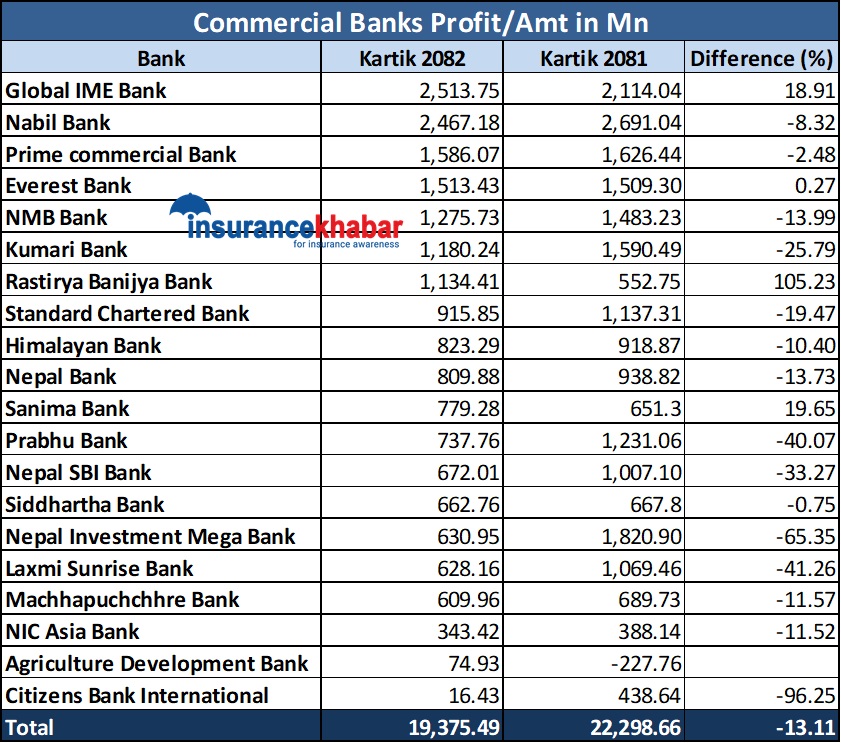

Kathmandu. In the first four months of the current fiscal year, the commercial banks have earned a net profit of Rs 19.37 billion.

According to the data released by Nepal Rastra Bank (NRB), the net profit of 20 commercial banks stood at Rs 19.37 billion in the current fiscal year. Last year, 2081. The commercial banks had earned a net profit of Rs 22.29 billion till mid-November 2018. In the review period, the profit of the banks decreased by 13.11 percent compared to the previous year.

According to the statistics, Global IME Bank is the highest earner of profit while Rastriya Banijya Bank is in the top position in terms of growth rate.

During the review period, Global IME Bank earned a net profit of Rs 2.51 billion. The bank had posted a net profit of Rs 2.11 billion in the same period last year. The profit of the bank increased by 18.91 percent.

Similarly, Nabil Bank is the second highest profiter. During the review period, Nabil earned a net profit of Rs 2.46 billion. The bank had posted a net profit of Rs 2,710 crore in the same period last year. The profit of the bank decreased by 8.32 percent compared to the previous year.

Prime Commercial Bank is the third highest profiter. Prime earned a net profit of Rs 1.58 billion in the review period. The company had posted a net profit of Rs 1.62 billion in the same period last year. Prime’s net profit also declined by 2.48 percent in the review period compared to the previous year.

Similarly, Everest Bank and NMB Bank earned a net profit of Rs 1.51 billion during the review period. In the same period last year, Everest Bank had earned a profit of Rs 1.50 billion and NMB had earned Rs 1.48 billion. Compared to the previous year, Everest Bank’s profit increased by 0.27 percent and NMB Bank’s decreased by 13.99 percent.

Similarly, Kumari Bank and Rastriya Banijya Bank earned a net profit of Rs 1.18 billion in the review period. In the same period last year, Kumari Bank had earned a profit of Rs 1.59 billion and Rastriya Banijya Bank had earned Rs 552.7 million. In the review period, Kumari Bank’s profit increased by 25.79 percent while that of Rastriya Banijya Bank increased by 105.23 percent.

Citizens Bank is the least profitable bank in the review period. The bank has earned a net profit of Rs 1.64 crore. The profit of the bank has decreased by 96.25 percent compared to the previous year.