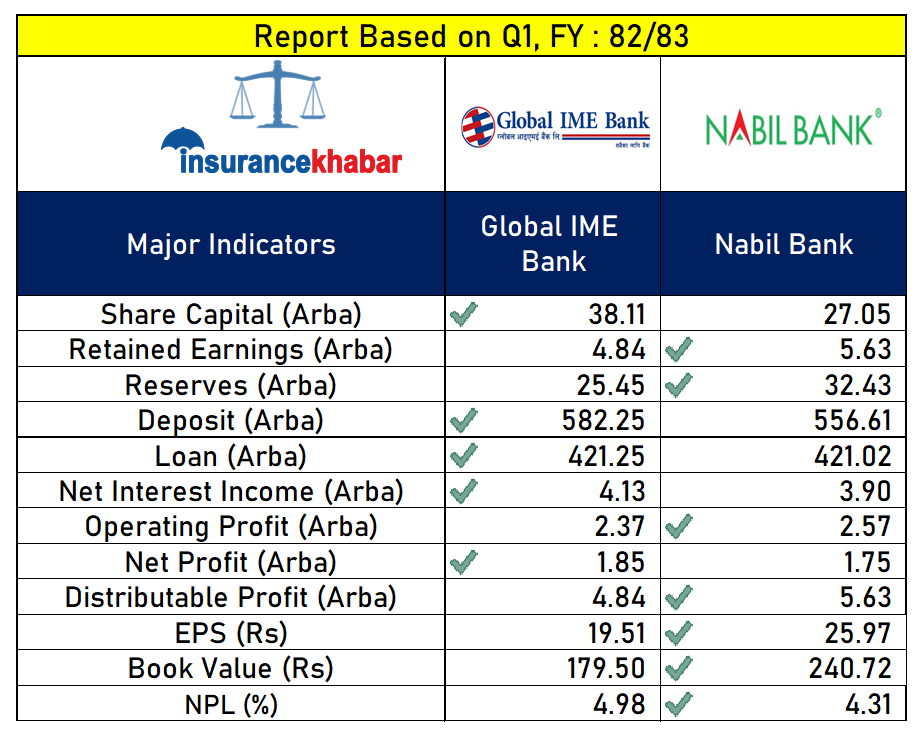

Kathmandu. Global IME Bank and Nabil Bank in the current fiscal year 2082. The financial statements for the first quarter (July-September) of 83 years have been made public. In this case, a comparative study conducted by Insurance Khabar on the basis of key financial indicators between the two banks:

Global IME Bank has a paid-up capital of Rs 38.11 billion and Nabil Bank has a paid-up capital of Rs 27.05 billion.

Global IME Bank has reserve fund of Rs 25.45 billion and Nabil Bank has reserve fund of Rs 32.43 billion.TAG_CLOSE_span_38 TAG_CLOSE_strong_49 TAG_OPEN_strong_49

Global IME Bank has retained earnings of Rs 4.84 billion and Nabil Bank has retained earnings of Rs 5.63 billion.TAG_CLOSE_span_37 TAG_CLOSE_strong_48 TAG_OPEN_strong_48

Global IME Bank has collected deposit of Rs 582 billion and extended loans of Rs TAG_CLOSE_strong_47 TAG_OPEN_strong_47 421 billion, while Nabil Bank has collected deposit of Rs 556 billion and extended loans of Rs 42 TAG_CLOSE_span_36 1 billion.

Global IME Bank has earned a net interest income of Rs 4.13 billion while Nabil Bank has earned Rs 3.90 billion.TAG_CLOSE_span_35 TAG_CLOSE_strong_46 TAG_OPEN_strong_46

Global IME Bank earned an operating profit of Rs. 2.37 billion while Nabil Bank earned an operating profit of Rs. 2.57 billion.TAG_CLOSE_span_34 TAG_CLOSE_strong_45 TAG_OPEN_strong_45

Global IME Bank earned a net profit of Rs 1.85 billion while Nabil Bank earned a net profit of Rs 1.75 billion.TAG_CLOSE_span_33 TAG_CLOSE_strong_44 TAG_OPEN_strong_44

Global IME Bank made a distributable profit of Rs. 4.84 billion while Nabil Bank earned a distributable profit of Rs. 5.63 billion.TAG_CLOSE_span_32 TAG_CLOSE_strong_43 TAG_OPEN_strong_43

The book price of Global IME Bank is Rs. 179.50 while that of Nabil Bank is Rs. 240.72.TAG_CLOSE_span_31 TAG_CLOSE_strong_42 TAG_OPEN_strong_42

Global IME Bank has EPS of Rs 19.51 while Nabil Bank has EPS of Rs 25.97.TAG_CLOSE_span_30 TAG_CLOSE_strong_41 TAG_OPEN_strong_41

Global IME Bank has a bad loan of 4.98 percent while Nabil Bank has a bad loan of 4.31 percent.TAG_CLOSE_span_29 TAG_CLOSE_strong_40 TAG_OPEN_strong_40

(Note: The analysis based on the available data is not exhaustive.) Do more research and make a decision. The above news is not for share trading purposes. )